The Fannie Mae appraisal form 1007 is a crucial document in the mortgage lending process. As a lender, investor, or borrower, understanding the intricacies of this form can make a significant difference in ensuring that the appraisal process is smooth, efficient, and compliant with regulatory requirements. In this article, we will delve into the world of the Fannie Mae appraisal form 1007, exploring its purpose, components, and significance in the mortgage lending industry.

What is the Fannie Mae Appraisal Form 1007?

The Fannie Mae appraisal form 1007, also known as the "Individual Condominium Unit Appraisal Report," is a standardized form used to evaluate the value of a condominium unit. The form is designed to provide lenders with a comprehensive and detailed analysis of the property's value, which is essential in determining the loan-to-value (LTV) ratio and ensuring that the borrower is not over-borrowing.

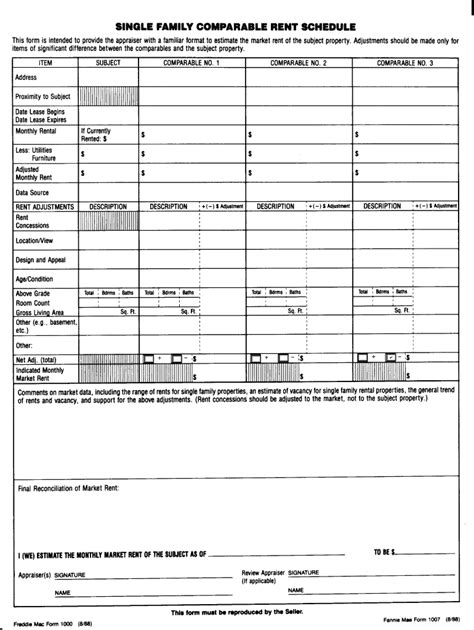

**Components of the Fannie Mae Appraisal Form 1007**

The Fannie Mae appraisal form 1007 is divided into several sections, each designed to capture specific information about the condominium unit being appraised. The key components of the form include:

- Property Identification: This section provides essential information about the property, including the address, unit number, and condominium complex name.

- Subject Property Characteristics: This section details the physical characteristics of the condominium unit, such as the number of bedrooms and bathrooms, square footage, and age of the property.

- Neighborhood and Market Analysis: This section provides an analysis of the neighborhood and market trends, including the quality of local schools, transportation, and shopping.

- Highest and Best Use: This section determines the highest and best use of the property, which is essential in determining the property's value.

- Site and Improvements: This section describes the site and improvements, including the size and topography of the land, and the quality of the building's construction.

- Sales Comparison Approach: This section provides a comparison of the subject property to similar properties in the area, which helps to determine the property's value.

- Income Approach: This section is used to estimate the value of the property based on its potential rental income.

- Reconciliation: This section reconciles the values determined by the sales comparison and income approaches to arrive at a final value.

Benefits of the Fannie Mae Appraisal Form 1007

The Fannie Mae appraisal form 1007 provides numerous benefits to lenders, investors, and borrowers. Some of the key benefits include:

- Standardization: The form provides a standardized approach to appraising condominium units, ensuring that all relevant information is captured and analyzed.

- Compliance: The form is designed to meet regulatory requirements, ensuring that lenders are compliant with industry standards.

- Risk Management: The form helps lenders to manage risk by providing a comprehensive analysis of the property's value and potential risks.

- Investor Confidence: The form provides investors with confidence in the appraisal process, knowing that the property's value has been thoroughly analyzed.

**Who Uses the Fannie Mae Appraisal Form 1007?**

The Fannie Mae appraisal form 1007 is used by various stakeholders in the mortgage lending industry, including:

- Lenders: Lenders use the form to evaluate the value of condominium units and determine the loan-to-value (LTV) ratio.

- Investors: Investors use the form to evaluate the potential risks and returns of investing in condominium units.

- Borrowers: Borrowers use the form to understand the value of their condominium unit and the potential risks associated with ownership.

- Appraisers: Appraisers use the form to provide a comprehensive analysis of the property's value and potential risks.

Best Practices for Completing the Fannie Mae Appraisal Form 1007

To ensure that the Fannie Mae appraisal form 1007 is completed accurately and efficiently, follow these best practices:

- Use Clear and Concise Language: Use clear and concise language when completing the form to ensure that all relevant information is captured.

- Provide Detailed Descriptions: Provide detailed descriptions of the property's characteristics, including the number of bedrooms and bathrooms, square footage, and age of the property.

- Use Relevant Market Data: Use relevant market data to support the appraisal analysis, including sales data and market trends.

- Ensure Regulatory Compliance: Ensure that the form is completed in compliance with regulatory requirements, including the Uniform Standards of Professional Appraisal Practice (USPAP).

**Common Mistakes to Avoid When Completing the Fannie Mae Appraisal Form 1007**

When completing the Fannie Mae appraisal form 1007, avoid the following common mistakes:

- Inaccurate or Incomplete Information: Ensure that all relevant information is captured and accurate, including the property's characteristics and market data.

- Failure to Use Relevant Market Data: Use relevant market data to support the appraisal analysis, including sales data and market trends.

- Non-Compliance with Regulatory Requirements: Ensure that the form is completed in compliance with regulatory requirements, including USPAP.

Conclusion

The Fannie Mae appraisal form 1007 is a critical document in the mortgage lending industry, providing lenders, investors, and borrowers with a comprehensive analysis of the property's value and potential risks. By understanding the components, benefits, and best practices for completing the form, stakeholders can ensure that the appraisal process is smooth, efficient, and compliant with regulatory requirements.

Final Thoughts

The Fannie Mae appraisal form 1007 is a powerful tool in the mortgage lending industry, providing stakeholders with a comprehensive analysis of the property's value and potential risks. By following best practices and avoiding common mistakes, stakeholders can ensure that the appraisal process is accurate, efficient, and compliant with regulatory requirements.

Call to Action

We hope this article has provided you with a comprehensive understanding of the Fannie Mae appraisal form 1007. If you have any questions or comments, please feel free to share them below. Additionally, if you are a lender, investor, or borrower looking to complete the Fannie Mae appraisal form 1007, we encourage you to seek the advice of a qualified appraiser or mortgage professional.

What is the purpose of the Fannie Mae appraisal form 1007?

+The Fannie Mae appraisal form 1007 is used to evaluate the value of a condominium unit and provide lenders with a comprehensive analysis of the property's value and potential risks.

Who uses the Fannie Mae appraisal form 1007?

+The Fannie Mae appraisal form 1007 is used by lenders, investors, borrowers, and appraisers to evaluate the value of condominium units and determine the loan-to-value (LTV) ratio.

What are the common mistakes to avoid when completing the Fannie Mae appraisal form 1007?

+Common mistakes to avoid when completing the Fannie Mae appraisal form 1007 include inaccurate or incomplete information, failure to use relevant market data, and non-compliance with regulatory requirements.