Receiving your W2 form from McDonald's in a timely manner is crucial for filing your taxes accurately and on time. Unfortunately, many employees face delays or difficulties in obtaining their W2 forms, which can lead to unnecessary stress and potential penalties. In this article, we will explore five ways to get your McDonald's W2 form quickly, ensuring you can file your taxes with ease.

Understanding the Importance of W2 Forms

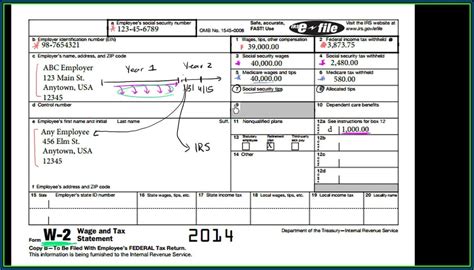

Before we dive into the methods for obtaining your McDonald's W2 form, it's essential to understand the significance of this document. A W2 form, also known as the Wage and Tax Statement, is a critical tax document that reports your income, taxes withheld, and other relevant information to the Internal Revenue Service (IRS). Employers, including McDonald's, are required to provide W2 forms to their employees by January 31st each year. This document serves as a vital component of your tax return, and its accuracy is crucial for avoiding delays or errors in processing your taxes.

Method 1: Accessing Your W2 Form Online through the McDonald's Employee Portal

One of the most convenient ways to obtain your McDonald's W2 form is through the company's employee portal. If you have access to the portal, you can log in and download your W2 form directly. Here's how:

- Visit the McDonald's employee portal website

- Log in with your username and password

- Navigate to the "Payroll" or "Tax Documents" section

- Click on the "W2 Form" link to download and print your document

Troubleshooting Tips

If you're having trouble accessing the employee portal or finding your W2 form, try the following:

- Verify your login credentials to ensure you're using the correct username and password

- Check your browser settings to ensure you're using a compatible browser

- Contact the McDonald's HR department or IT support for assistance

Method 2: Contacting the McDonald's HR Department

If you're unable to access your W2 form through the employee portal, you can reach out to the McDonald's HR department for assistance. Here's how:

- Contact the McDonald's HR department via phone or email

- Provide your employee ID number and request a copy of your W2 form

- Confirm your mailing address to ensure the document is sent to the correct location

Additional Tips

When contacting the HR department, be prepared to provide additional information, such as:

- Your Social Security number or Employee ID number

- Your employment dates with McDonald's

- Any changes to your address or contact information

Method 3: Visiting Your Local McDonald's Restaurant

If you're unable to access your W2 form online or through the HR department, you can visit your local McDonald's restaurant for assistance. Here's how:

- Visit your local McDonald's restaurant during business hours

- Speak with a manager or HR representative

- Provide your employee ID number and request a copy of your W2 form

Tips for Visiting Your Local Restaurant

When visiting your local McDonald's restaurant, be prepared to:

- Provide identification and proof of employment

- Confirm your mailing address to ensure the document is sent to the correct location

- Ask about any additional fees or requirements for obtaining your W2 form

Method 4: Using the IRS Website to Obtain a Duplicate W2 Form

If you're unable to obtain your W2 form from McDonald's, you can use the IRS website to request a duplicate copy. Here's how:

- Visit the IRS website at irs.gov

- Navigate to the "Get Your Tax Record" section

- Click on the "Get Transcript Online" link to request a duplicate W2 form

Additional Requirements

When requesting a duplicate W2 form through the IRS website, you'll need to:

- Provide your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Verify your identity through the IRS's authentication process

- Confirm your mailing address to ensure the document is sent to the correct location

Method 5: Contacting the Social Security Administration

If you're unable to obtain your W2 form from McDonald's or the IRS, you can contact the Social Security Administration (SSA) for assistance. Here's how:

- Contact the SSA via phone or email

- Provide your Social Security number and request a copy of your W2 form

- Confirm your mailing address to ensure the document is sent to the correct location

Additional Tips

When contacting the SSA, be prepared to:

- Provide identification and proof of employment

- Confirm your employment dates with McDonald's

- Ask about any additional fees or requirements for obtaining your W2 form

In conclusion, obtaining your McDonald's W2 form quickly and efficiently is crucial for filing your taxes accurately and on time. By using one of the five methods outlined above, you can ensure you receive your W2 form in a timely manner and avoid any potential delays or penalties. Remember to stay calm and patient, and don't hesitate to reach out to the relevant authorities if you need assistance.

What is the deadline for McDonald's to provide W2 forms to employees?

+McDonald's is required to provide W2 forms to employees by January 31st each year.

Can I obtain my W2 form from McDonald's if I'm no longer employed by the company?

+Yes, you can still obtain your W2 form from McDonald's even if you're no longer employed by the company. Contact the HR department or visit your local restaurant for assistance.

What should I do if I receive an incorrect W2 form from McDonald's?

+If you receive an incorrect W2 form from McDonald's, contact the HR department or visit your local restaurant to request a corrected copy.