The City of Kansas City, Missouri, imposes an earnings tax on residents and non-residents who work within the city limits. As a resident or an employer, understanding the KCMO earnings tax form filing process is crucial to ensure compliance with the city's tax regulations. In this article, we will guide you through the KCMO earnings tax form filing process, making it easier for you to navigate and meet the necessary requirements.

Understanding KCMO Earnings Tax

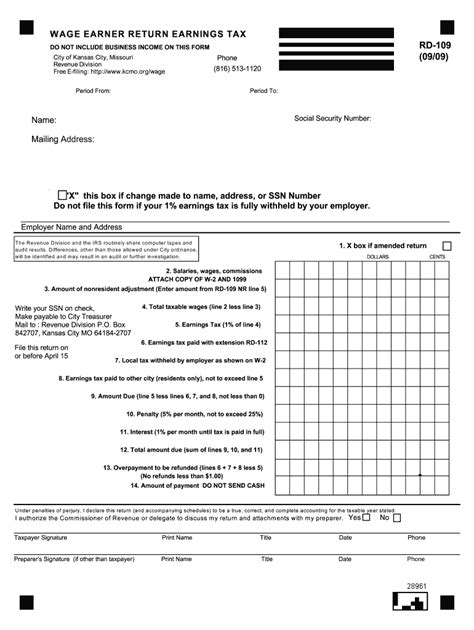

The KCMO earnings tax is a 1% tax on earnings for residents and a 1% tax on earnings for non-residents who work in Kansas City, Missouri. The tax is used to fund city services and infrastructure projects. As an employer, you are required to withhold the earnings tax from your employees' wages and remit it to the City of Kansas City. Residents are also required to file a tax return with the city and pay any tax due.

KCMO Earnings Tax Form Filing Requirements

To file the KCMO earnings tax form, you will need to provide the following information:

- Your name and address

- Your employer's name and address (if applicable)

- Your Social Security number or Employer Identification Number (EIN)

- Your earnings from Kansas City, Missouri sources

- The amount of earnings tax withheld (if applicable)

Who Needs to File?

You need to file the KCMO earnings tax form if:

- You are a resident of Kansas City, Missouri, and have earnings from Kansas City, Missouri sources.

- You are a non-resident who works in Kansas City, Missouri, and have earnings from Kansas City, Missouri sources.

- You are an employer who withholds earnings tax from your employees' wages.

Filing the KCMO Earnings Tax Form

To file the KCMO earnings tax form, follow these steps:

- Gather all necessary information and documents.

- Complete the KCMO earnings tax form (Form 8840) and attach any required schedules and supporting documentation.

- File the form and supporting documentation with the City of Kansas City by the required deadline (April 15th for individual filers and March 15th for employers).

- Pay any tax due or claim a refund if you have overpaid.

Filing Options

You can file the KCMO earnings tax form:

- Electronically through the City of Kansas City's website.

- By mail using the address listed on the form.

- In person at the City of Kansas City's Taxpayer Assistance Center.

Penalties and Interest

Failure to file or pay the KCMO earnings tax can result in penalties and interest. The City of Kansas City imposes a penalty of 5% of the unpaid tax for each month or part of a month that the tax is late, up to a maximum of 25%. Interest is also charged on the unpaid tax at a rate of 1% per month or part of a month.

Amending a Return

If you need to amend a previously filed KCMO earnings tax return, you can file an amended return (Form 8840X) with the City of Kansas City. You will need to provide a copy of the original return, as well as any supporting documentation for the changes you are making.

Conclusion

Filing the KCMO earnings tax form can seem daunting, but by understanding the requirements and following the steps outlined in this article, you can ensure compliance with the city's tax regulations. Remember to file on time to avoid penalties and interest, and seek assistance if you need help with the filing process.

We invite you to share your experiences and ask questions about the KCMO earnings tax form filing process in the comments section below. Additionally, if you found this article helpful, please share it with others who may benefit from the information.

What is the KCMO earnings tax rate?

+The KCMO earnings tax rate is 1% for residents and 1% for non-residents who work in Kansas City, Missouri.

Who needs to file the KCMO earnings tax form?

+Residents and non-residents who work in Kansas City, Missouri, and have earnings from Kansas City, Missouri sources need to file the KCMO earnings tax form.

What is the deadline for filing the KCMO earnings tax form?

+The deadline for filing the KCMO earnings tax form is April 15th for individual filers and March 15th for employers.