Wisconsin businesses are no strangers to the complexities of sales tax compliance. One crucial aspect of this process is filing the correct forms with the state's Department of Revenue. In this article, we'll delve into the world of Wisconsin Form ST-12, providing a comprehensive guide on instructions and filing requirements.

Understanding Wisconsin Form ST-12

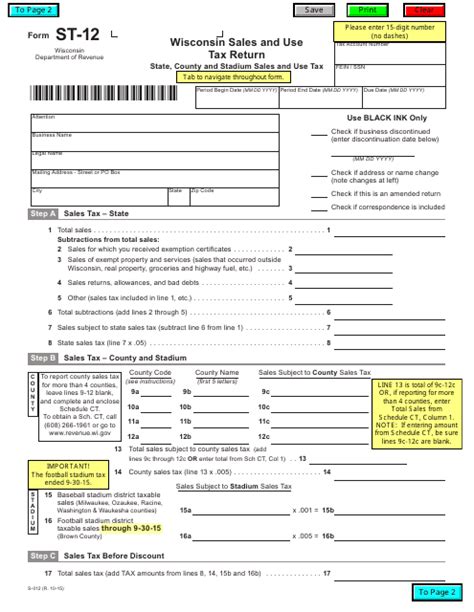

Wisconsin Form ST-12, also known as the "Sales and Use Tax Return," is a quarterly return used by businesses to report and pay sales and use taxes owed to the state. The form is typically filed by businesses that have a physical presence in Wisconsin or those that have nexus with the state.

Who Needs to File Form ST-12?

Businesses that meet the following criteria are required to file Form ST-12:

- Have a physical presence in Wisconsin

- Have nexus with the state (e.g., selling products or services to Wisconsin customers)

- Are registered with the Wisconsin Department of Revenue

- Have a sales tax permit or use tax permit

Filing Frequency and Deadlines

Wisconsin Form ST-12 is typically filed on a quarterly basis. The filing deadlines are as follows:

- January 31st for the fourth quarter (October 1 - December 31)

- April 30th for the first quarter (January 1 - March 31)

- July 31st for the second quarter (April 1 - June 30)

- October 31st for the third quarter (July 1 - September 30)

Preparing and Filing Form ST-12

To prepare and file Form ST-12, businesses will need to gather the following information:

- Gross sales and receipts

- Sales tax collected

- Use tax owed

- Exemptions and deductions

- Any other relevant tax information

The form can be filed electronically through the Wisconsin Department of Revenue's online portal or by mail.

Step-by-Step Filing Guide

Here's a step-by-step guide to help you navigate the Form ST-12 filing process:

- Gather necessary information: Collect your business's sales tax records, including gross sales, sales tax collected, and use tax owed.

- Complete the form: Fill out Form ST-12, ensuring accuracy and completeness.

- Calculate tax owed: Determine the total tax owed, including any interest or penalties.

- File electronically or by mail: Submit the form and payment through the Wisconsin Department of Revenue's online portal or by mail.

- Keep records: Maintain a copy of the filed form and supporting documentation for at least three years.

Common Errors to Avoid

When filing Form ST-12, it's essential to avoid common errors that can lead to delays or penalties. Some of the most common mistakes include:

- Inaccurate or incomplete information

- Failure to report all sales and use tax

- Incorrect calculations or math errors

- Missing or incomplete supporting documentation

Conclusion

Filing Wisconsin Form ST-12 is a crucial step in maintaining sales tax compliance. By understanding the instructions and filing requirements, businesses can avoid common errors and ensure timely submission. Remember to gather necessary information, complete the form accurately, and file electronically or by mail. If you're unsure about any aspect of the process, consider consulting a tax professional or contacting the Wisconsin Department of Revenue.

FAQs

Who is required to file Wisconsin Form ST-12?

+Businesses with a physical presence in Wisconsin or those with nexus with the state are required to file Form ST-12.

What is the filing deadline for Wisconsin Form ST-12?

+The filing deadline is typically the last day of the month following the quarter-end (January 31st, April 30th, July 31st, and October 31st).