Filing tax forms can be a daunting task, but understanding the process can make it more manageable. In Maryland, Form 505 is a crucial document for individuals who need to report their state income tax. If you're a Maryland resident or have income sourced from the state, you'll likely need to complete this form. In this article, we'll break down the process into 5 steps to help you navigate the Form 505 Maryland with ease.

Why Do You Need to File Form 505 Maryland?

Before we dive into the steps, it's essential to understand why you need to file Form 505 Maryland. This form is used to report your Maryland state income tax. You'll need to file this form if you're a resident of Maryland and have earned income from various sources, such as employment, self-employment, or investments. Even if you don't owe taxes, you may still need to file this form to report your income and claim any applicable credits or deductions.

Step 1: Gather Required Documents and Information

To start the process, gather all necessary documents and information. You'll need:

- Your federal income tax return (Form 1040)

- W-2 forms from your employer(s)

- 1099 forms for self-employment income, interest, dividends, and capital gains

- Any other relevant tax documents, such as receipts for charitable donations or medical expenses

Step 2: Determine Your Filing Status and Residency

Filing Status and Residency

Your filing status and residency will impact how you complete Form 505 Maryland. You'll need to determine your filing status, which can be single, married filing jointly, married filing separately, head of household, or qualifying widow(er). You'll also need to determine your residency status, which can be resident, nonresident, or part-year resident.

- Residents: You're a Maryland resident if you lived in the state for at least 183 days during the tax year.

- Nonresidents: You're a nonresident if you didn't live in Maryland during the tax year, but you earned income from Maryland sources.

- Part-year residents: You're a part-year resident if you moved to or from Maryland during the tax year.

Step 3: Complete Form 505 Maryland

Form 505 Maryland Completion

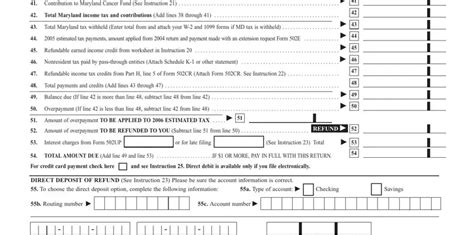

With your documents and information in hand, you can start completing Form 505 Maryland. The form is divided into several sections, including:

- Income: Report your income from various sources, such as employment, self-employment, and investments.

- Adjustments: Claim any applicable adjustments, such as deductions for charitable donations or medical expenses.

- Credits: Claim any applicable credits, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit.

- Tax Calculation: Calculate your Maryland state income tax liability.

Step 4: File Form 505 Maryland

Filing Options

Once you've completed Form 505 Maryland, you'll need to file it with the Maryland Comptroller's Office. You can file electronically or by mail.

- Electronic Filing: You can file electronically through the Maryland Comptroller's website or through a tax software provider.

- Mail Filing: You can mail your completed form to the Maryland Comptroller's Office.

Step 5: Pay Any Tax Due or Request a Refund

Payment and Refund Options

If you owe taxes, you'll need to pay by the filing deadline to avoid penalties and interest. You can pay online, by phone, or by mail.

- Online Payment: You can pay online through the Maryland Comptroller's website.

- Phone Payment: You can pay by phone using a credit or debit card.

- Mail Payment: You can mail a check or money order with your completed form.

If you're due a refund, you can request a direct deposit or a paper check.

Final Thoughts

Completing Form 505 Maryland requires attention to detail and organization. By following these 5 steps, you'll be able to navigate the process with ease. Remember to gather all necessary documents, determine your filing status and residency, complete the form accurately, file on time, and pay any tax due or request a refund. If you're unsure about any part of the process, consider consulting a tax professional or contacting the Maryland Comptroller's Office for guidance.

We hope this article has been informative and helpful. If you have any questions or comments, please don't hesitate to reach out. Share this article with friends and family who may need to complete Form 505 Maryland.