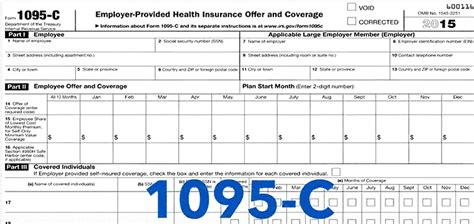

The 1095-C form is a crucial document that plays a significant role in the Affordable Care Act (ACA), also known as Obamacare. It is a form that employers with 50 or more full-time employees, including full-time equivalent employees, are required to provide to their employees and the Internal Revenue Service (IRS) each year. In this article, we will delve into the details of the 1095-C form, its importance, and how it works.

The 1095-C form is used to report information about the health insurance coverage offered by an employer to its employees. This information is essential for the IRS to determine whether an employer is complying with the ACA's employer shared responsibility provisions. The form is also used to determine whether an employee is eligible for premium tax credits when purchasing health insurance through the Health Insurance Marketplace.

Who Needs to File the 1095-C Form?

The 1095-C form is required to be filed by Applicable Large Employers (ALEs), which are employers with 50 or more full-time employees, including full-time equivalent employees. ALEs must provide a 1095-C form to each of their full-time employees, regardless of whether the employee enrolled in the employer's health plan or not.

What Information is Reported on the 1095-C Form?

The 1095-C form requires employers to report the following information:

- The employer's name, address, and Employer Identification Number (EIN)

- The employee's name, address, and Social Security number

- The months during which the employee was offered health insurance coverage

- The type of health insurance coverage offered, including the plan's name and the employee's share of the premium cost

- The employee's enrollment status in the health plan

- The employer's determination of the employee's full-time status

How Does the 1095-C Form Work?

The 1095-C form works as follows:

- The employer completes the form by reporting the required information.

- The employer provides a copy of the form to each of its full-time employees by January 31st of each year.

- The employer files the form with the IRS by March 31st of each year, if filing electronically, or February 28th, if filing paper forms.

- The IRS uses the information reported on the form to determine whether the employer is complying with the ACA's employer shared responsibility provisions.

- The employee uses the information reported on the form to determine whether they are eligible for premium tax credits when purchasing health insurance through the Health Insurance Marketplace.

What are the Penalties for Not Filing the 1095-C Form?

Employers who fail to file the 1095-C form or who fail to provide the form to their employees may be subject to penalties. The penalties for not filing the 1095-C form can range from $260 to $530 per return, depending on the circumstances.

How to File the 1095-C Form

Employers can file the 1095-C form electronically or by mail. To file electronically, employers must use the IRS's Affordable Care Act Information Returns (AIR) system. To file by mail, employers must use the IRS's Form 1094-C, which is a transmittal form that accompanies the 1095-C forms.

Common Mistakes to Avoid When Filing the 1095-C Form

When filing the 1095-C form, employers should avoid the following common mistakes:

- Failing to provide the form to employees on time

- Failing to file the form with the IRS on time

- Reporting incorrect information on the form

- Failing to include all required information on the form

Conclusion

In conclusion, the 1095-C form is an essential document that plays a critical role in the Affordable Care Act. Employers with 50 or more full-time employees must provide the form to their employees and file it with the IRS each year. The form reports information about the health insurance coverage offered by the employer, which is used to determine whether the employer is complying with the ACA's employer shared responsibility provisions.

Takeaway

Employers should take the 1095-C form seriously and ensure that they are complying with the ACA's requirements. Failure to do so can result in penalties and fines. Employers should also ensure that they are providing accurate and complete information on the form, as this information is used to determine their compliance with the ACA.

Call to Action

If you are an employer with 50 or more full-time employees, make sure to file the 1095-C form on time and provide accurate and complete information. If you have any questions or concerns about the 1095-C form, consult with a tax professional or the IRS.

What is the 1095-C form used for?

+The 1095-C form is used to report information about the health insurance coverage offered by an employer to its employees.

Who needs to file the 1095-C form?

+Employers with 50 or more full-time employees, including full-time equivalent employees, are required to file the 1095-C form.

What are the penalties for not filing the 1095-C form?

+The penalties for not filing the 1095-C form can range from $260 to $530 per return, depending on the circumstances.