Transferring property ownership in Polk County, Florida, can be a complex process, but using a quit claim deed form can simplify the transaction. A quit claim deed is a legal document that allows one party to transfer their interest in a property to another party, without making any warranties or guarantees about the property's title. In this article, we will provide five essential tips for using a Polk County Florida quit claim deed form.

Understanding the Basics of Quit Claim Deeds

Before we dive into the tips, it's essential to understand the basics of quit claim deeds. A quit claim deed is a type of deed that allows the grantor (the party transferring the property) to convey their interest in the property to the grantee (the party receiving the property). Quit claim deeds are often used in situations where the grantor wants to transfer property quickly, without making any warranties or guarantees about the property's title.

What is Included in a Quit Claim Deed Form?

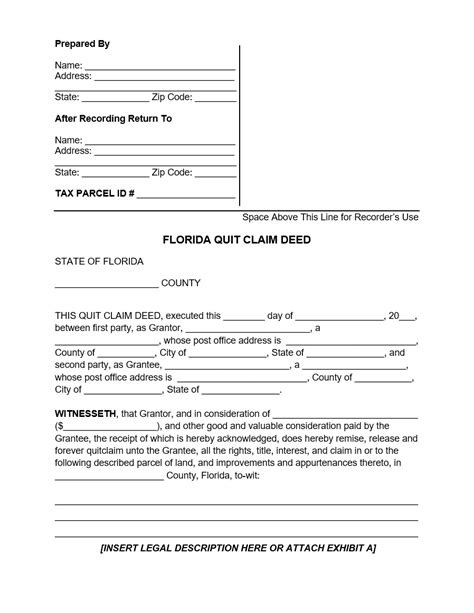

A Polk County Florida quit claim deed form typically includes the following information:

- The names and addresses of the grantor and grantee

- A description of the property being transferred

- The grantor's signature and notarization

- The grantee's signature and notarization (in some cases)

Tip #1: Choose the Correct Quit Claim Deed Form

In Polk County, Florida, there are different types of quit claim deed forms, each with its own specific requirements and uses. It's essential to choose the correct form for your specific situation. Some common types of quit claim deed forms include:

- Individual to individual quit claim deed

- Married couple to individual quit claim deed

- Corporation to individual quit claim deed

Make sure to select the correct form to avoid any potential issues or delays in the transfer process.

How to Choose the Correct Quit Claim Deed Form

To choose the correct quit claim deed form, consider the following factors:

- The type of property being transferred (residential, commercial, etc.)

- The relationship between the grantor and grantee (individuals, married couples, corporations, etc.)

- Any specific requirements or restrictions on the property

Tip #2: Ensure Proper Signatures and Notarization

Proper signatures and notarization are essential for a valid quit claim deed. Make sure that:

- The grantor signs the deed in the presence of a notary public

- The grantor's signature is notarized

- The grantee's signature is not required, but it's recommended to obtain their signature to acknowledge receipt of the deed

What Happens if Signatures are Not Properly Notarized?

If the signatures are not properly notarized, the quit claim deed may be considered invalid. This can lead to delays or even the rejection of the deed by the county recorder's office.

Tip #3: Record the Quit Claim Deed

Recording the quit claim deed is crucial to provide public notice of the transfer of ownership. In Polk County, Florida, the quit claim deed must be recorded with the county recorder's office. This involves:

- Filing the original quit claim deed with the county recorder's office

- Paying the required recording fees

- Obtaining a certified copy of the recorded deed

What Happens if the Quit Claim Deed is Not Recorded?

If the quit claim deed is not recorded, the transfer of ownership may not be recognized by the county. This can lead to potential issues or disputes in the future.

Tip #4: Consider Tax Implications

The transfer of property using a quit claim deed may have tax implications. In Polk County, Florida, the grantor may be responsible for paying documentary stamp taxes on the transfer. Additionally, the grantee may be responsible for paying property taxes on the property.

How to Minimize Tax Implications

To minimize tax implications, consider the following:

- Consult with a tax professional to determine the potential tax implications

- Ensure that the quit claim deed is properly recorded to avoid any potential tax penalties

Tip #5: Seek Professional Advice

Using a quit claim deed form can be complex, and it's recommended to seek professional advice to ensure that the transfer is done correctly. Consider consulting with:

- An attorney specializing in real estate law

- A title company or escrow agent

- A tax professional

By following these five tips, you can ensure a smooth and successful transfer of property using a Polk County Florida quit claim deed form. Remember to choose the correct form, ensure proper signatures and notarization, record the deed, consider tax implications, and seek professional advice.

Encourage Engagement:

We hope this article has provided valuable information on using a Polk County Florida quit claim deed form. If you have any questions or comments, please feel free to share them below. Additionally, if you have any experience with quit claim deeds, we'd love to hear about it. Share your story and help others navigate the process.

FAQ Section:

What is a quit claim deed?

+A quit claim deed is a type of deed that allows the grantor to convey their interest in the property to the grantee, without making any warranties or guarantees about the property's title.

What are the different types of quit claim deed forms?

+There are different types of quit claim deed forms, including individual to individual, married couple to individual, and corporation to individual.

Do I need to record the quit claim deed?

+Yes, recording the quit claim deed is crucial to provide public notice of the transfer of ownership.