Filling out the Nebraska PTC (Property Tax Credit) form can be a daunting task, especially for those who are new to the process. However, with the right guidance, it can be a straightforward and beneficial experience. The Nebraska PTC form is designed to provide relief to homeowners and renters who are eligible for a property tax credit. In this article, we will walk you through five ways to fill out the Nebraska PTC form, ensuring that you receive the credit you deserve.

Understanding the Nebraska PTC Form

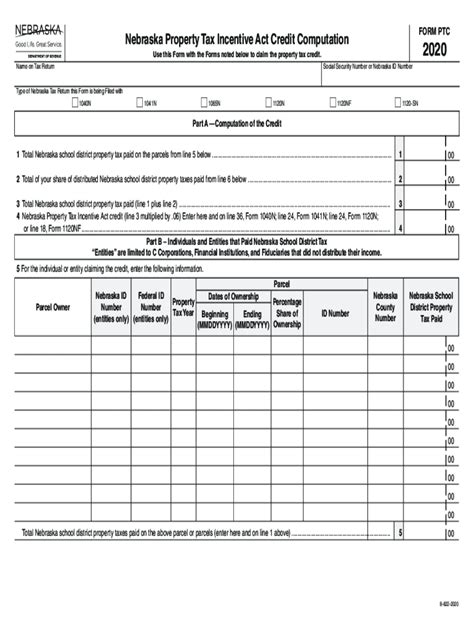

Before we dive into the ways to fill out the form, it's essential to understand what the Nebraska PTC form is and what it entails. The form is used to claim a credit against your Nebraska income tax liability for property taxes paid on your primary residence. The credit is calculated based on the amount of property taxes paid and the taxpayer's income.

1. Gather Required Documents and Information

Gathering Documents and Information

To fill out the Nebraska PTC form, you will need to gather several documents and pieces of information. These include:

- Your social security number or Individual Taxpayer Identification Number (ITIN)

- Your property tax statement or receipt

- Your income tax return (Form 1040 or Form 1040-SR)

- Your W-2 forms and 1099 forms (if applicable)

- Your spouse's social security number or ITIN (if filing jointly)

2. Determine Your Eligibility

Eligibility Requirements

To be eligible for the Nebraska PTC, you must meet certain requirements. These include:

- You must be a resident of Nebraska

- You must own or rent a primary residence in Nebraska

- You must have paid property taxes on your primary residence

- Your income must not exceed certain limits (see the Nebraska Department of Revenue website for current limits)

3. Choose the Correct Filing Status

Filing Status Options

When filling out the Nebraska PTC form, you will need to choose a filing status. The options include:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the filing status that applies to you, and make sure to attach any required supporting documentation.

4. Calculate Your Property Tax Credit

Calculating Your Credit

To calculate your property tax credit, you will need to complete Schedule I of the Nebraska PTC form. This involves:

- Entering the amount of property taxes paid on your primary residence

- Entering your income and any applicable deductions

- Calculating the credit using the formula provided on the form

Make sure to follow the instructions carefully and use the correct formula to ensure accuracy.

5. Submit Your Form and Supporting Documentation

Submitting Your Form

Once you have completed the Nebraska PTC form and attached all required supporting documentation, you can submit it to the Nebraska Department of Revenue. You can file electronically or by mail.

Tips and Reminders:

- Make sure to keep a copy of your completed form and supporting documentation for your records.

- If you have any questions or concerns, contact the Nebraska Department of Revenue for assistance.

- The deadline for submitting the Nebraska PTC form is April 15th of each year.

By following these five ways to fill out the Nebraska PTC form, you can ensure that you receive the property tax credit you deserve. Remember to gather all required documents and information, determine your eligibility, choose the correct filing status, calculate your credit, and submit your form and supporting documentation on time.

Encourage Engagement:

We hope this article has been helpful in guiding you through the process of filling out the Nebraska PTC form. If you have any questions or comments, please feel free to share them below. Don't forget to share this article with friends and family who may be eligible for the Nebraska PTC.

FAQ Section:

What is the Nebraska PTC form?

+The Nebraska PTC form is used to claim a credit against your Nebraska income tax liability for property taxes paid on your primary residence.

Who is eligible for the Nebraska PTC?

+To be eligible, you must be a resident of Nebraska, own or rent a primary residence in Nebraska, pay property taxes on your primary residence, and meet certain income limits.

How do I calculate my property tax credit?

+To calculate your credit, complete Schedule I of the Nebraska PTC form, entering the amount of property taxes paid on your primary residence, your income, and any applicable deductions. Use the formula provided on the form to calculate the credit.