For publicly traded companies in the United States, filing Form 10-Q with the Securities and Exchange Commission (SEC) is a crucial aspect of financial reporting. Form 10-Q is a quarterly report that provides a comprehensive overview of a company's financial performance and position during the quarter. In this article, we will delve into the essential filing instructions for mastering Form 10-Q, highlighting key requirements, and providing practical examples to ensure compliance with SEC regulations.

Understanding Form 10-Q: Purpose and Frequency

Form 10-Q is a quarterly report that publicly traded companies must file with the SEC to provide stakeholders with timely and accurate information about their financial performance and position. The report covers a company's financial results for the quarter, as well as any significant events or transactions that occurred during the period. Companies must file Form 10-Q within 40 days after the end of each quarter, except for the fourth quarter, which is combined with the annual report on Form 10-K.

Who Must File Form 10-Q?

Form 10-Q must be filed by publicly traded companies, including:

- Companies with a class of securities registered under Section 12(b) or 12(g) of the Exchange Act

- Companies with a market value of $10 million or more and 2,000 or more shareholders

- Companies that have filed a registration statement that has not yet become effective

Form 10-Q Filing Instructions: Part I – Financial Information

Part I of Form 10-Q requires companies to provide financial information, including:

- Unaudited balance sheets as of the end of the quarter and the end of the preceding fiscal year

- Unaudited statements of income and comprehensive income for the quarter and year-to-date periods

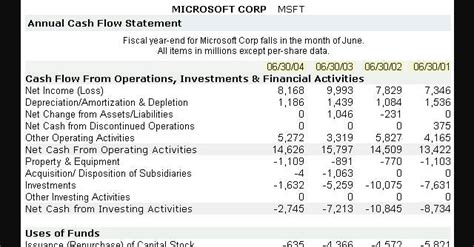

- Unaudited statements of cash flows for the quarter and year-to-date periods

- Notes to the financial statements

Financial Statement Requirements

Financial statements must be presented in accordance with generally accepted accounting principles (GAAP) and must include:

- A balance sheet as of the end of the quarter

- A statement of income and comprehensive income for the quarter and year-to-date periods

- A statement of cash flows for the quarter and year-to-date periods

Form 10-Q Filing Instructions: Part II – Management's Discussion and Analysis (MD&A)

Part II of Form 10-Q requires companies to provide a Management's Discussion and Analysis (MD&A) section, which provides a narrative explanation of a company's financial performance and position. The MD&A must include:

- A discussion of the company's financial condition and results of operations

- A discussion of the company's liquidity and capital resources

- A discussion of the company's critical accounting policies and estimates

MD&A Requirements

The MD&A must be written in a clear and concise manner and must include:

- A discussion of the company's financial condition and results of operations

- A discussion of the company's liquidity and capital resources

- A discussion of the company's critical accounting policies and estimates

Form 10-Q Filing Instructions: Part III – Quantitative and Qualitative Disclosures about Market Risk

Part III of Form 10-Q requires companies to provide quantitative and qualitative disclosures about market risk, including:

- A discussion of the company's exposure to market risk

- A discussion of the company's risk management strategies

- A table showing the company's market risk exposure

Market Risk Disclosures

Market risk disclosures must include:

- A discussion of the company's exposure to market risk

- A discussion of the company's risk management strategies

- A table showing the company's market risk exposure

Form 10-Q Filing Instructions: Part IV – Controls and Procedures

Part IV of Form 10-Q requires companies to provide information about their internal controls and procedures, including:

- A discussion of the company's internal controls and procedures

- A discussion of the company's disclosure controls and procedures

Controls and Procedures Disclosures

Controls and procedures disclosures must include:

- A discussion of the company's internal controls and procedures

- A discussion of the company's disclosure controls and procedures

Form 10-Q Filing Instructions: Part V – Other Information

Part V of Form 10-Q requires companies to provide other information, including:

- A discussion of any significant events or transactions that occurred during the quarter

- A discussion of any changes in the company's business or operations

Other Information Disclosures

Other information disclosures must include:

- A discussion of any significant events or transactions that occurred during the quarter

- A discussion of any changes in the company's business or operations

Conclusion: Mastering Form 10-Q Filing Instructions

Mastering Form 10-Q filing instructions requires a thorough understanding of the SEC's regulations and requirements. By following the guidelines outlined in this article, companies can ensure compliance with SEC regulations and provide stakeholders with timely and accurate information about their financial performance and position.

Final Tips for Filing Form 10-Q

- Ensure that all financial statements are presented in accordance with GAAP

- Provide clear and concise disclosures in the MD&A section

- Ensure that all market risk disclosures are accurate and complete

- Review and update internal controls and procedures regularly

- Ensure that all other information disclosures are accurate and complete

What is the purpose of Form 10-Q?

+The purpose of Form 10-Q is to provide stakeholders with timely and accurate information about a company's financial performance and position during the quarter.

Who must file Form 10-Q?

+Form 10-Q must be filed by publicly traded companies, including companies with a class of securities registered under Section 12(b) or 12(g) of the Exchange Act, companies with a market value of $10 million or more and 2,000 or more shareholders, and companies that have filed a registration statement that has not yet become effective.

What are the key components of Form 10-Q?

+The key components of Form 10-Q include financial information, Management's Discussion and Analysis (MD&A), quantitative and qualitative disclosures about market risk, controls and procedures, and other information.