Filing taxes can be a daunting task, especially for those who are new to the process. The Umgc Tax Form is a critical document that individuals and businesses must submit to the government to report their income and pay their taxes. In this article, we will provide a comprehensive guide on how to file the Umgc Tax Form, including the benefits, steps, and requirements.

Understanding the Umgc Tax Form

The Umgc Tax Form is a tax return form used by individuals and businesses to report their income, deductions, and credits to the government. The form is used to calculate the amount of taxes owed or the amount of refund due. It is essential to file the Umgc Tax Form accurately and on time to avoid penalties and fines.

Benefits of Filing the Umgc Tax Form

Filing the Umgc Tax Form has several benefits, including:

- Meeting tax obligations: Filing the Umgc Tax Form ensures that individuals and businesses meet their tax obligations and avoid penalties.

- Claiming refunds: Filing the Umgc Tax Form allows individuals and businesses to claim refunds if they have overpaid their taxes.

- Reporting income: Filing the Umgc Tax Form provides a record of income earned, which can be useful for future reference.

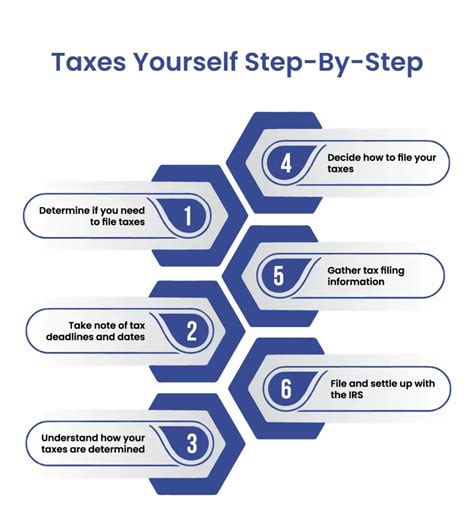

Steps to File the Umgc Tax Form

Filing the Umgc Tax Form involves several steps, including:

- Gathering necessary documents: Individuals and businesses must gather all necessary documents, including income statements, receipts, and identification documents.

- Choosing a filing status: Individuals and businesses must choose a filing status, such as single, married, or self-employed.

- Calculating income: Individuals and businesses must calculate their income, including wages, salaries, and tips.

- Claiming deductions and credits: Individuals and businesses can claim deductions and credits, such as charitable donations and education expenses.

- Filing the form: The Umgc Tax Form can be filed electronically or by mail.

Requirements for Filing the Umgc Tax Form

To file the Umgc Tax Form, individuals and businesses must meet certain requirements, including:

- Having a valid Social Security number or Employer Identification Number (EIN)

- Having a valid address

- Meeting the income threshold

- Providing accurate and complete information

Common Mistakes to Avoid

When filing the Umgc Tax Form, individuals and businesses should avoid common mistakes, including:

- Inaccurate or incomplete information

- Missing or incomplete documentation

- Failure to sign and date the form

- Failure to file on time

Tips for Filing the Umgc Tax Form

To ensure a smooth and successful filing process, individuals and businesses should:

- Seek professional help if needed

- Use tax software or online tools

- Keep accurate and detailed records

- File on time to avoid penalties

Filing the Umgc Tax Form Electronically

Filing the Umgc Tax Form electronically is a convenient and efficient way to submit the form. Individuals and businesses can use tax software or online tools to file the form electronically.

Filing the Umgc Tax Form by Mail

Filing the Umgc Tax Form by mail is also an option. Individuals and businesses must ensure that the form is accurately completed and signed, and that all necessary documentation is included.

Tracking the Status of the Umgc Tax Form

After filing the Umgc Tax Form, individuals and businesses can track the status of their form using online tools or by contacting the tax authority.

Conclusion

Filing the Umgc Tax Form is a critical step in meeting tax obligations and avoiding penalties. By following the steps and requirements outlined in this guide, individuals and businesses can ensure a smooth and successful filing process. Remember to seek professional help if needed, use tax software or online tools, and keep accurate and detailed records.

Stay Informed

Stay informed about the latest tax laws and regulations by visiting the official website of the tax authority or consulting with a tax professional.

Share Your Experience

Share your experience with filing the Umgc Tax Form by commenting below. Your feedback can help others who are going through the same process.

What is the deadline for filing the Umgc Tax Form?

+The deadline for filing the Umgc Tax Form varies depending on the tax authority and the individual's or business's filing status. It is essential to check with the tax authority for the specific deadline.

Can I file the Umgc Tax Form electronically?

+Yes, individuals and businesses can file the Umgc Tax Form electronically using tax software or online tools.

What documents do I need to file the Umgc Tax Form?

+Individuals and businesses must gather all necessary documents, including income statements, receipts, and identification documents, to file the Umgc Tax Form.