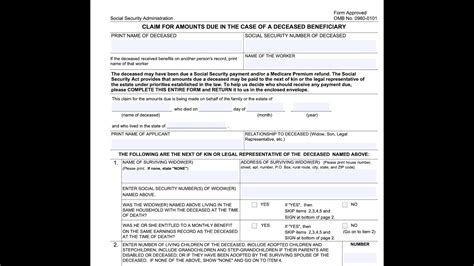

Filling out the SSA Form 1724 can be a daunting task, especially for those who are not familiar with the process. The SSA Form 1724, also known as the Claim for Amounts Due in the Case of a Deceased Beneficiary, is used to claim benefits that were due to a deceased Social Security beneficiary. In this article, we will provide you with a comprehensive guide on how to fill out the SSA Form 1724 correctly.

Understanding the SSA Form 1724

Before we dive into the steps to fill out the SSA Form 1724, it's essential to understand the purpose of the form. The SSA Form 1724 is used to claim benefits that were due to a deceased Social Security beneficiary. This form is typically used by the beneficiary's spouse, children, or parents to claim the benefits.

Who Can Claim Benefits Using the SSA Form 1724?

To claim benefits using the SSA Form 1724, you must meet one of the following criteria:

- You are the spouse of the deceased beneficiary and are eligible for survivor benefits.

- You are the child of the deceased beneficiary and are eligible for survivor benefits.

- You are the parent of the deceased beneficiary and are eligible for survivor benefits.

- You are the representative payee of the deceased beneficiary.

Step 1: Gather Required Information

Before filling out the SSA Form 1724, you will need to gather some required information. This includes:

- The deceased beneficiary's Social Security number

- The deceased beneficiary's date of birth and date of death

- Your relationship to the deceased beneficiary (spouse, child, parent, or representative payee)

- Your Social Security number

- Your date of birth

Required Documents

You will also need to provide supporting documents to accompany your claim. These documents may include:

- A copy of the deceased beneficiary's death certificate

- A copy of your marriage certificate (if you are the spouse of the deceased beneficiary)

- A copy of your birth certificate (if you are the child of the deceased beneficiary)

Step 2: Fill Out the SSA Form 1724

Now that you have gathered all the required information and documents, it's time to fill out the SSA Form 1724. The form is divided into several sections, which we will outline below.

Section 1: Claimant Information

In this section, you will need to provide your personal information, including your name, Social Security number, and date of birth.

Section 2: Deceased Beneficiary Information

In this section, you will need to provide information about the deceased beneficiary, including their name, Social Security number, date of birth, and date of death.

Section 3: Relationship to Deceased Beneficiary

In this section, you will need to indicate your relationship to the deceased beneficiary (spouse, child, parent, or representative payee).

Section 4: Claim for Benefits

In this section, you will need to indicate the type of benefits you are claiming (survivor benefits, lump-sum death payment, or both).

Step 3: Sign and Date the Form

Once you have completed the SSA Form 1724, you will need to sign and date it. Make sure to sign the form in the presence of a notary public.

Step 4: Submit the Form

You can submit the SSA Form 1724 to the Social Security Administration in person, by mail, or by fax. Make sure to keep a copy of the form for your records.

Step 5: Follow Up

After submitting the SSA Form 1724, you should follow up with the Social Security Administration to ensure that your claim is being processed. You can check the status of your claim online or by contacting your local Social Security office.

By following these steps, you can ensure that you fill out the SSA Form 1724 correctly and claim the benefits you are entitled to. Remember to gather all required information and documents before filling out the form, and make sure to sign and date it in the presence of a notary public.

Conclusion

Filling out the SSA Form 1724 can be a complex process, but by following the steps outlined in this article, you can ensure that you complete the form correctly and claim the benefits you are entitled to. Remember to gather all required information and documents, fill out the form carefully, and submit it to the Social Security Administration. If you have any questions or concerns, don't hesitate to contact your local Social Security office for assistance.

We encourage you to share your experiences and tips for filling out the SSA Form 1724 in the comments section below. Your input can help others who are going through the same process.

Who can claim benefits using the SSA Form 1724?

+The SSA Form 1724 can be claimed by the spouse, children, or parents of the deceased beneficiary, as well as the representative payee of the deceased beneficiary.

What documents are required to accompany the SSA Form 1724?

+The required documents may include a copy of the deceased beneficiary's death certificate, a copy of your marriage certificate (if you are the spouse of the deceased beneficiary), and a copy of your birth certificate (if you are the child of the deceased beneficiary).

How do I submit the SSA Form 1724?

+You can submit the SSA Form 1724 to the Social Security Administration in person, by mail, or by fax.