As a resident of Oregon, it's essential to understand the process of filing your state income tax return. The Oregon Resident Tax Return Form 40 is a crucial document that requires accurate and timely submission to avoid any penalties or fines. In this comprehensive guide, we'll walk you through the process of filing your Oregon tax return, highlighting the necessary steps, deadlines, and requirements.

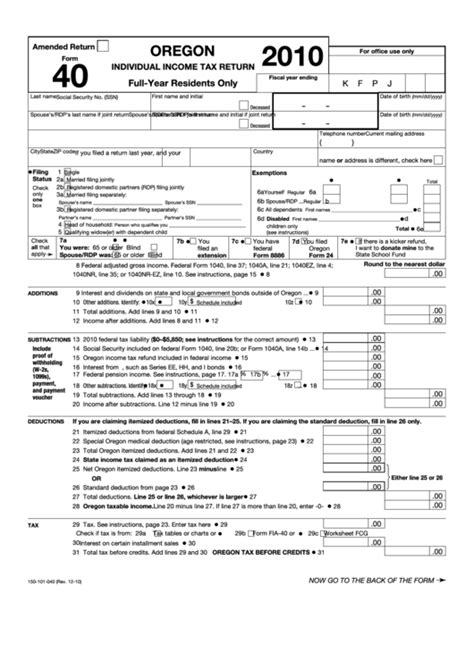

Understanding the Oregon Resident Tax Return Form 40

The Oregon Resident Tax Return Form 40 is used by Oregon residents to report their state income tax liability. The form is typically filed annually, and the deadline for submission is usually April 15th of each year. The Oregon Department of Revenue (DOR) requires residents to file this form to report their income, deductions, and credits for the tax year.

Who Needs to File the Oregon Resident Tax Return Form 40?

As an Oregon resident, you are required to file the Form 40 if you have income that is subject to state taxation. This includes:

- Wages and salaries

- Self-employment income

- Interest and dividends

- Capital gains and losses

- Rental income

- Business income

You are also required to file if you have made estimated tax payments or have tax withheld from any of the above sources.

Gathering Necessary Documents and Information

Before you begin filing your Oregon Resident Tax Return Form 40, make sure you have the following documents and information:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN (if filing jointly)

- Your dependents' Social Security numbers or ITINs (if claiming dependents)

- Your W-2 forms from all employers

- Your 1099 forms for self-employment income, interest, dividends, and capital gains and losses

- Your Oregon tax withholding statements (if applicable)

- Your charitable donation receipts (if itemizing deductions)

Filing Status and Exemptions

Your filing status determines the tax rates and credits you are eligible for. Oregon recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

You may also be eligible for exemptions, such as the standard exemption or itemized deductions.

Computing Your Oregon Tax Liability

To compute your Oregon tax liability, you will need to calculate your taxable income and apply the applicable tax rates. Oregon has a progressive tax system, with tax rates ranging from 5% to 9.9%.

Claiming Credits and Deductions

Oregon offers various credits and deductions to reduce your tax liability. Some of the most common credits and deductions include:

- Earned Income Tax Credit (EITC)

- Child and dependent care credit

- Education credits

- Charitable donation deduction

- Mortgage interest and property tax deduction

Filing the Oregon Resident Tax Return Form 40

You can file your Oregon Resident Tax Return Form 40 electronically or by mail. The Oregon DOR recommends e-filing, as it is faster and more accurate.

E-Filing

To e-file your Oregon tax return, you can use the Oregon DOR's online filing system or a third-party tax preparation software. Make sure you have all the necessary documents and information before starting the e-filing process.

Mailing Your Return

If you prefer to mail your return, make sure to use the correct address and include all required documents and payments.

Payment Options

If you owe taxes, you can pay online, by phone, or by mail. The Oregon DOR also offers payment plans and installment agreements for those who cannot pay their tax liability in full.

Filing Deadline and Penalties

The deadline for filing your Oregon Resident Tax Return Form 40 is typically April 15th of each year. If you fail to file or pay your taxes on time, you may be subject to penalties and interest.

Amending Your Return

If you need to make changes to your Oregon tax return, you can file an amended return using Form 40-EXT. Make sure to include all required documentation and explanations for the changes.

Conclusion

Filing your Oregon Resident Tax Return Form 40 requires attention to detail and accuracy. By following this guide, you can ensure a smooth and timely filing process. Remember to gather all necessary documents and information, compute your tax liability, and claim applicable credits and deductions. Don't hesitate to contact the Oregon DOR or a tax professional if you have any questions or concerns.

We hope this guide has been helpful in navigating the process of filing your Oregon tax return. If you have any questions or need further clarification, please don't hesitate to ask.

FAQs

What is the deadline for filing my Oregon Resident Tax Return Form 40?

+The deadline for filing your Oregon Resident Tax Return Form 40 is typically April 15th of each year.

Can I e-file my Oregon tax return?

+Yes, you can e-file your Oregon tax return using the Oregon DOR's online filing system or a third-party tax preparation software.

What happens if I miss the filing deadline?

+If you miss the filing deadline, you may be subject to penalties and interest. You can file for an extension or make a payment plan to avoid further penalties.