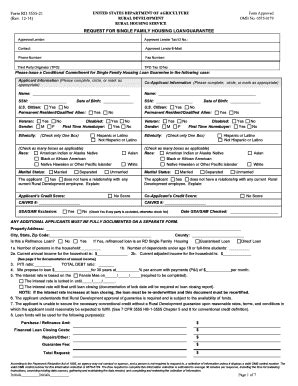

Filling out the USDA Form 3555-21, also known as the "Request for Single Family Housing Loan Guarantee," can be a daunting task for many applicants. This form is a crucial step in the process of obtaining a USDA loan guarantee, which can help low-to-moderate-income borrowers purchase, build, or improve homes in rural areas. In this article, we will guide you through the process of filling out the USDA Form 3555-21 correctly, ensuring that your application is processed efficiently and effectively.

Understanding the Importance of Accuracy

Before we dive into the tips for filling out the USDA Form 3555-21, it's essential to understand the importance of accuracy. Incomplete or incorrect applications can lead to delays or even rejection. Therefore, it's crucial to carefully review and complete each section of the form to ensure that your application is processed smoothly.

Tip 1: Gather Required Documents and Information

To fill out the USDA Form 3555-21 correctly, you'll need to gather various documents and information. These may include:

- Identification documents (e.g., driver's license, passport)

- Income verification documents (e.g., pay stubs, tax returns)

- Credit reports

- Property information (e.g., address, value)

- Loan information (e.g., loan amount, interest rate)

Having all the necessary documents and information readily available will save you time and reduce the risk of errors.

Tip 2: Read the Instructions Carefully

Before starting to fill out the form, take the time to read the instructions carefully. The USDA provides detailed instructions for each section, which will help you understand what information is required and how to complete each section correctly.

Tip 3: Complete Section 1: Borrower Information

Section 1 of the USDA Form 3555-21 requires you to provide personal and contact information. This includes your name, address, phone number, and email address. Make sure to double-check your information for accuracy and completeness.

Tip 4: Complete Section 2: Property Information

In Section 2, you'll need to provide information about the property you're purchasing, building, or improving. This includes the property address, value, and location. Ensure that you provide accurate and complete information, as this will affect the processing of your application.

Tip 5: Complete Section 3: Loan Information

Section 3 requires you to provide information about the loan you're applying for, including the loan amount, interest rate, and loan term. Make sure to review your loan documents carefully and ensure that the information you provide is accurate.

Tip 6: Sign and Date the Form

Once you've completed all sections of the form, sign and date it. This is an essential step, as the USDA will not process applications without a signature and date.

Tip 7: Review and Submit the Form

Finally, review the form carefully to ensure that all sections are complete and accurate. Once you're satisfied that the form is correct, submit it to the USDA. You can submit the form online or by mail, depending on your preference.

Conclusion

Filling out the USDA Form 3555-21 requires attention to detail and accuracy. By following these 7 tips, you can ensure that your application is processed efficiently and effectively. Remember to gather all required documents and information, read the instructions carefully, and review the form carefully before submitting it. With these tips, you'll be well on your way to obtaining a USDA loan guarantee and achieving your dream of homeownership.

Benefits of USDA Loans

USDA loans offer several benefits to borrowers, including:

- Zero Down Payment: USDA loans require no down payment, making it easier for borrowers to purchase a home.

- Low Interest Rates: USDA loans often have lower interest rates compared to other types of loans.

- Lenient Credit Requirements: USDA loans have more lenient credit requirements, making it easier for borrowers with lower credit scores to qualify.

Eligibility Requirements

To be eligible for a USDA loan, borrowers must meet certain requirements, including:

- Income Limits: Borrowers must meet income limits, which vary by area.

- Credit Requirements: Borrowers must meet credit requirements, which vary by lender.

- Property Location: The property must be located in a rural area, as defined by the USDA.

Conclusion

In conclusion, filling out the USDA Form 3555-21 requires attention to detail and accuracy. By following these 7 tips, you can ensure that your application is processed efficiently and effectively. Remember to gather all required documents and information, read the instructions carefully, and review the form carefully before submitting it. With these tips, you'll be well on your way to obtaining a USDA loan guarantee and achieving your dream of homeownership.

What is the USDA Form 3555-21?

+The USDA Form 3555-21 is a request for a single-family housing loan guarantee. It's a crucial step in the process of obtaining a USDA loan guarantee, which can help low-to-moderate-income borrowers purchase, build, or improve homes in rural areas.

What documents do I need to fill out the USDA Form 3555-21?

+To fill out the USDA Form 3555-21, you'll need to gather various documents and information, including identification documents, income verification documents, credit reports, property information, and loan information.

How do I submit the USDA Form 3555-21?

+You can submit the USDA Form 3555-21 online or by mail, depending on your preference.