As the tax season approaches, many individuals and businesses in Maryland are gearing up to file their tax returns. For non-residents who have earned income in Maryland, filing the correct tax form is crucial to avoid any penalties or delays. In this article, we will provide 6 tips for filing Maryland Form 505NR, which is the tax return form for non-resident individuals.

Understanding Maryland Form 505NR

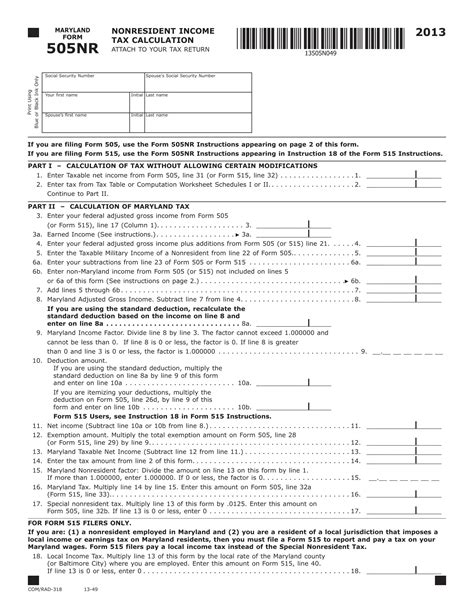

Maryland Form 505NR is the non-resident income tax return form that must be filed by individuals who are not residents of Maryland but have earned income in the state. This form is used to report income earned from sources within Maryland, such as employment, self-employment, and rental income. It's essential to file this form accurately and on time to avoid any penalties or interest.

Tip 1: Determine Your Filing Status

Before filing Maryland Form 505NR, you need to determine your filing status. Your filing status will depend on your marital status, age, and other factors. The most common filing statuses for non-residents are Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er). Make sure to choose the correct filing status to avoid any errors.

Tip 2: Gather Required Documents

To file Maryland Form 505NR, you will need to gather several documents, including:

- Your federal income tax return (Form 1040)

- Your Maryland Form 1099-MISC (if you earned self-employment income)

- Your Maryland Form W-2 (if you earned employment income)

- Any other relevant tax documents, such as receipts for business expenses

Make sure to have all these documents ready before starting the filing process.

Tip 3: Report All Income Earned in Maryland

As a non-resident, you are required to report all income earned in Maryland, including:

- Employment income (W-2)

- Self-employment income (1099-MISC)

- Rental income

- Capital gains income

- Other income earned in Maryland

Make sure to report all income earned in Maryland, even if you don't have a Maryland tax account.

Tip 4: Claim Credits and Deductions

As a non-resident, you may be eligible for certain credits and deductions, including:

- The Maryland earned income tax credit (EITC)

- The Maryland child care credit

- Business expense deductions

- Itemized deductions (such as mortgage interest and charitable donations)

Make sure to claim all eligible credits and deductions to minimize your tax liability.

Tip 5: File Electronically or by Mail

You can file Maryland Form 505NR electronically or by mail. Electronic filing is faster and more convenient, but you can also file by mail if you prefer. Make sure to sign and date the form, and include all required attachments.

Tip 6: Meet the Filing Deadline

The filing deadline for Maryland Form 505NR is typically April 15th, but it may be extended to October 15th if you file for an extension. Make sure to meet the filing deadline to avoid any penalties or interest.

Additional Tips and Reminders

- Make sure to keep a copy of your filed tax return for your records.

- If you need help filing your tax return, consider consulting a tax professional or contacting the Maryland Comptroller's Office.

- If you owe taxes, make sure to pay them on time to avoid any penalties or interest.

By following these 6 tips, you can ensure that you file your Maryland Form 505NR accurately and on time. Remember to report all income earned in Maryland, claim all eligible credits and deductions, and meet the filing deadline to avoid any penalties or interest.

Take Action Today

Don't wait until the last minute to file your Maryland Form 505NR. Take action today and start gathering your documents, reporting all income earned in Maryland, and claiming all eligible credits and deductions. If you need help, consider consulting a tax professional or contacting the Maryland Comptroller's Office.

What is Maryland Form 505NR?

+Maryland Form 505NR is the non-resident income tax return form that must be filed by individuals who are not residents of Maryland but have earned income in the state.

Who needs to file Maryland Form 505NR?

+Non-resident individuals who have earned income in Maryland must file Maryland Form 505NR.

What is the filing deadline for Maryland Form 505NR?

+The filing deadline for Maryland Form 505NR is typically April 15th, but it may be extended to October 15th if you file for an extension.