The world of tax filing can be overwhelming, especially for those who are new to the process. One of the key forms that individuals and businesses need to be familiar with is the PA Form 8453. In this article, we will delve into the details of this form, its importance, and how it relates to electronic filing.

The Pennsylvania Department of Revenue requires taxpayers to file certain tax returns electronically, and the PA Form 8453 is a crucial part of this process. This form is used to authenticate and verify the identity of the taxpayer, ensuring that the electronic filing is secure and accurate. By understanding the purpose and requirements of the PA Form 8453, taxpayers can navigate the electronic filing process with ease and avoid any potential issues.

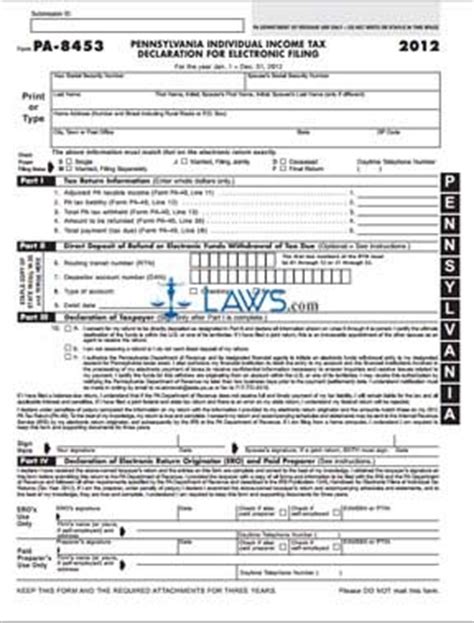

What is PA Form 8453?

PA Form 8453 is a declaration for an electronically filed return. It is a mandatory form that taxpayers must complete and sign when filing their tax returns electronically. The form serves as a written declaration that the taxpayer has reviewed and approved the return, and that the information provided is accurate and true.

Why is PA Form 8453 Important?

The PA Form 8453 plays a critical role in the electronic filing process. By signing this form, taxpayers acknowledge that they have reviewed and approved the return, and that they understand the penalties for filing a false or inaccurate return. This form also helps to prevent identity theft and ensures that the taxpayer's personal and financial information is secure.

Benefits of Electronic Filing with PA Form 8453

Electronic filing with PA Form 8453 offers several benefits to taxpayers, including:

- Faster Refunds: Electronic filing allows taxpayers to receive their refunds faster, often within a few days of filing.

- Increased Accuracy: Electronic filing reduces the risk of errors and inaccuracies, as the software used for filing will detect and prevent mistakes.

- Convenience: Electronic filing can be done from the comfort of your own home, 24/7, making it a convenient option for those with busy schedules.

- Environmental Benefits: Electronic filing reduces the need for paper and ink, making it a more environmentally friendly option.

How to Complete PA Form 8453

Completing PA Form 8453 is a straightforward process. Here are the steps to follow:

- Review Your Return: Before signing PA Form 8453, review your tax return to ensure that all information is accurate and complete.

- Sign the Form: Sign PA Form 8453, acknowledging that you have reviewed and approved the return.

- Date the Form: Date the form, indicating the date you signed it.

- Attach Supporting Documents: Attach any supporting documents, such as W-2s and 1099s, to the form.

- Submit the Form: Submit the form along with your electronic tax return.

Common Errors to Avoid when Completing PA Form 8453

When completing PA Form 8453, it is essential to avoid common errors that can delay or reject your tax return. Here are some common errors to avoid:

- Inaccurate Information: Ensure that all information on the form is accurate and complete.

- Unsigned Form: Make sure to sign the form, as an unsigned form will not be accepted.

- Inadequate Supporting Documents: Ensure that all supporting documents are attached to the form.

- Incorrect Dating: Ensure that the form is dated correctly, indicating the date you signed it.

Tips for Electronic Filing with PA Form 8453

Here are some tips to keep in mind when electronic filing with PA Form 8453:

- Use Tax Software: Use tax software that is approved by the Pennsylvania Department of Revenue to ensure accuracy and compliance.

- Review Your Return: Review your tax return carefully before submitting it to ensure accuracy and completeness.

- Keep Records: Keep records of your tax return and supporting documents, in case of an audit or review.

- Seek Professional Help: If you are unsure about any aspect of the electronic filing process, seek professional help from a tax professional.

Conclusion

In conclusion, PA Form 8453 is a critical component of the electronic filing process in Pennsylvania. By understanding the purpose and requirements of this form, taxpayers can navigate the electronic filing process with ease and avoid any potential issues. Remember to review your return carefully, sign the form, and attach supporting documents to ensure a smooth and accurate filing process.

We hope this article has been informative and helpful in guiding you through the process of electronic filing with PA Form 8453. If you have any further questions or concerns, please don't hesitate to comment below.

What is PA Form 8453?

+PA Form 8453 is a declaration for an electronically filed return. It is a mandatory form that taxpayers must complete and sign when filing their tax returns electronically.

Why is PA Form 8453 Important?

+The PA Form 8453 plays a critical role in the electronic filing process. By signing this form, taxpayers acknowledge that they have reviewed and approved the return, and that they understand the penalties for filing a false or inaccurate return.

How do I Complete PA Form 8453?

+Completing PA Form 8453 is a straightforward process. Review your return, sign the form, date the form, attach supporting documents, and submit the form along with your electronic tax return.