Setting up a direct deposit can be a convenient and efficient way to receive your paychecks, tax refunds, or other regular payments. The TFCU (Tinker Federal Credit Union) direct deposit form is a straightforward process that can be completed in just a few easy steps.

The benefits of setting up a direct deposit are numerous. For one, it eliminates the need to physically visit a bank or credit union branch to deposit your checks. This saves you time and effort, and also reduces the risk of lost or stolen checks. Additionally, direct deposit ensures that your funds are available to you immediately, so you can start using them right away.

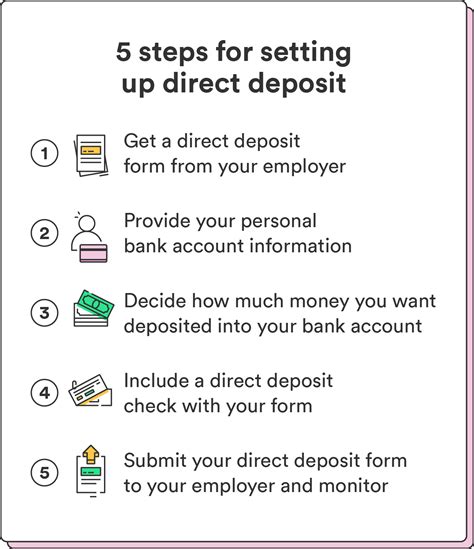

In this article, we will walk you through the simple process of setting up a TFCU direct deposit form. We will provide you with step-by-step instructions, so you can easily complete the process and start enjoying the benefits of direct deposit.

What is Direct Deposit?

Before we dive into the steps, let's take a quick look at what direct deposit is and how it works. Direct deposit is an electronic payment system that allows you to receive your paychecks, tax refunds, or other regular payments directly into your bank or credit union account.

When you set up direct deposit, you provide your employer or payer with your bank or credit union's routing number and your account number. The payer then uses this information to electronically deposit your payment into your account.

Step 1: Gather Required Information

To set up a TFCU direct deposit, you will need to gather some required information. This includes:

- Your TFCU account number

- The TFCU routing number (also known as the ABA number)

- Your employer's name and address

- Your payment amount and frequency (e.g. weekly, bi-weekly, monthly)

You can find your TFCU account number and routing number on your account statement or by contacting TFCU customer service.

Step 2: Fill Out the Direct Deposit Form

Once you have gathered the required information, you can fill out the TFCU direct deposit form. The form will ask for the following information:

- Your name and address

- Your TFCU account number and routing number

- Your employer's name and address

- Your payment amount and frequency

You can fill out the form online or print it out and complete it by hand.

Step 3: Provide the Form to Your Employer

After you have completed the direct deposit form, you will need to provide it to your employer. This will allow them to set up the direct deposit and start sending your payments electronically.

You can provide the form to your employer in person, by mail, or by email.

Step 4: Verify the Direct Deposit

After you have provided the direct deposit form to your employer, you will need to verify that the direct deposit has been set up correctly. You can do this by checking your account statement or by contacting TFCU customer service.

Step 5: Start Enjoying the Benefits of Direct Deposit

Once the direct deposit has been set up and verified, you can start enjoying the benefits of direct deposit. This includes:

- Faster access to your funds

- Reduced risk of lost or stolen checks

- Increased convenience and flexibility

We hope this article has provided you with the information you need to set up a TFCU direct deposit form. If you have any questions or need further assistance, please don't hesitate to contact TFCU customer service.

Common Questions About Direct Deposit

If you have any questions about direct deposit, here are some answers to common questions:

How long does it take to set up direct deposit?

The time it takes to set up direct deposit varies depending on the payer and the payee. However, it typically takes 1-2 pay periods for the direct deposit to be set up and verified.

Can I set up direct deposit for multiple accounts?

Yes, you can set up direct deposit for multiple accounts. However, you will need to provide a separate direct deposit form for each account.

Can I cancel direct deposit?

Yes, you can cancel direct deposit at any time. However, you will need to provide written notice to your employer or payer.

Is direct deposit secure?

Yes, direct deposit is a secure payment system. The direct deposit form requires your employer or payer to provide your account information, which is then verified by the bank or credit union.

What is the TFCU routing number?

+The TFCU routing number is 303085026.

How do I fill out the direct deposit form?

+To fill out the direct deposit form, you will need to provide your name and address, your TFCU account number and routing number, your employer's name and address, and your payment amount and frequency.

Can I set up direct deposit for my tax refund?

+Yes, you can set up direct deposit for your tax refund. However, you will need to provide the IRS with your TFCU account information.

We hope this article has provided you with the information you need to set up a TFCU direct deposit form. If you have any further questions or need assistance, please don't hesitate to contact TFCU customer service.