Completing IRS Form 5405 can be a daunting task, but breaking it down into manageable steps makes it more accessible. This form is specifically designed for homebuyers claiming the first-time homebuyer credit. If you're eligible for this credit, understanding the process will help you navigate the form with ease.

The First-Time Homebuyer Credit was introduced as part of the Housing and Economic Recovery Act of 2008. It's designed to assist individuals in purchasing their first home by providing a refundable tax credit. However, to claim this credit, you must accurately complete Form 5405.

Here's how you can do it in 5 steps.

Step 1: Determine Your Eligibility

Before diving into the form, it's crucial to ensure you're eligible for the First-Time Homebuyer Credit. The IRS has specific requirements that must be met:

- First-Time Homebuyer: You or your spouse must not have owned a principal residence in the three years prior to the purchase of your new home.

- Purchase Date: The home must have been purchased after April 8, 2008, and before May 1, 2010.

- Income Limits: Your income must be below the specified limits, which vary based on filing status and the year of purchase.

- Home Location: The home must be located in the United States.

If you meet these criteria, you can proceed to fill out the form.

Gathering Necessary Documents

To accurately complete Form 5405, you'll need several documents:

- Settlement Statement (HUD-1): This document outlines the terms of your home purchase, including the purchase price and any credits or adjustments.

- Copy of Form 1098: If you claimed the mortgage interest deduction, you'll need this form from your lender.

- Proof of Residency: Ensure you have documents that prove you lived in the home as your principal residence.

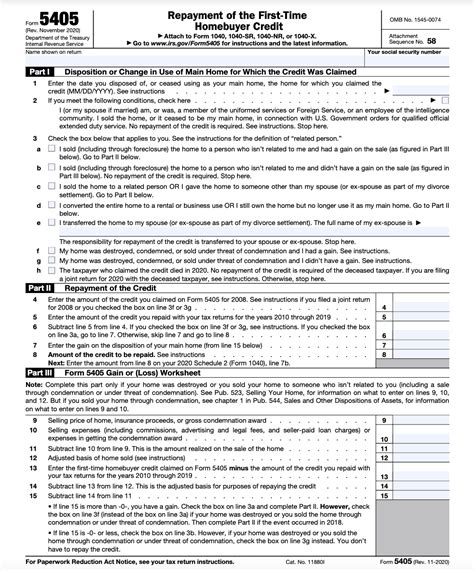

Step 2: Fill Out Part I of Form 5405

Part I of the form requires basic information about your home purchase:

- Purchase Date and Price: Fill in the date you purchased your home and the purchase price as shown on your settlement statement.

- Address of Home: Enter the address of the home you purchased.

- Credit Amount: If you're claiming the full credit, check the box indicating so. Otherwise, calculate the credit based on the purchase price and the phase-out limits.

Step 3: Calculate the Credit

If your income exceeds the phase-out limits, you'll need to calculate the reduced credit amount:

- Phase-Out Limits: Check the IRS instructions for the phase-out limits for your filing status.

- Reduced Credit Calculation: Use the formula provided in the instructions to calculate the reduced credit amount.

Reporting the Credit

- Line 1: Enter the credit amount you're claiming.

- Line 2: If you're claiming a reduced credit, enter the amount from your calculation.

Step 4: Fill Out Part II of Form 5405 (If Necessary)

If you received a credit in a prior year and are required to repay it, you'll need to complete Part II:

- Prior Year Credit: Enter the credit amount you received in a prior year.

- Repayment Amount: Calculate the repayment amount based on the instructions provided.

Repayment Calculation

- 15-Year Repayment Period: Divide the prior year credit by 15 to determine the annual repayment amount.

Step 5: Submit Form 5405 with Your Tax Return

Once you've completed Form 5405, attach it to your tax return (Form 1040):

- Attach Supporting Documents: Include your settlement statement and any other required documents.

- Submit Your Return: File your tax return as you normally would, making sure to include Form 5405.

By following these steps, you can accurately complete Form 5405 and claim the First-Time Homebuyer Credit. If you're unsure about any part of the process, consider consulting a tax professional for guidance.

Your turn! Have you claimed the First-Time Homebuyer Credit before? Share your experience in the comments below. If you found this guide helpful, consider sharing it with friends or family who might be eligible for this credit.