In the United States, the Internal Revenue Service (IRS) provides various forms for taxpayers to request and obtain information about their tax accounts. One such form is the IRS Form 4506-F, which is used to request a transcript of a taxpayer's Form 1040 series return. This form is crucial for various purposes, including income verification, loan applications, and tax preparation. Here, we will delve into six essential facts about IRS Form 4506-F, exploring its purpose, eligibility, and benefits.

What is IRS Form 4506-F?

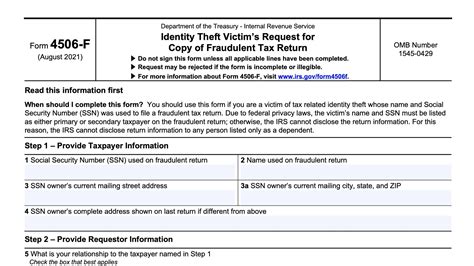

IRS Form 4506-F is a document used to request a transcript of a taxpayer's Form 1040 series return. The form is used to obtain a copy of the taxpayer's previously filed tax return, which can be necessary for various purposes such as income verification, loan applications, and tax preparation. The form can be used to request a transcript of the taxpayer's Form 1040, Form 1040A, or Form 1040EZ.

Purpose of IRS Form 4506-F

The primary purpose of IRS Form 4506-F is to provide taxpayers with a copy of their previously filed tax return. This can be useful for various purposes, including:

- Income verification: Taxpayers may need to verify their income for loan applications, credit card applications, or other financial purposes.

- Tax preparation: Taxpayers may need a copy of their previous tax return to prepare their current tax return.

- Audit purposes: Taxpayers may need a copy of their previous tax return to respond to an audit or examination by the IRS.

Eligibility to Use IRS Form 4506-F

To use IRS Form 4506-F, taxpayers must meet certain eligibility criteria. The following individuals are eligible to use the form:

- Taxpayers who have filed a Form 1040 series return (Form 1040, Form 1040A, or Form 1040EZ)

- Taxpayers who need a copy of their previously filed tax return for income verification, tax preparation, or other purposes

- Taxpayers who are authorized representatives of the taxpayer (such as a tax professional or attorney)

Benefits of Using IRS Form 4506-F

Using IRS Form 4506-F can provide several benefits to taxpayers, including:

- Convenience: The form can be used to obtain a copy of the taxpayer's previously filed tax return, which can save time and effort.

- Accuracy: The form can help ensure that the taxpayer's tax return information is accurate and up-to-date.

- Cost-effective: The form can help taxpayers avoid the cost of obtaining a copy of their tax return from other sources.

How to Complete IRS Form 4506-F

To complete IRS Form 4506-F, taxpayers must provide certain information, including:

- Their name and address

- Their Social Security number or Individual Taxpayer Identification Number (ITIN)

- The tax year of the return they are requesting

- The type of return they are requesting (Form 1040, Form 1040A, or Form 1040EZ)

Taxpayers can complete the form online or by mail. The form can be downloaded from the IRS website or obtained by calling the IRS at 1-800-829-1040.

Where to Send IRS Form 4506-F

Completed IRS Form 4506-F should be sent to the IRS at the following address:

Internal Revenue Service raービrance Team 1111 Constitution Ave NW Washington, DC 20224

Taxpayers can also fax the form to the IRS at 855-214-2223.

FAQs About IRS Form 4506-F

Here are some frequently asked questions about IRS Form 4506-F:

Q: How long does it take to receive a transcript of my tax return? A: The IRS typically processes requests for transcripts within 10-15 business days.

Q: Can I request a transcript of my tax return online? A: Yes, taxpayers can request a transcript of their tax return online through the IRS website.

Q: Can I request a transcript of my tax return by phone? A: Yes, taxpayers can request a transcript of their tax return by calling the IRS at 1-800-829-1040.

Q: How much does it cost to request a transcript of my tax return? A: There is no cost to request a transcript of your tax return.

What is the purpose of IRS Form 4506-F?

+The primary purpose of IRS Form 4506-F is to provide taxpayers with a copy of their previously filed tax return.

Who is eligible to use IRS Form 4506-F?

+Taxpayers who have filed a Form 1040 series return (Form 1040, Form 1040A, or Form 1040EZ) are eligible to use the form.

How do I complete IRS Form 4506-F?

+To complete the form, taxpayers must provide their name and address, Social Security number or ITIN, tax year of the return they are requesting, and the type of return they are requesting.

We hope this article has provided you with essential information about IRS Form 4506-F. If you have any further questions or concerns, please do not hesitate to reach out to us. Don't forget to share this article with your friends and family who may be interested in learning more about IRS Form 4506-F.