As an employee, one of the most important forms you'll need to complete is the Form W-4, also known as the Employee's Withholding Certificate. This form is used to determine how much federal income tax should be withheld from your paycheck. In this article, we'll delve into the world of Form W-4 and its counterpart, Form W-4Q, to help you understand the ins and outs of IRS tax withholding.

Why is Form W-4 Important?

Form W-4 is crucial because it helps your employer determine how much federal income tax to withhold from your wages. By accurately completing this form, you can avoid overpaying or underpaying taxes throughout the year. If you don't provide a completed Form W-4, your employer will withhold taxes as if you're single and have no dependents, which could lead to overpayment.

What is Form W-4Q?

Form W-4Q is the Quarterly Federal Tax Return, which is used to report and pay quarterly estimated tax payments. This form is typically used by self-employed individuals, freelancers, and small business owners who are required to make quarterly tax payments to the IRS.

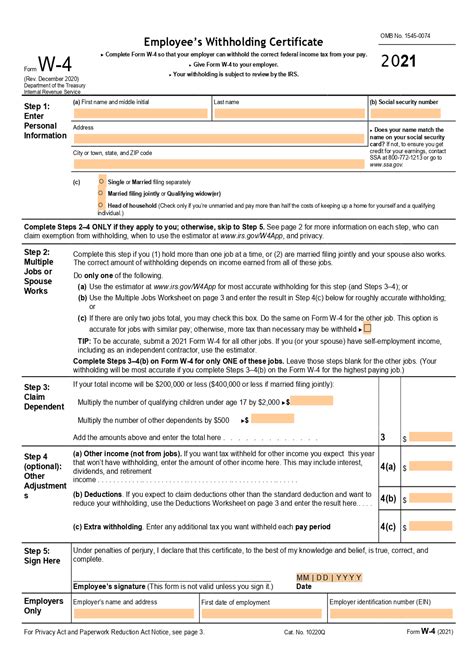

How to Complete Form W-4

Completing Form W-4 is relatively straightforward. Here's a step-by-step guide:

- Step 1: Provide Personal Information

- Enter your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Indicate your filing status: single, married, or head of household.

- Step 2: Claim Allowances

- Claim one allowance for yourself, your spouse, and each dependent.

- You can also claim additional allowances if you're eligible for certain tax credits, such as the Earned Income Tax Credit (EITC).

- Step 3: Report Income and Deductions

- Report your expected income from all sources, including wages, tips, and self-employment income.

- List your expected deductions, such as mortgage interest, charitable donations, and state taxes.

- Step 4: Calculate Withholding

- Use the IRS withholding tables or a tax calculator to determine how much federal income tax should be withheld from your paycheck.

Form W-4 and W-4Q: What's the Difference?

While both forms deal with tax withholding, they serve different purposes. Form W-4 is used to determine federal income tax withholding from employee wages, whereas Form W-4Q is used to report and pay quarterly estimated tax payments.

Form W-4 vs. Form W-4Q: Key Differences

- Purpose: Form W-4 is for employee withholding, while Form W-4Q is for quarterly estimated tax payments.

- Frequency: Form W-4 is completed annually or when changes occur, while Form W-4Q is completed quarterly.

- Who uses it: Form W-4 is used by employees, while Form W-4Q is used by self-employed individuals, freelancers, and small business owners.

Form W-4 Updates and Changes

In 2020, the IRS introduced a new version of Form W-4, which includes significant changes. The updated form aims to improve accuracy and reduce over-withholding. Key changes include:

- New Layout: The form now has a more straightforward layout, making it easier to complete.

- Fewer Allowances: The new form eliminates the "personal allowance" and instead focuses on the number of dependents and other income.

- Improved Accuracy: The form includes a worksheet to help employees accurately calculate their withholding.

Tips for Accurate Withholding

To ensure accurate withholding, follow these tips:

- Review and Update: Review your Form W-4 annually or when changes occur, such as marriage, divorce, or a new baby.

- Use the IRS Withholding Estimator: Utilize the IRS withholding estimator to ensure you're withholding the correct amount.

- Consider Multiple Jobs: If you have multiple jobs or a working spouse, consider completing a new Form W-4 to avoid over-withholding.

Form W-4 and W-4Q FAQs

Q: What happens if I don't complete Form W-4? A: If you don't provide a completed Form W-4, your employer will withhold taxes as if you're single and have no dependents.

Q: Can I complete Form W-4 online? A: Yes, many employers offer online Form W-4 completion options. You can also complete the form manually and submit it to your employer.

Q: What is the deadline for filing Form W-4Q? A: The deadline for filing Form W-4Q is April 15th for the first quarter, June 15th for the second quarter, September 15th for the third quarter, and January 15th of the following year for the fourth quarter.

What is the difference between Form W-4 and Form W-4Q?

+Form W-4 is used to determine federal income tax withholding from employee wages, while Form W-4Q is used to report and pay quarterly estimated tax payments.

Who needs to complete Form W-4Q?

+Self-employed individuals, freelancers, and small business owners who are required to make quarterly tax payments to the IRS need to complete Form W-4Q.

How often should I review my Form W-4?

+You should review your Form W-4 annually or when changes occur, such as marriage, divorce, or a new baby.

Take Action Today

Don't let tax withholding confuse you. Take control of your finances by understanding Form W-4 and Form W-4Q. Review and update your Form W-4 annually, and consider consulting with a tax professional if you're unsure about anything. Share this article with friends and family who may benefit from this information, and don't hesitate to comment below with any questions or concerns.