The California Form CA-7A is a crucial document for individuals and businesses seeking a refund or credit for overpaid taxes in the state of California. Understanding the intricacies of this form is essential for ensuring that your claim is processed correctly and efficiently. In this article, we will delve into the world of California Form CA-7A, exploring its purpose, benefits, and the step-by-step process of filing a claim.

What is California Form CA-7A?

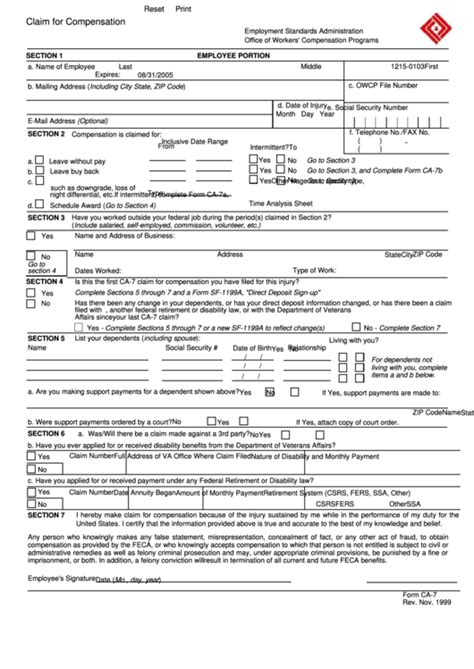

California Form CA-7A, also known as the Claim for Refund or Credit, is a document used by taxpayers to request a refund or credit for overpaid taxes, interest, or penalties. This form is typically used for claims related to personal income tax, corporate income tax, and other taxes administered by the California Franchise Tax Board (FTB).

Benefits of Filing California Form CA-7A

Filing California Form CA-7A can have several benefits for taxpayers, including:

- Receiving a refund for overpaid taxes

- Applying a credit to future tax liabilities

- Reducing the amount of taxes owed

- Avoiding penalties and interest on underpaid taxes

Eligibility and Requirements

To be eligible to file California Form CA-7A, taxpayers must meet the following requirements:

- Have overpaid taxes, interest, or penalties

- Have a valid reason for the overpayment, such as an error on the original tax return

- File the claim within the statutory deadline (typically 4 years from the original due date of the tax return)

Step-by-Step Process for Filing California Form CA-7A

Filing California Form CA-7A involves several steps, which are outlined below:

- Gather necessary documents and information, including:

- Original tax return and supporting documentation

- Proof of overpayment (e.g., cancelled checks, bank statements)

- Explanation of the reason for the overpayment

- Complete California Form CA-7A, ensuring accuracy and completeness

- Attach supporting documentation and schedules, as required

- Sign and date the form

- File the claim with the California Franchise Tax Board (FTB) by mail or electronically

Common Mistakes to Avoid When Filing California Form CA-7A

To avoid delays or rejection of your claim, it's essential to avoid common mistakes, such as:

- Incomplete or inaccurate information

- Failure to attach supporting documentation

- Missing or unsigned forms

- Filing after the statutory deadline

What to Expect After Filing California Form CA-7A

After filing California Form CA-7A, taxpayers can expect the following:

- Processing time: 6-12 weeks for paper-filed claims, 2-4 weeks for electronically filed claims

- Refund or credit: If the claim is approved, a refund or credit will be issued

- Denial or adjustment: If the claim is denied or adjusted, a notice will be sent explaining the reason

Conclusion and Next Steps

Filing California Form CA-7A can be a straightforward process, but it requires attention to detail and accuracy. By understanding the purpose, benefits, and step-by-step process of filing a claim, taxpayers can ensure a smooth and efficient experience. If you have any questions or concerns, consult with a tax professional or contact the California Franchise Tax Board (FTB) for guidance.

What is the deadline for filing California Form CA-7A?

+The deadline for filing California Form CA-7A is typically 4 years from the original due date of the tax return.

Can I file California Form CA-7A electronically?

+Yes, you can file California Form CA-7A electronically through the California Franchise Tax Board (FTB) website.

What happens if my claim is denied or adjusted?

+If your claim is denied or adjusted, a notice will be sent explaining the reason. You can appeal the decision or seek guidance from a tax professional.