The world of tax accounting can be complex and nuanced, and one area that can be particularly tricky is understanding at-risk limitations. For investors and business owners, understanding these limitations is crucial to ensuring that their tax liabilities are accurate and minimized. In this article, we will delve into the world of Form 6198 and explore the ins and outs of at-risk limitations.

At-risk limitations are a critical component of tax accounting, as they determine the amount of losses that can be deducted from a business or investment activity. The at-risk rules were enacted to prevent taxpayers from deducting losses that are not actually at risk. In other words, the rules are designed to ensure that taxpayers are not using losses to offset income that is not related to the activity.

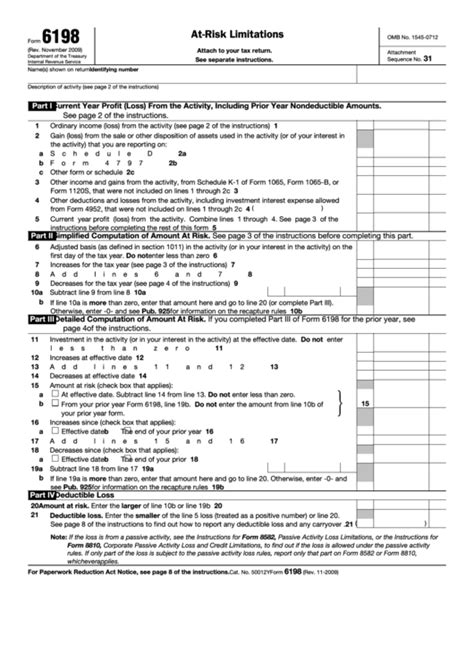

What is Form 6198?

Form 6198 is a tax form used to calculate the at-risk limitations for a business or investment activity. The form is used to determine the amount of losses that can be deducted from an activity, as well as the amount of gains that can be reported. The form takes into account the amount of money invested in the activity, as well as any losses or gains that have been reported in previous years.

The form is typically filed by individuals who have invested in a business or investment activity, such as a partnership or S corporation. The form is also used by taxpayers who have invested in real estate or other activities that are subject to the at-risk rules.

How to Calculate At-Risk Limitations

Calculating at-risk limitations can be a complex process, but it can be broken down into several steps. Here are the general steps to follow:

- Determine the amount of money invested in the activity. This includes any cash or property that has been contributed to the activity.

- Determine the amount of losses that have been reported in previous years. This includes any losses that have been deducted on previous tax returns.

- Calculate the amount of gains that have been reported in previous years. This includes any gains that have been reported on previous tax returns.

- Calculate the at-risk limitation using the formula:

At-Risk Limitation = (Amount Invested - Total Losses) + Total Gains

The at-risk limitation is the maximum amount of losses that can be deducted from the activity.

Types of Activities Subject to At-Risk Limitations

Not all business and investment activities are subject to at-risk limitations. Here are some examples of activities that are subject to the at-risk rules:

- Partnerships: Partnerships are subject to the at-risk rules, and partners must file Form 6198 to calculate their at-risk limitations.

- S Corporations: S corporations are subject to the at-risk rules, and shareholders must file Form 6198 to calculate their at-risk limitations.

- Real Estate: Real estate activities are subject to the at-risk rules, and taxpayers must file Form 6198 to calculate their at-risk limitations.

- Commodities: Commodities trading is subject to the at-risk rules, and taxpayers must file Form 6198 to calculate their at-risk limitations.

Penalties for Failure to Comply with At-Risk Limitations

Failure to comply with the at-risk limitations can result in penalties and interest. Here are some examples of penalties that can be imposed:

- Accuracy-Related Penalty: A penalty of up to 20% of the underpaid tax can be imposed for failure to comply with the at-risk limitations.

- Negligence Penalty: A penalty of up to 20% of the underpaid tax can be imposed for failure to comply with the at-risk limitations due to negligence.

- Interest: Interest can be charged on any underpaid tax due to failure to comply with the at-risk limitations.

Conclusion

Understanding at-risk limitations is crucial for investors and business owners who want to ensure that their tax liabilities are accurate and minimized. Form 6198 is a critical tool for calculating at-risk limitations, and taxpayers must follow the correct procedures to avoid penalties and interest. By following the steps outlined in this article, taxpayers can ensure that they are in compliance with the at-risk rules and avoid any potential penalties.

We hope this article has provided valuable insights into the world of at-risk limitations. If you have any questions or need further clarification, please don't hesitate to comment below.

What is the purpose of Form 6198?

+Form 6198 is used to calculate the at-risk limitations for a business or investment activity.

Who must file Form 6198?

+Individuals who have invested in a business or investment activity, such as a partnership or S corporation, must file Form 6198.

What are the consequences of failure to comply with at-risk limitations?

+Failure to comply with at-risk limitations can result in penalties and interest.