The world of tax filing can be a complex and daunting task, especially when it comes to reporting capital gains and losses on Form 8949. One of the most critical aspects of this process is understanding the various codes that are used to categorize and report these transactions. In this article, we will delve into the six codes to know for Form 8949 Code M, providing you with a comprehensive guide to help you navigate this often-confusing landscape.

What is Form 8949?

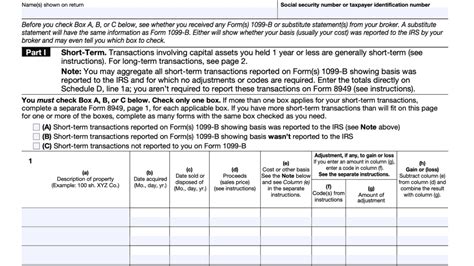

Before we dive into the specifics of Code M, let's take a brief look at what Form 8949 is and why it's so important. Form 8949 is a tax form used by the Internal Revenue Service (IRS) to report sales and other dispositions of capital assets, such as stocks, bonds, and real estate. This form is used to calculate the capital gains and losses from these transactions, which are then reported on Schedule D of the taxpayer's individual income tax return (Form 1040).

What is Code M on Form 8949?

Code M on Form 8949 is used to report sales of securities that are subject to the wash sale rule. The wash sale rule is a provision in the tax code that prohibits taxpayers from claiming a loss on the sale of a security if they purchase a "substantially identical" security within 30 days before or after the sale. Code M is used to identify these transactions and ensure that the taxpayer is not claiming a loss that is subject to the wash sale rule.

6 Codes to Know for Form 8949 Code M

Now that we've covered the basics of Code M, let's take a closer look at the six codes that are used in conjunction with Code M on Form 8949:

1. Code M - Wash Sale

As we mentioned earlier, Code M is used to report sales of securities that are subject to the wash sale rule. This code is used to identify transactions that may be subject to this rule and ensure that the taxpayer is not claiming a loss that is not allowed.

2. Code A - Acquisition

Code A is used to report the acquisition of a security, which can include purchases, inheritances, or gifts. This code is used to establish the taxpayer's basis in the security, which is necessary for calculating capital gains and losses.

3. Code B - Basis Adjustment

Code B is used to report adjustments to the taxpayer's basis in a security. This can include adjustments for dividends, interest, or other income received on the security.

4. Code C - Sale

Code C is used to report the sale of a security, which can include sales, exchanges, or other dispositions. This code is used to calculate the capital gain or loss from the transaction.

5. Code D - Dividend

Code D is used to report dividends received on a security. This code is used to calculate the taxpayer's ordinary income from the dividend.

6. Code E - Exclusion

Code E is used to report exclusions from income, such as exclusions for qualified dividends or long-term capital gains. This code is used to calculate the taxpayer's taxable income from the transaction.

How to Use Code M on Form 8949

Now that we've covered the six codes to know for Form 8949 Code M, let's take a closer look at how to use Code M on the form.

Example:

Suppose a taxpayer sells 100 shares of XYZ stock on January 10, 2023, for $10,000. The taxpayer had purchased the stock on December 15, 2022, for $12,000. The taxpayer also purchased 100 shares of XYZ stock on January 20, 2023, for $10,500.

In this example, the taxpayer would report the sale of the stock on Form 8949 using Code M, as the sale is subject to the wash sale rule. The taxpayer would also report the purchase of the stock on Form 8949 using Code A, and the subsequent purchase of the same stock using Code C.

Conclusion

Form 8949 Code M is an important code to know when reporting capital gains and losses on Form 8949. By understanding the six codes to know for Code M, taxpayers can ensure that they are accurately reporting their transactions and avoiding any potential errors or penalties. Whether you're a seasoned tax professional or just starting out, this guide provides a comprehensive overview of Code M and how to use it on Form 8949.

FAQ Section

What is Form 8949?

+Form 8949 is a tax form used to report sales and other dispositions of capital assets, such as stocks, bonds, and real estate.

What is Code M on Form 8949?

+Code M on Form 8949 is used to report sales of securities that are subject to the wash sale rule.

How do I use Code M on Form 8949?

+To use Code M on Form 8949, report the sale of the security on the form using Code M, and also report the purchase of the security using Code A and the subsequent purchase of the same security using Code C.