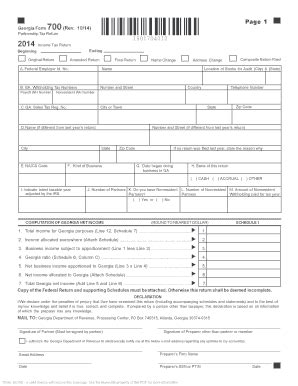

The Georgia Form 700 is a critical document for businesses operating in the state, as it relates to the payment of state income tax. Filing for an extension can be a straightforward process, but it's essential to understand the various methods available to ensure you meet the necessary deadlines and avoid potential penalties. In this article, we will explore the five ways to file a Georgia Form 700 extension, providing you with a comprehensive guide to navigate this process.

Why File for a Georgia Form 700 Extension?

Before diving into the methods for filing an extension, it's crucial to understand why this might be necessary. Businesses may need to file for an extension for various reasons, such as:

- Needing more time to gather necessary documentation or financial records

- Experiencing unforeseen circumstances that hinder the ability to file on time

- Requiring additional time to consult with tax professionals or accountants

- Wanting to avoid penalties and interest associated with late filing

Method 1: E-File Through the Georgia Tax Center

One of the most convenient ways to file for a Georgia Form 700 extension is through the Georgia Tax Center. This online platform allows you to e-file your extension request quickly and efficiently.

To e-file through the Georgia Tax Center:

- Log in to your account or create a new one if you haven't already

- Select the "File an Extension" option

- Fill out the required information, including your business name, tax ID number, and extension request details

- Submit your request and receive confirmation of receipt

Method 2: Mail a Paper Extension Request

For those who prefer a more traditional approach or don't have access to the Georgia Tax Center, mailing a paper extension request is a viable option.

To mail a paper extension request:

- Download and complete Form 700-EXT from the Georgia Department of Revenue website

- Attach any required supporting documentation or payment

- Mail the request to the address listed on the form

- Ensure timely mailing to meet the extension deadline

Method 3: Fax Your Extension Request

Faxing your extension request is another option, although it's essential to confirm receipt and ensure the fax is transmitted correctly.

To fax your extension request:

- Complete Form 700-EXT and attach any required supporting documentation or payment

- Fax the request to the number listed on the form

- Verify receipt of the fax with the Georgia Department of Revenue

Method 4: Use a Tax Professional or Accountant

Many businesses prefer to work with tax professionals or accountants to handle their tax obligations, including filing for extensions.

To use a tax professional or accountant:

- Consult with a qualified professional to determine the best course of action for your business

- Provide necessary documentation and information to complete the extension request

- Ensure the professional submits the request on your behalf and receives confirmation of receipt

Method 5: Call the Georgia Department of Revenue

In some cases, businesses may need to call the Georgia Department of Revenue directly to file for an extension or address specific questions or concerns.

To call the Georgia Department of Revenue:

- Dial the phone number listed on the Georgia Department of Revenue website

- Explain your situation and request an extension

- Provide necessary documentation or information as requested

- Confirm receipt of the extension request and any additional requirements

Next Steps and Important Deadlines

After filing for a Georgia Form 700 extension, it's essential to remember the following:

- The extension is typically granted for six months, but this may vary depending on the specific circumstances

- Businesses must still make estimated tax payments throughout the year, even with an extension

- The final tax return and payment are due on the extended deadline date

Invitation to Engage

We hope this article has provided valuable insights into the five ways to file a Georgia Form 700 extension. If you have any questions, concerns, or would like to share your experiences, please don't hesitate to comment below. Share this article with your colleagues or business associates who may benefit from this information.

What is the deadline for filing a Georgia Form 700 extension?

+The deadline for filing a Georgia Form 700 extension is typically the original due date of the tax return, but this may vary depending on the specific circumstances. It's essential to consult the Georgia Department of Revenue website or contact a tax professional for specific guidance.

Can I file for a Georgia Form 700 extension online?

+Yes, you can file for a Georgia Form 700 extension online through the Georgia Tax Center. This is a convenient and efficient way to submit your extension request.

What documentation is required to file for a Georgia Form 700 extension?

+The required documentation for filing a Georgia Form 700 extension may vary depending on the specific circumstances. It's essential to consult the Georgia Department of Revenue website or contact a tax professional to determine the necessary documentation for your business.