The process of filing tax returns can be overwhelming, especially for those who are new to the system. With numerous forms and regulations to navigate, it's easy to get lost in the paperwork. One such form that often raises questions is the Form 8453, used for electronic filing of individual income tax returns. In this article, we will break down the Form 8453 into 5 easy steps, helping you understand its purpose, requirements, and benefits.

What is Form 8453 and Why is it Important?

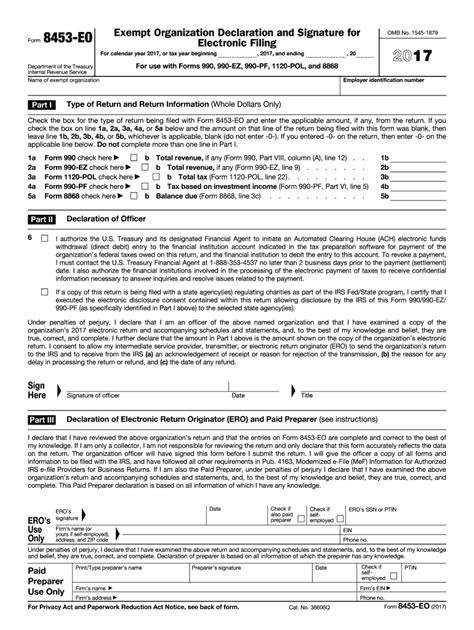

Form 8453 is an IRS form used by taxpayers to authenticate and authorize the electronic filing of their individual income tax returns. It serves as a digital signature, allowing the taxpayer to verify their identity and confirm the accuracy of the return. This form is crucial for maintaining the security and integrity of the electronic filing system.

Step 1: Understanding the Purpose of Form 8453

The primary purpose of Form 8453 is to provide a secure way for taxpayers to sign and authenticate their electronic tax returns. By completing this form, taxpayers can ensure that their returns are accurate, complete, and submitted to the IRS in a timely manner.

Step 2: Who Needs to File Form 8453?

Eligibility Criteria for Filing Form 8453

Not everyone needs to file Form 8453. To determine if you need to file this form, consider the following criteria:

- You are filing your individual income tax return electronically.

- You are using a tax software or a tax professional to prepare your return.

- You want to authenticate your return and verify your identity.

If you meet these criteria, you will need to complete Form 8453 as part of the electronic filing process.

Step 3: Gathering Required Information

Documents and Information Needed for Form 8453

To complete Form 8453, you will need to gather the following information:

- Your name, address, and Social Security number (or Individual Taxpayer Identification Number).

- Your spouse's name, address, and Social Security number (if filing jointly).

- Your income tax return information, including your filing status, income, deductions, and credits.

- Your electronic filing information, including your tax software or tax professional's details.

Make sure you have all the necessary documents and information before starting the Form 8453.

Step 4: Completing and Signing Form 8453

Step-by-Step Guide to Completing Form 8453

Completing Form 8453 is a straightforward process. Follow these steps:

- Download and print Form 8453 from the IRS website or obtain it from your tax software or tax professional.

- Fill in the required information, including your name, address, and Social Security number.

- Review your income tax return information and ensure it is accurate and complete.

- Sign and date the form.

- Attach the form to your electronic tax return or submit it separately to the IRS.

Step 5: Submitting Form 8453 and E-Filing Your Return

E-Filing Your Return with Form 8453

Once you have completed and signed Form 8453, you can submit it to the IRS along with your electronic tax return. Make sure to follow the instructions provided by your tax software or tax professional for e-filing your return.

Benefits of Using Form 8453

Using Form 8453 provides several benefits, including:

- Increased security and authentication of your electronic tax return.

- Faster processing and refund times.

- Reduced errors and rejections.

- Convenience and ease of use.

Frequently Asked Questions

Do I need to file Form 8453 if I'm filing a paper return?

+No, Form 8453 is only required for electronic filing of individual income tax returns.

Can I use Form 8453 for business tax returns?

+No, Form 8453 is only for individual income tax returns. Business tax returns require different forms and procedures.

What happens if I don't file Form 8453 with my electronic tax return?

+If you don't file Form 8453, your electronic tax return may be rejected or delayed. You may need to resubmit your return with the completed Form 8453.

By following these 5 easy steps, you can understand and complete Form 8453 with confidence. Remember to gather all required information, complete the form accurately, and submit it with your electronic tax return. If you have any further questions or concerns, don't hesitate to reach out to a tax professional or the IRS directly.

We hope this article has helped you understand the importance of Form 8453 and how to use it correctly. If you have any comments or suggestions, please share them with us below. Don't forget to share this article with others who may benefit from this information.