The Ksu 1098 T Form is a crucial document for students who receive financial aid, scholarships, or grants to pursue higher education. It's essential to understand the purpose, content, and implications of this form to ensure accurate tax reporting and potential tax benefits. In this comprehensive guide, we'll delve into the world of the Ksu 1098 T Form, exploring its significance, key components, and how to navigate its complexities.

What is the Ksu 1098 T Form?

The Ksu 1098 T Form, also known as the Tuition Statement, is a tax document issued by educational institutions to students who have paid qualified tuition and related expenses (QTRE). This form reports the amount of QTRE paid by the student during the tax year, which may be eligible for tax credits or deductions. The form is typically sent to students by January 31st of each year, covering the previous tax year.

Why is the Ksu 1098 T Form important?

The Ksu 1098 T Form serves several purposes:

- Tax Credits and Deductions: The form helps students and their families claim tax credits or deductions for qualified education expenses. These tax benefits can significantly reduce their tax liability, providing much-needed relief for education expenses.

- Accurate Tax Reporting: The Ksu 1098 T Form ensures accurate tax reporting by providing a standardized format for reporting QTRE. This helps prevent errors and discrepancies in tax returns.

- Compliance with IRS Regulations: Educational institutions are required to issue the Ksu 1098 T Form to students who meet specific criteria, ensuring compliance with IRS regulations.

Key Components of the Ksu 1098 T Form

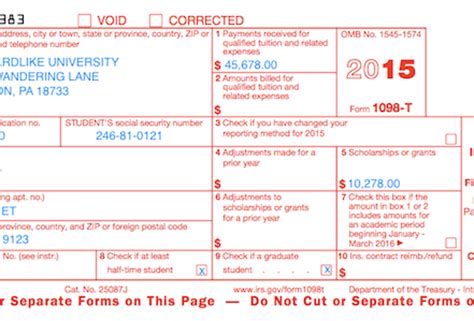

The Ksu 1098 T Form typically includes the following information:

- Student's Information: Name, address, and taxpayer identification number (TIN) or social security number (SSN).

- Institution's Information: Name, address, and employer identification number (EIN) of the educational institution.

- QTRE Amounts: Total amount of qualified tuition and related expenses paid by the student during the tax year.

- Box 1: Payments Received: Amount of payments received by the institution for QTRE.

- Box 2: Amounts Billed: Amount of QTRE billed by the institution, but not necessarily paid.

- Box 3: Adjustments: Adjustments made to the QTRE amounts, such as refunds or reductions.

- Box 4: Scholarships or Grants: Amount of scholarships or grants received by the student.

- Box 5: Adjustments to Scholarships or Grants: Adjustments made to scholarships or grants, such as reductions or refunds.

How to Read and Understand the Ksu 1098 T Form

When reviewing your Ksu 1098 T Form, keep the following tips in mind:

- Verify Student Information: Ensure your name, address, and TIN or SSN are accurate.

- Understand QTRE Amounts: Review the total amount of QTRE paid and any adjustments made.

- Distinguish Between Boxes: Understand the differences between Box 1 (payments received) and Box 2 (amounts billed).

- Scholarships and Grants: Review the amount of scholarships or grants received and any adjustments made.

Tax Credits and Deductions

The Ksu 1098 T Form is essential for claiming tax credits or deductions for qualified education expenses. Two popular tax benefits are:

- American Opportunity Tax Credit (AOTC): A credit of up to $2,500 for qualified education expenses, with a phase-out limit of $90,000 for single filers and $180,000 for joint filers.

- Lifetime Learning Credit (LLC): A credit of up to $2,000 for qualified education expenses, with a phase-out limit of $69,000 for single filers and $138,000 for joint filers.

Frequently Asked Questions

What is the deadline for receiving the Ksu 1098 T Form?

+The Ksu 1098 T Form is typically sent to students by January 31st of each year, covering the previous tax year.

What is the difference between Box 1 and Box 2 on the Ksu 1098 T Form?

+Box 1 reports payments received by the institution for QTRE, while Box 2 reports amounts billed by the institution, but not necessarily paid.

Can I claim the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC) in the same tax year?

+No, you can only claim one of these credits per tax year.

In conclusion, the Ksu 1098 T Form is a vital document for students who receive financial aid, scholarships, or grants. By understanding the purpose, content, and implications of this form, you can ensure accurate tax reporting and potentially claim tax credits or deductions. If you have any further questions or concerns, please don't hesitate to reach out to your educational institution or a tax professional.

We hope this comprehensive guide has helped you navigate the complexities of the Ksu 1098 T Form. If you found this article informative, please share it with others who may benefit from this information.