Filing tax returns can be a daunting task, especially for those who are new to the process. In Texas, individuals who need to report their tax liability for the year must file Form 05-359. However, the form can be complex, and the process can be overwhelming. In this article, we will break down the essential steps to complete Form 05-359 successfully.

As a taxpayer, it's crucial to understand the importance of filing tax returns accurately and on time. Failure to do so can result in penalties, fines, and even legal consequences. Moreover, the Texas Comptroller's office requires individuals to report their tax liability accurately to ensure fair distribution of tax revenue.

Completing Form 05-359 requires attention to detail, patience, and a clear understanding of the tax laws and regulations. By following the steps outlined in this article, you can ensure a smooth and successful filing process.

Understanding Form 05-359

Before we dive into the steps, it's essential to understand what Form 05-359 is and what it's used for. Form 05-359 is the Texas Franchise Tax Report, which is used by businesses and individuals to report their tax liability for the year. The form requires taxpayers to report their total revenue, deductions, and exemptions.

Step 1: Gather Required Documents and Information

The first step to complete Form 05-359 successfully is to gather all the required documents and information. You will need:

- Your federal tax return (Form 1040)

- Your Texas Franchise Tax Account number

- Your business entity's name and address

- Your business entity's total revenue for the year

- Your business entity's deductions and exemptions for the year

- Your payment voucher (Form 05-359-P)

Make sure you have all the necessary documents and information before starting the filing process.

Step 2: Determine Your Tax Liability

The next step is to determine your tax liability. You will need to calculate your total revenue, deductions, and exemptions. You can use the Texas Franchise Tax Calculator to estimate your tax liability.

It's essential to note that the tax rate for Form 05-359 is 0.75% of your total revenue, minus any deductions and exemptions.

Step 3: Complete Form 05-359

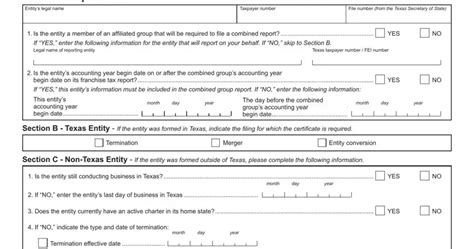

Once you have determined your tax liability, you can start completing Form 05-359. The form is divided into several sections, including:

- Section 1: Business Entity Information

- Section 2: Total Revenue

- Section 3: Deductions and Exemptions

- Section 4: Tax Liability

- Section 5: Payment Voucher

Make sure you fill out each section accurately and completely.

Step 4: Submit Form 05-359 and Payment

After completing Form 05-359, you need to submit it to the Texas Comptroller's office along with your payment. You can file the form electronically or by mail.

If you owe taxes, you must submit your payment by the deadline to avoid penalties and fines.

Step 5: Verify Your Filing Status

The final step is to verify your filing status. You can check the status of your filing on the Texas Comptroller's website. Make sure you receive a confirmation number or a receipt for your filing.

It's essential to keep records of your filing, including your confirmation number and payment receipt.

Additional Tips and Reminders

- Make sure you file Form 05-359 on time to avoid penalties and fines.

- Use the correct tax rate and calculate your tax liability accurately.

- Keep records of your filing, including your confirmation number and payment receipt.

- If you have any questions or concerns, contact the Texas Comptroller's office for assistance.

By following these essential steps, you can complete Form 05-359 successfully and ensure a smooth filing process. Remember to stay organized, attention to detail, and seek assistance if needed.

What's Next?

Now that you have completed Form 05-359, you can focus on other aspects of your business or personal finances. Remember to stay up-to-date with tax laws and regulations to ensure compliance and avoid any potential issues.

If you have any questions or concerns about Form 05-359 or any other tax-related topics, please don't hesitate to comment below or share this article with others who may benefit from it.

What is Form 05-359 used for?

+Form 05-359 is the Texas Franchise Tax Report, which is used by businesses and individuals to report their tax liability for the year.

What is the tax rate for Form 05-359?

+The tax rate for Form 05-359 is 0.75% of your total revenue, minus any deductions and exemptions.

How do I submit Form 05-359 and payment?

+You can file Form 05-359 electronically or by mail. If you owe taxes, you must submit your payment by the deadline to avoid penalties and fines.