In Missouri, a beneficiary deed is a type of deed that allows property owners to transfer their property to beneficiaries upon their death, without the need for probate. This can be a valuable tool for individuals looking to plan their estate and ensure that their loved ones inherit their property quickly and efficiently. In this article, we'll take a closer look at the Missouri beneficiary deed form, including how to get one, how it works, and the benefits of using this type of deed.

What is a Missouri Beneficiary Deed Form?

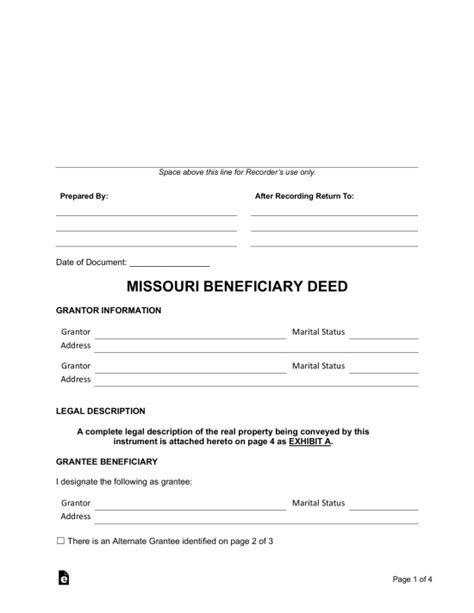

A Missouri beneficiary deed form is a document that allows property owners to transfer their property to beneficiaries upon their death. This type of deed is also known as a "transfer on death" (TOD) deed or a "beneficiary deed." It's a convenient way to transfer property without the need for probate, which can be a time-consuming and costly process.

How Does a Missouri Beneficiary Deed Form Work?

A Missouri beneficiary deed form works by allowing property owners to name one or more beneficiaries who will inherit their property upon their death. The deed is recorded with the county recorder's office, and the property owner retains full control over the property during their lifetime. When the property owner passes away, the property is automatically transferred to the beneficiaries, without the need for probate.

Benefits of Using a Missouri Beneficiary Deed Form

There are several benefits to using a Missouri beneficiary deed form, including:

- Avoiding probate: By using a beneficiary deed, property owners can avoid the probate process, which can be time-consuming and costly.

- Retaining control: Property owners retain full control over the property during their lifetime, and can sell or transfer the property as they see fit.

- Reducing taxes: Beneficiary deeds can help reduce taxes, as the property is transferred to the beneficiaries without being subject to estate taxes.

- Simplifying the transfer process: Beneficiary deeds simplify the transfer process, as the property is automatically transferred to the beneficiaries upon the property owner's death.

How to Get a Free Missouri Beneficiary Deed Form

There are several ways to get a free Missouri beneficiary deed form, including:

- Online templates: Many online templates are available that can be downloaded and printed for free.

- Government websites: The Missouri Secretary of State's website offers a free beneficiary deed form that can be downloaded and printed.

- Law libraries: Many law libraries offer free access to beneficiary deed forms.

Things to Consider When Using a Missouri Beneficiary Deed Form

When using a Missouri beneficiary deed form, there are several things to consider, including:

- Property type: Beneficiary deeds can only be used for certain types of property, such as real estate and personal property.

- Beneficiary requirements: Beneficiaries must meet certain requirements, such as being at least 18 years old and having the capacity to own property.

- Spousal rights: Spouses have certain rights to property, and using a beneficiary deed may affect those rights.

Common Mistakes to Avoid When Using a Missouri Beneficiary Deed Form

When using a Missouri beneficiary deed form, there are several common mistakes to avoid, including:

- Not recording the deed: The deed must be recorded with the county recorder's office in order to be valid.

- Not using the correct language: The deed must use specific language in order to be valid.

- Not naming the correct beneficiaries: The deed must name the correct beneficiaries in order to ensure that the property is transferred to the intended individuals.

Alternatives to Missouri Beneficiary Deed Forms

There are several alternatives to Missouri beneficiary deed forms, including:

- Wills: Wills can be used to transfer property upon death, but may be subject to probate.

- Trusts: Trusts can be used to transfer property upon death, but may be more complex and expensive to establish.

- Joint ownership: Joint ownership can be used to transfer property upon death, but may have tax implications.

By understanding the Missouri beneficiary deed form and how it works, property owners can ensure that their loved ones inherit their property quickly and efficiently. Whether you're looking to avoid probate, retain control over your property, or simplify the transfer process, a Missouri beneficiary deed form can be a valuable tool in your estate planning arsenal.

We invite you to share your thoughts and experiences with Missouri beneficiary deed forms in the comments below. Have you used a beneficiary deed to transfer property? What were some of the benefits and challenges you encountered? Share your story and help others understand the importance of estate planning.

What is a Missouri beneficiary deed form?

+A Missouri beneficiary deed form is a document that allows property owners to transfer their property to beneficiaries upon their death, without the need for probate.

How does a Missouri beneficiary deed form work?

+A Missouri beneficiary deed form works by allowing property owners to name one or more beneficiaries who will inherit their property upon their death. The deed is recorded with the county recorder's office, and the property owner retains full control over the property during their lifetime.

What are the benefits of using a Missouri beneficiary deed form?

+The benefits of using a Missouri beneficiary deed form include avoiding probate, retaining control over the property, reducing taxes, and simplifying the transfer process.