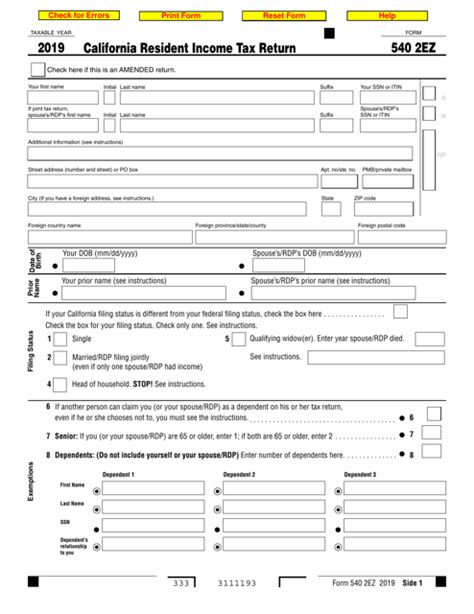

Filing taxes can be a daunting task, especially for those who are new to the process. The California 540 2EZ tax form is a simplified version of the standard 540 form, designed for taxpayers with simple returns. However, even with its streamlined design, it's essential to understand the requirements and potential pitfalls to avoid errors and ensure a smooth filing experience. In this article, we will provide you with five valuable tips to help you navigate the 540 2EZ tax form and make the most of your tax filing.

Tip 1: Determine Your Eligibility

Before you start filling out the 540 2EZ tax form, you need to determine if you're eligible to use it. The California Franchise Tax Board (FTB) has specific requirements for taxpayers who can use this form. You must meet the following conditions:

- Your filing status is single, married/RDP filing jointly, head of household, or qualifying widow(er).

- You have only one source of income, such as a W-2 or a 1099.

- You don't have any dependents.

- You don't claim any adjustments to income, such as alimony or student loan interest.

- You don't itemize deductions.

- You don't claim any credits, except for the earned income tax credit (EITC).

If you meet these requirements, you can proceed with the 540 2EZ tax form.

What Happens If You're Not Eligible?

If you don't meet the eligibility criteria, you'll need to use the standard 540 tax form. This form requires more information and may be more complicated to complete. However, it's essential to use the correct form to avoid delays or errors in processing your tax return.

Tip 2: Gather Required Documents

To complete the 540 2EZ tax form, you'll need to gather specific documents. These include:

- Your W-2 form from your employer.

- Your 1099 form, if you're self-employed or have other income.

- Your Social Security number or individual taxpayer identification number (ITIN).

- Your California driver's license or state ID number.

- Your tax filing status and number of dependents (if applicable).

Having these documents ready will help you complete the form accurately and efficiently.

What If You're Missing Documents?

If you're missing any of the required documents, you may need to request duplicates from your employer or the Social Security Administration. You can also contact the FTB for guidance on how to proceed.

Tip 3: Complete the Form Accurately

When completing the 540 2EZ tax form, accuracy is crucial. Make sure to:

- Read the instructions carefully before starting.

- Use black ink to fill out the form.

- Write clearly and legibly.

- Use the correct format for dates and numbers.

- Answer all questions truthfully and accurately.

If you're unsure about any section or question, consider consulting the FTB's instructions or seeking help from a tax professional.

What If You Make a Mistake?

If you make a mistake on the form, you may need to correct it and resubmit. This can delay the processing of your tax return. To avoid errors, take your time and review the form carefully before submitting it.

Tip 4: Claim Your Refund

If you're due a refund, make sure to claim it on the 540 2EZ tax form. You can choose to receive your refund via direct deposit, check, or prepaid debit card. Keep in mind that direct deposit is the fastest and most secure way to receive your refund.

What If You Owe Taxes?

If you owe taxes, you'll need to pay the amount due by the tax filing deadline to avoid penalties and interest. You can pay online, by phone, or by mail. Consider setting up a payment plan if you're unable to pay the full amount due.

Tip 5: Submit Your Return On Time

Finally, make sure to submit your 540 2EZ tax form on time. The tax filing deadline is typically April 15th, but it may vary if you're filing for an extension. You can submit your return electronically or by mail.

What If You Miss the Deadline?

If you miss the deadline, you may face penalties and interest on your tax bill. Consider filing for an extension or seeking help from a tax professional if you're unable to meet the deadline.

By following these five tips, you'll be well on your way to a smooth and successful tax filing experience with the 540 2EZ tax form. Remember to take your time, gather all required documents, and complete the form accurately. If you're unsure or have questions, don't hesitate to seek help from the FTB or a tax professional.

We hope this article has been helpful in guiding you through the process of filing the 540 2EZ tax form. If you have any further questions or comments, please feel free to share them below.

What is the 540 2EZ tax form?

+The 540 2EZ tax form is a simplified version of the standard 540 tax form, designed for taxpayers with simple returns.

Who is eligible to use the 540 2EZ tax form?

+Taxpayers who meet specific requirements, such as having only one source of income and no dependents, may use the 540 2EZ tax form.

What documents do I need to complete the 540 2EZ tax form?

+You'll need your W-2 form, 1099 form (if applicable), Social Security number or ITIN, California driver's license or state ID number, and tax filing status and number of dependents (if applicable).