As a taxpayer, you may be entitled to claim a refund or credit due to an incorrect withholding or overpayment of taxes. The IRS Form 8379, also known as the Injured Spouse Allocation, is designed to help you claim a fair share of the refund or credit. However, the process can be complex and time-consuming, especially if you are not familiar with tax laws and procedures. In this article, we will provide a step-by-step guide to help you navigate the Form 8379 instructions and claim the refund or credit you deserve.

Understanding the Purpose of Form 8379

Before we dive into the instructions, it's essential to understand the purpose of Form 8379. This form is used to allocate a joint refund or credit between spouses when one spouse is liable for a debt, such as past-due taxes, child support, or student loans. The form allows the injured spouse to claim their fair share of the refund or credit, which would otherwise be applied to the debt.

Step 1: Determine If You Are Eligible to File Form 8379

To determine if you are eligible to file Form 8379, you need to meet the following conditions:

- You filed a joint tax return with your spouse.

- You have a debt, such as past-due taxes, child support, or student loans, that is owed by your spouse.

- You are not responsible for the debt.

- You want to claim a fair share of the joint refund or credit.

Step 2: Gather Required Information and Documents

To complete Form 8379, you will need to gather the following information and documents:

- Your social security number and your spouse's social security number.

- Your joint tax return information, including the refund or credit amount.

- Proof of your income and expenses, such as pay stubs and bank statements.

- Documentation supporting your claim, such as court orders or separation agreements.

Step 3: Complete Form 8379

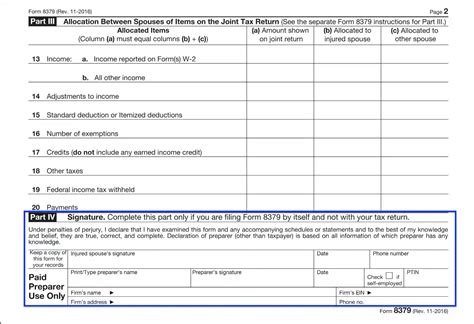

Form 8379 consists of two parts: Part I and Part II. Part I requires you to provide personal and tax return information, while Part II requires you to calculate your injured spouse allocation.

-

In Part I, you will need to provide your name, social security number, and joint tax return information.

-

In Part II, you will need to calculate your injured spouse allocation using the following steps:

- Determine the total joint refund or credit amount.

- Calculate your share of the joint income.

- Calculate your share of the joint refund or credit.

Step 4: Attach Supporting Documents

You will need to attach supporting documents to Form 8379, such as:

- Proof of your income and expenses.

- Documentation supporting your claim.

- A copy of your joint tax return.

Step 5: Submit Form 8379

Once you have completed Form 8379 and attached the required supporting documents, you can submit it to the IRS. You can submit the form electronically or by mail.

- If you are filing electronically, you can use the IRS e-file system.

- If you are filing by mail, you can send the form to the address listed in the instructions.

Common Mistakes to Avoid

When completing Form 8379, there are several common mistakes to avoid:

- Inaccurate or incomplete information.

- Failure to attach required supporting documents.

- Incorrect calculation of the injured spouse allocation.

Tips and Reminders

Here are some tips and reminders to keep in mind when completing Form 8379:

- Make sure to read the instructions carefully and follow the steps outlined in this guide.

- Use the IRS website to access the form and instructions.

- Seek professional help if you are unsure about how to complete the form.

Conclusion

Claiming a fair share of a joint refund or credit can be a complex and time-consuming process. However, by following the step-by-step guide outlined in this article, you can navigate the Form 8379 instructions with confidence. Remember to gather required information and documents, complete the form accurately, and attach supporting documents. By avoiding common mistakes and following the tips and reminders outlined in this guide, you can ensure a smooth and successful claim process.

We hope this article has been informative and helpful in guiding you through the Form 8379 instructions. If you have any further questions or concerns, please do not hesitate to reach out to us.

FAQ Section

What is the purpose of Form 8379?

+Form 8379 is used to allocate a joint refund or credit between spouses when one spouse is liable for a debt.

Who is eligible to file Form 8379?

+You are eligible to file Form 8379 if you filed a joint tax return with your spouse and have a debt that is owed by your spouse.

What documents do I need to attach to Form 8379?

+You will need to attach supporting documents, such as proof of income and expenses, and documentation supporting your claim.