The Peconic Bay region, located on the East End of Long Island, New York, is a beautiful and ecologically sensitive area. To preserve its natural resources and support conservation efforts, the Peconic Bay Community Preservation Fund (CPF) was established. One key aspect of the CPF is the Peconic Bay Transfer Tax Form, which is required for certain real estate transactions in the area. In this article, we will delve into the details of the Peconic Bay Transfer Tax Form, its purpose, and how it affects buyers and sellers of properties in the Peconic Bay region.

Understanding the Peconic Bay Transfer Tax

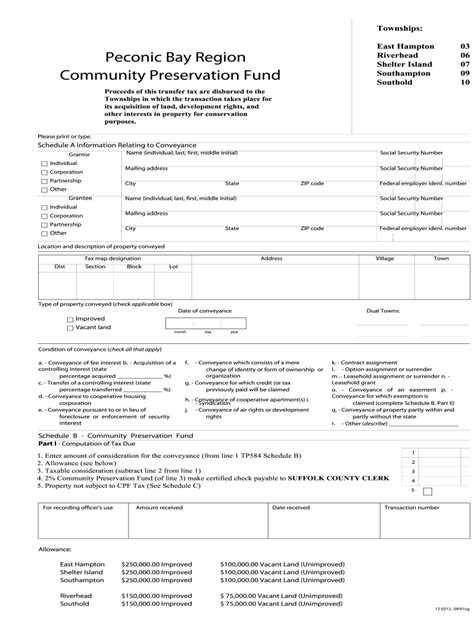

The Peconic Bay Transfer Tax is a 2% tax on certain real estate transactions in the Peconic Bay region, which includes the towns of East Hampton, Riverhead, Shelter Island, Southampton, and Southold. The tax is levied on the transfer of properties, including sales, gifts, and other conveyances. The revenue generated from the transfer tax is used to support conservation efforts, such as the acquisition of open spaces, farmland, and historic sites.

Who is Required to File the Peconic Bay Transfer Tax Form?

The Peconic Bay Transfer Tax Form is required for certain real estate transactions in the Peconic Bay region, including:

- Sales of properties: The seller is responsible for filing the form and paying the transfer tax.

- Gifts of properties: The donor is responsible for filing the form and paying the transfer tax.

- Other conveyances: The grantor is responsible for filing the form and paying the transfer tax.

How to Complete the Peconic Bay Transfer Tax Form

The Peconic Bay Transfer Tax Form is a relatively straightforward document that requires the following information:

- Property information: The form requires the property's address, tax map number, and a description of the property.

- Transfer information: The form requires information about the transfer, including the date of the transfer, the type of transfer, and the names of the parties involved.

- Tax computation: The form requires the computation of the transfer tax, which is 2% of the consideration paid for the property.

Tips for Filing the Peconic Bay Transfer Tax Form

Here are some tips to keep in mind when filing the Peconic Bay Transfer Tax Form:

- File the form on time: The form must be filed within 30 days of the transfer date.

- Pay the transfer tax: The transfer tax must be paid at the time of filing.

- Use the correct form: Make sure to use the most up-to-date version of the form.

- Seek professional help: If you are unsure about how to complete the form or have questions about the transfer tax, seek the help of a real estate attorney or tax professional.

Exemptions from the Peconic Bay Transfer Tax

There are certain exemptions from the Peconic Bay Transfer Tax, including:

- Transfers between spouses or domestic partners

- Transfers to or from a charitable organization

- Transfers to or from a governmental entity

- Transfers of properties that are exempt from real estate taxes

How to Claim an Exemption

To claim an exemption from the Peconic Bay Transfer Tax, the parties involved in the transfer must file an exemption application with the Suffolk County Treasurer's Office. The application must be filed within 30 days of the transfer date.

Penalties for Failure to File the Peconic Bay Transfer Tax Form

Failure to file the Peconic Bay Transfer Tax Form or pay the transfer tax can result in penalties, including:

- Late filing fees: A fee of $100 per month or fraction thereof, up to a maximum of $1,000.

- Interest on the transfer tax: Interest on the unpaid transfer tax at a rate of 1% per month or fraction thereof.

- Additional penalties: Additional penalties may be imposed for failure to file or pay the transfer tax.

How to Avoid Penalties

To avoid penalties, make sure to file the Peconic Bay Transfer Tax Form on time and pay the transfer tax. If you are unsure about how to complete the form or have questions about the transfer tax, seek the help of a real estate attorney or tax professional.

Conclusion

The Peconic Bay Transfer Tax Form is an important document that must be filed for certain real estate transactions in the Peconic Bay region. The form requires information about the property, the transfer, and the computation of the transfer tax. There are exemptions from the transfer tax, and penalties may be imposed for failure to file or pay the tax. By understanding the requirements and exemptions, buyers and sellers of properties in the Peconic Bay region can ensure compliance with the transfer tax regulations.

What is the Peconic Bay Transfer Tax?

+The Peconic Bay Transfer Tax is a 2% tax on certain real estate transactions in the Peconic Bay region.

Who is required to file the Peconic Bay Transfer Tax Form?

+The seller, donor, or grantor is required to file the form and pay the transfer tax.

What are the penalties for failure to file the Peconic Bay Transfer Tax Form?

+Penalties may include late filing fees, interest on the transfer tax, and additional penalties.