As a Mercari seller, you're likely no stranger to the world of online marketplaces and the various forms and documents that come with it. One of the most important forms you'll encounter as a seller on Mercari is the W-9 form. In this article, we'll delve into the world of W-9 forms, explaining what they are, why you need them, and how to fill them out correctly.

What is a W-9 Form?

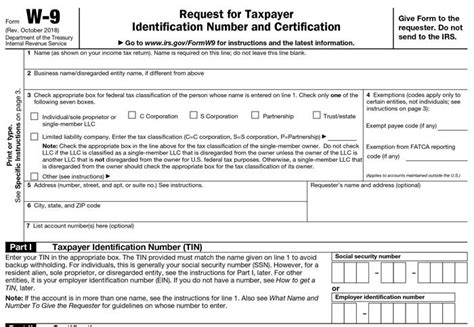

A W-9 form, also known as the Request for Taxpayer Identification Number and Certification, is a document used by the Internal Revenue Service (IRS) to collect information from individuals and businesses that will be used to report income and withhold taxes. As a Mercari seller, you'll need to complete a W-9 form to provide your taxpayer identification number (TIN) to Mercari, which will then use this information to report your income to the IRS.

Why Do I Need to Fill Out a W-9 Form?

You'll need to fill out a W-9 form if you're a Mercari seller who has earned more than $600 in a calendar year. This is because the IRS requires Mercari to report your income to the IRS using a 1099-K form, and the W-9 form is used to collect the necessary information to complete this reporting.

What Information Do I Need to Fill Out a W-9 Form?

To fill out a W-9 form, you'll need to provide the following information:

- Your name and business name (if applicable)

- Your address

- Your taxpayer identification number (TIN), which can be either your Social Security number (SSN) or your Employer Identification Number (EIN)

- Your business type (individual, sole proprietor, partnership, corporation, etc.)

- Your account number (if applicable)

How Do I Fill Out a W-9 Form?

Filling out a W-9 form is a relatively straightforward process. Here's a step-by-step guide to help you complete the form:

- Download and print the W-9 form from the IRS website or have Mercari provide you with a copy.

- Fill out the form using black ink and print clearly.

- Enter your name and business name (if applicable) in the spaces provided.

- Enter your address in the space provided.

- Enter your TIN in the space provided. Make sure to use the correct TIN format (SSN or EIN).

- Check the box that corresponds to your business type.

- Enter your account number (if applicable).

- Sign and date the form.

What Happens if I Don't Fill Out a W-9 Form?

If you don't fill out a W-9 form, you may face penalties and fines from the IRS. Additionally, Mercari may withhold payment to you until they receive a completed W-9 form. This is because the IRS requires Mercari to report your income to the IRS, and without a W-9 form, they cannot do so.

Common Mistakes to Avoid When Filling Out a W-9 Form

Here are some common mistakes to avoid when filling out a W-9 form:

- Using the wrong TIN format (SSN or EIN)

- Entering incorrect information

- Failing to sign and date the form

- Failing to provide all required information

How Do I Correct a Mistake on My W-9 Form?

If you've made a mistake on your W-9 form, you can correct it by following these steps:

- Download and print a new W-9 form.

- Fill out the new form with the correct information.

- Sign and date the new form.

- Submit the new form to Mercari.

Can I Fill Out a W-9 Form Electronically?

Yes, you can fill out a W-9 form electronically using Mercari's online platform. This can save you time and reduce the risk of errors.

Conclusion

In conclusion, filling out a W-9 form is an important step for Mercari sellers who have earned more than $600 in a calendar year. By following the steps outlined in this article, you can ensure that you fill out the form correctly and avoid any penalties or fines from the IRS. Remember to always double-check your information and submit the form to Mercari in a timely manner.

Now that you've read this article, we invite you to share your thoughts and experiences with W-9 forms in the comments section below. Have you ever had any issues with filling out a W-9 form? Do you have any tips or advice to share with other Mercari sellers? Let's start a conversation!

What is the purpose of a W-9 form?

+The purpose of a W-9 form is to provide your taxpayer identification number (TIN) to Mercari, which will then use this information to report your income to the IRS.

Do I need to fill out a W-9 form if I'm a Mercari seller?

+Yes, you'll need to fill out a W-9 form if you've earned more than $600 in a calendar year as a Mercari seller.

What happens if I don't fill out a W-9 form?

+If you don't fill out a W-9 form, you may face penalties and fines from the IRS, and Mercari may withhold payment to you until they receive a completed W-9 form.