As a student, receiving your 1098-T form can be a confusing and overwhelming experience, especially if you're not familiar with the tax implications of higher education expenses. The 1098-T form is a crucial document that reports the tuition and fees you paid to your educational institution, and it's essential to understand what it entails to take advantage of potential tax credits and deductions.

The 1098-T form is an information return that colleges and universities are required to provide to the Internal Revenue Service (IRS) and to students who paid qualified tuition and related expenses. The form is used to report the amount of tuition and fees paid by the student, as well as any scholarships, grants, or other forms of financial aid received.

What's Reported on the 1098-T Form?

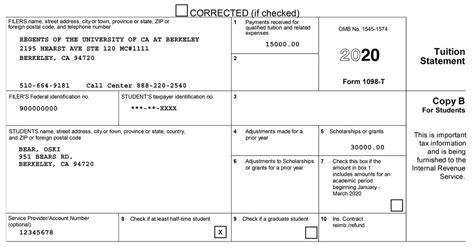

The 1098-T form reports the following information:

- The student's name, address, and taxpayer identification number (TIN)

- The educational institution's name, address, and employer identification number (EIN)

- The amount of qualified tuition and related expenses paid by the student

- The amount of scholarships, grants, and other forms of financial aid received by the student

- Whether the student was at least half-time enrolled in a degree program

- Whether the student was a graduate student

Box 1: Payments Received

Box 1 of the 1098-T form reports the total amount of payments received by the educational institution from the student for qualified tuition and related expenses. This includes payments made by the student, as well as payments made by others on the student's behalf, such as parents or spouses.

Box 2: Amounts Billed

Box 2 of the 1098-T form reports the total amount of qualified tuition and related expenses billed by the educational institution to the student. This amount may be different from the amount reported in Box 1, as it includes charges that were billed to the student, but not necessarily paid.

Box 3: Scholarships and Grants

Box 3 of the 1098-T form reports the total amount of scholarships and grants received by the student. This includes financial aid received from the educational institution, as well as from other sources, such as government agencies or private organizations.

Box 4: Adjustments

Box 4 of the 1098-T form reports any adjustments made to the amount of qualified tuition and related expenses reported in Box 1 or Box 2. This may include reductions in tuition or fees, or refunds made to the student.

Box 5: Scholarships and Grants Adjustments

Box 5 of the 1098-T form reports any adjustments made to the amount of scholarships and grants reported in Box 3. This may include reductions in financial aid or refunds made to the student.

What's Not Reported on the 1098-T Form?

The 1098-T form does not report the following information:

- Room and board expenses

- Transportation expenses

- Personal expenses

- Expenses for courses that are not part of a degree program

- Expenses for courses that are not qualified education expenses

How to Use the 1098-T Form for Tax Purposes

The 1098-T form is used to claim education tax credits and deductions on your tax return. The form provides the necessary information to complete Form 8863, Education Credits, and Form 8917, Tuition and Fees Deduction.

American Opportunity Tax Credit (AOTC)

The AOTC is a tax credit of up to $2,500 per eligible student. To qualify, you must have paid qualified tuition and related expenses, and the student must have been enrolled at least half-time in a degree program.

Lifetime Learning Credit (LLC)

The LLC is a tax credit of up to $2,000 per tax return. To qualify, you must have paid qualified tuition and related expenses, and the student must have been enrolled in a degree program.

Tuition and Fees Deduction

The Tuition and Fees Deduction allows you to deduct up to $4,000 of qualified tuition and related expenses. To qualify, you must have paid qualified tuition and related expenses, and the student must have been enrolled in a degree program.

Common Questions and Answers

Here are some common questions and answers about the 1098-T form:

Q: What is the 1098-T form?

A: The 1098-T form is an information return that reports the amount of qualified tuition and related expenses paid by a student, as well as any scholarships, grants, or other forms of financial aid received.Q: Who receives the 1098-T form?

A: The 1098-T form is provided to the student and to the IRS.Q: What is reported on the 1098-T form?

A: The 1098-T form reports the student's name, address, and taxpayer identification number, the educational institution's name, address, and employer identification number, the amount of qualified tuition and related expenses paid, and the amount of scholarships, grants, and other forms of financial aid received.Q: How do I use the 1098-T form for tax purposes?

A: The 1098-T form is used to claim education tax credits and deductions on your tax return. The form provides the necessary information to complete Form 8863, Education Credits, and Form 8917, Tuition and Fees Deduction.What is the deadline for receiving the 1098-T form?

+The deadline for receiving the 1098-T form is January 31st of each year.

Can I claim education tax credits and deductions without the 1098-T form?

+No, you cannot claim education tax credits and deductions without the 1098-T form. The form provides the necessary information to complete Form 8863, Education Credits, and Form 8917, Tuition and Fees Deduction.

How do I get a copy of my 1098-T form if I didn't receive one?

+You can contact your educational institution's registrar or student accounts office to request a copy of your 1098-T form.

We hope this article has helped you understand the 1098-T form and its implications for your taxes. If you have any further questions or concerns, please don't hesitate to reach out to your educational institution or a tax professional.