As a homeowner in Texas, you may find yourself in a situation where you need to transfer ownership of your property to another party. This can be a complex and daunting process, especially when it comes to navigating the world of real estate law. One of the most common ways to transfer property ownership in Texas is through the use of a quitclaim deed form. In this article, we'll take a closer look at the Texas quitclaim deed form, including what it is, how it works, and how to download and fill it out easily.

What is a Quitclaim Deed?

A quitclaim deed is a type of deed that transfers the interest of the grantor (the person giving up the property) to the grantee (the person receiving the property). Unlike other types of deeds, such as a warranty deed, a quitclaim deed does not guarantee that the grantor has good title to the property or that the property is free of any defects or liens. Instead, it simply transfers whatever interest the grantor has in the property to the grantee.

Why Use a Quitclaim Deed?

There are several reasons why you might choose to use a quitclaim deed to transfer ownership of your property. For example:

- Divorce: If you're going through a divorce, a quitclaim deed can be used to transfer ownership of the marital home from one spouse to the other.

- Inheritance: If you've inherited a property from a loved one, a quitclaim deed can be used to transfer ownership to you.

- Gift: If you want to give a property to someone as a gift, a quitclaim deed can be used to transfer ownership.

- Business transactions: Quitclaim deeds can also be used in business transactions, such as when a company is transferring ownership of a property to another company.

How to Download and Fill Out a Texas Quitclaim Deed Form

If you're looking to download and fill out a Texas quitclaim deed form, you can find many resources online. However, it's essential to ensure that you're using a reputable source to avoid any potential issues with the form. Here are the steps to follow:

- Find a reputable source: Look for a reputable website that offers Texas quitclaim deed forms. Some popular options include the Texas Secretary of State's website, the Texas Real Estate Commission's website, or a reputable online legal document provider.

- Choose the correct form: Make sure you're choosing the correct form for your specific situation. Texas quitclaim deed forms may vary depending on the type of property being transferred, the parties involved, and other factors.

- Download the form: Once you've found the correct form, download it to your computer or mobile device.

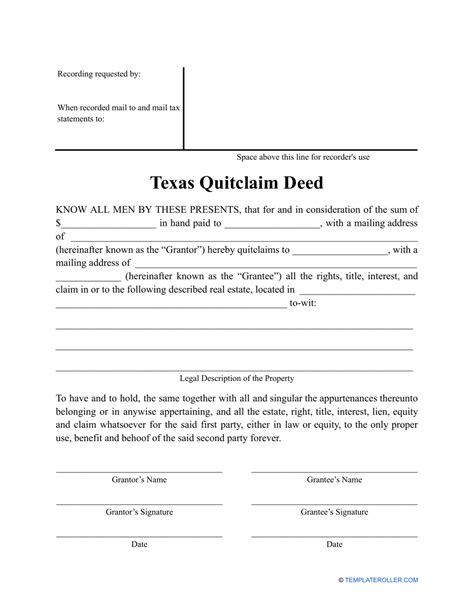

- Fill out the form: Fill out the form carefully and accurately, making sure to include all required information. This may include:

- The names and addresses of the grantor and grantee

- A description of the property being transferred

- The date of the transfer

- The consideration (if any)

- Sign the form: Sign the form in front of a notary public, as required by Texas law.

- Record the form: Record the form with the county clerk's office in the county where the property is located.

Benefits of Using a Texas Quitclaim Deed Form

Using a Texas quitclaim deed form can provide several benefits, including:

- Convenience: Quitclaim deeds can be used to transfer ownership of property quickly and easily.

- Cost-effective: Quitclaim deeds can be less expensive than other types of deeds, such as warranty deeds.

- Flexibility: Quitclaim deeds can be used in a variety of situations, including divorce, inheritance, gifts, and business transactions.

Common Mistakes to Avoid

When using a Texas quitclaim deed form, there are several common mistakes to avoid, including:

- Incorrect form: Using the wrong form for your specific situation can lead to delays or even invalidation of the transfer.

- Incomplete information: Failing to include all required information on the form can lead to delays or even invalidation of the transfer.

- Failure to sign: Failing to sign the form in front of a notary public can lead to invalidation of the transfer.

- Failure to record: Failing to record the form with the county clerk's office can lead to delays or even invalidation of the transfer.

**Texas Quitclaim Deed Form Requirements**

When using a Texas quitclaim deed form, there are several requirements to keep in mind, including:

- Format: The form must be in the correct format, with all required information included.

- Signatures: The form must be signed by the grantor in front of a notary public.

- Recording: The form must be recorded with the county clerk's office in the county where the property is located.

- Timing: The form must be recorded within a certain timeframe, typically within a few days of the transfer.

How to Record a Texas Quitclaim Deed Form

Recording a Texas quitclaim deed form is an essential step in the transfer process. Here's how to do it:

- Prepare the form: Make sure the form is complete and signed in front of a notary public.

- Gather required documents: Gather any required documents, such as a copy of the property deed or a survey.

- Take the form to the county clerk's office: Take the form and any required documents to the county clerk's office in the county where the property is located.

- Record the form: Record the form with the county clerk's office. This may involve paying a fee and providing any required information.

- Obtain a certified copy: Obtain a certified copy of the recorded form, which will serve as proof of the transfer.

**Texas Quitclaim Deed Form Fees**

When using a Texas quitclaim deed form, there may be several fees associated with the transfer process. Here are some of the common fees:

- Recording fee: This fee is charged by the county clerk's office for recording the form. The fee varies by county but is typically around $20-$50.

- Notary fee: This fee is charged by the notary public for signing the form. The fee varies by notary but is typically around $10-$20.

- Document preparation fee: This fee is charged by the document preparation service for preparing the form. The fee varies by service but is typically around $50-$100.

Conclusion

In conclusion, using a Texas quitclaim deed form can be a convenient and cost-effective way to transfer ownership of property. However, it's essential to follow the correct procedures and avoid common mistakes to ensure a smooth transfer process. By understanding the requirements and fees associated with using a Texas quitclaim deed form, you can navigate the transfer process with confidence.

We encourage you to comment below with any questions or concerns you may have about using a Texas quitclaim deed form. Additionally, please share this article with anyone who may be interested in learning more about the topic.

What is a quitclaim deed?

+A quitclaim deed is a type of deed that transfers the interest of the grantor (the person giving up the property) to the grantee (the person receiving the property).

Why use a quitclaim deed?

+Quitclaim deeds can be used in a variety of situations, including divorce, inheritance, gifts, and business transactions. They are also a convenient and cost-effective way to transfer ownership of property.

How do I record a Texas quitclaim deed form?

+To record a Texas quitclaim deed form, take the completed form to the county clerk's office in the county where the property is located. You will need to pay a recording fee and provide any required documents.