Ohio businesses are required to file the IT-941 form, also known as the Employer's Quarterly Tax Return, to report their withholding taxes and other employment taxes. Filing this form correctly is crucial to avoid penalties, fines, and potential audits. In this article, we will provide you with a comprehensive guide on how to file the Ohio IT-941 form correctly, highlighting five essential steps to ensure accuracy and compliance.

The Importance of Filing Ohio IT-941 Form Correctly

Filing the IT-941 form correctly is critical for Ohio businesses to maintain compliance with state tax regulations. The form requires employers to report their withholding taxes, including income tax, school district income tax, and municipal income tax. Failure to file the form accurately can result in penalties, fines, and even audits. Moreover, accurate filing helps employers to maintain a good reputation and avoid any unnecessary complications with the Ohio Department of Taxation.

5 Ways to File Ohio IT-941 Form Correctly

1. Gather Required Information and Documents

Before filing the IT-941 form, ensure you have gathered all the necessary information and documents. This includes:

- Employer's identification number (EIN)

- Quarterly withholding tax returns (W-2 and 1099 forms)

- Total wages paid to employees

- Total taxes withheld from employees

- School district income tax rates and municipal income tax rates (if applicable)

2. Calculate Withholding Taxes Accurately

Understanding Withholding Tax Rates

Ohio employers must calculate withholding taxes accurately to avoid underpayment or overpayment. The state has a progressive tax system, with rates ranging from 2.85% to 4.23%. Employers must also consider school district income tax rates and municipal income tax rates, which vary depending on the location.

To calculate withholding taxes, employers can use the Ohio Tax Withholding Tables or the Ohio Tax Withholding Calculator. It is essential to ensure accuracy in calculating withholding taxes to avoid any discrepancies.

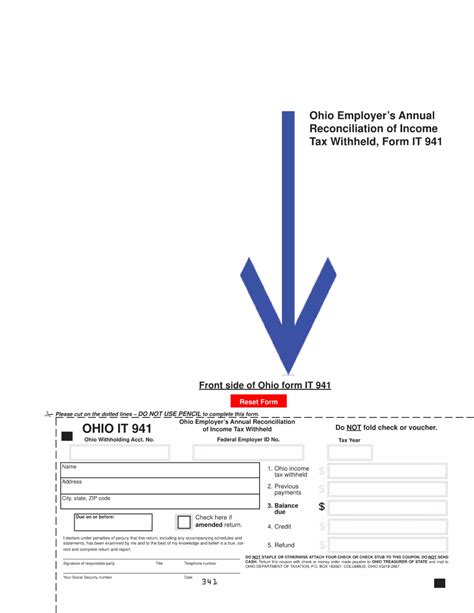

3. Complete the IT-941 Form Correctly

Understanding the IT-941 Form Structure

The IT-941 form consists of several sections, including:

- Employer information

- Withholding tax information

- School district income tax information (if applicable)

- Municipal income tax information (if applicable)

Employers must complete each section accurately, ensuring all required information is provided. It is essential to review the form carefully to avoid any errors or omissions.

4. Submit the Form Electronically or by Mail

Electronic Filing vs. Mailing

Ohio employers can submit the IT-941 form electronically or by mail. Electronic filing is recommended, as it reduces the risk of errors and provides faster processing. Employers can use the Ohio Business Gateway (OBG) to file electronically. If mailing, ensure the form is postmarked by the due date to avoid penalties.

5. Pay Any Due Taxes or Make Adjustments

Understanding Payment Options

Employers must pay any due taxes or make adjustments by the due date to avoid penalties and interest. Ohio offers several payment options, including:

- Electronic payment through OBG

- Check or money order by mail

- Payment by credit card (with a convenience fee)

Employers can also make adjustments to their withholding tax returns by filing an amended return (Form IT-941-X).

Tips for Filing Ohio IT-941 Form Correctly

- Ensure accurate calculation of withholding taxes

- Review the form carefully to avoid errors or omissions

- Submit the form electronically to reduce errors and ensure faster processing

- Pay any due taxes or make adjustments by the due date to avoid penalties and interest

FAQ Section

What is the due date for filing the Ohio IT-941 form?

+The due date for filing the Ohio IT-941 form is the last day of the month following the end of the quarter.

Can I file the Ohio IT-941 form electronically?

+Yes, you can file the Ohio IT-941 form electronically through the Ohio Business Gateway (OBG).

What are the penalties for filing the Ohio IT-941 form late?

+The penalties for filing the Ohio IT-941 form late include a late filing fee, interest on unpaid taxes, and potential audits.

By following these five steps and tips, Ohio employers can ensure accurate and timely filing of the IT-941 form, avoiding potential penalties and complications. If you have any further questions or concerns, feel free to comment below or share this article with others who may find it helpful.