Filing taxes can be a daunting task, especially for those who are new to the process. In the state of Georgia, residents are required to file a state tax return in addition to their federal tax return. The Georgia state tax form, also known as the Form 500, is used to report an individual's income, deductions, and credits for the tax year. In this article, we will provide a comprehensive guide on how to fill out the Georgia state tax form, including five ways to make the process easier and less stressful.

Understanding the Georgia State Tax Form

Before we dive into the ways to fill out the Georgia state tax form, it's essential to understand the basics of the form. The Form 500 is a two-page document that requires individuals to report their income, deductions, and credits for the tax year. The form is divided into several sections, including:

- Income: This section requires individuals to report their income from all sources, including wages, salaries, tips, and self-employment income.

- Deductions: This section allows individuals to claim deductions for expenses such as mortgage interest, charitable donations, and medical expenses.

- Credits: This section provides credits for individuals who qualify, such as the earned income tax credit and the child tax credit.

5 Ways to Fill Out the Georgia State Tax Form

Filling out the Georgia state tax form can be a challenging task, but there are several ways to make the process easier. Here are five ways to fill out the Georgia state tax form:

Method 1: E-Filing with Tax Software

One of the easiest ways to fill out the Georgia state tax form is by using tax software. Tax software, such as TurboTax or H&R Block, provides a step-by-step guide to filling out the form and ensures accuracy. These programs also offer e-filing options, which allow individuals to submit their tax returns electronically. E-filing is a convenient and efficient way to file taxes, and it also reduces the risk of errors.

Benefits of E-Filing with Tax Software

- Accuracy: Tax software ensures accuracy by guiding individuals through the tax-filing process.

- Convenience: E-filing allows individuals to submit their tax returns electronically, reducing the need for paper forms and mail.

- Efficiency: Tax software saves time by automating the tax-filing process.

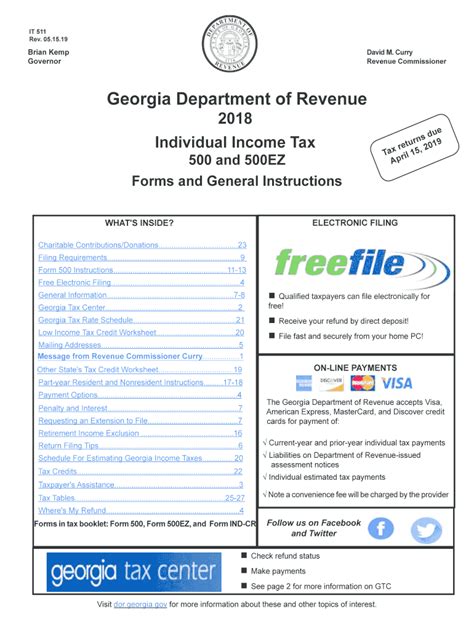

Method 2: Using the Georgia Tax Center

The Georgia Tax Center is a free online portal provided by the Georgia Department of Revenue. The portal allows individuals to file their state tax returns electronically and provides a step-by-step guide to filling out the form. The Georgia Tax Center also offers a tax calculator, which helps individuals estimate their tax liability.

Benefits of Using the Georgia Tax Center

- Free: The Georgia Tax Center is a free service provided by the Georgia Department of Revenue.

- Accuracy: The portal provides a step-by-step guide to filling out the form, ensuring accuracy.

- Convenience: The Georgia Tax Center allows individuals to e-file their tax returns, reducing the need for paper forms and mail.

Method 3: Filing by Mail

Filing by mail is a traditional method of filing taxes. Individuals can download the Form 500 from the Georgia Department of Revenue's website and mail it to the address listed on the form. This method requires individuals to print and sign the form, as well as attach any supporting documentation.

Benefits of Filing by Mail

- Cost-effective: Filing by mail is a cost-effective method, as individuals do not need to pay for tax software or e-filing services.

- Control: Filing by mail allows individuals to have control over the tax-filing process.

Method 4: Hiring a Tax Professional

Hiring a tax professional is a great option for individuals who are new to the tax-filing process or have complex tax situations. Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), have the expertise and knowledge to navigate the tax-filing process. They can also provide guidance on tax deductions and credits.

Benefits of Hiring a Tax Professional

- Expertise: Tax professionals have the expertise and knowledge to navigate the tax-filing process.

- Guidance: Tax professionals can provide guidance on tax deductions and credits.

- Accuracy: Tax professionals ensure accuracy by reviewing and preparing tax returns.

Method 5: Using a Tax Preparation Service

Tax preparation services, such as H&R Block or Jackson Hewitt, provide a convenient and efficient way to file taxes. These services offer a step-by-step guide to filling out the form and provide assistance with tax deductions and credits.

Benefits of Using a Tax Preparation Service

- Convenience: Tax preparation services offer a convenient and efficient way to file taxes.

- Assistance: Tax preparation services provide assistance with tax deductions and credits.

- Accuracy: Tax preparation services ensure accuracy by reviewing and preparing tax returns.

Conclusion

Filling out the Georgia state tax form can be a challenging task, but there are several ways to make the process easier. Whether you choose to e-file with tax software, use the Georgia Tax Center, file by mail, hire a tax professional, or use a tax preparation service, it's essential to ensure accuracy and take advantage of tax deductions and credits. By following these methods, individuals can make the tax-filing process less stressful and more efficient.

FAQ Section

What is the deadline for filing the Georgia state tax form?

+The deadline for filing the Georgia state tax form is typically April 15th of each year.

Can I file my Georgia state tax form electronically?

+What is the penalty for not filing the Georgia state tax form?

+The penalty for not filing the Georgia state tax form can range from 5% to 25% of the unpaid tax, depending on the circumstances.