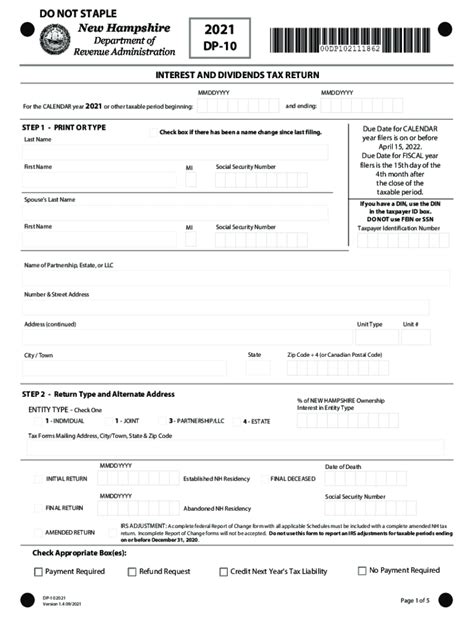

Filing taxes can be a daunting task, but with the right guidance, it can be a breeze. The NH Form DP-10 is a crucial document for New Hampshire residents, and filing it correctly is essential to avoid any penalties or delays. In this article, we will provide you with 5 tips to ensure your NH Form DP-10 filing is a success.

First and foremost, it's essential to understand the purpose of the NH Form DP-10. This form is used to report your income tax liability to the state of New Hampshire. It's a critical document that requires accuracy and attention to detail. By following these tips, you can ensure that your filing is successful and hassle-free.

Tip 1: Gather All Necessary Documents

Before starting the filing process, make sure you have all the necessary documents ready. These include:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your New Hampshire Driver's License or state-issued ID

- Your W-2 forms from all employers

- Your 1099 forms for any freelance or contract work

- Any other relevant tax documents, such as receipts for deductions

Having all these documents in one place will make it easier to fill out the form accurately and efficiently.

Tip 2: Understand the Filing Status

Your filing status plays a crucial role in determining your tax liability. Make sure you understand your filing status and choose the correct one on the form. The filing status options for the NH Form DP-10 are:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the correct filing status to avoid any errors or delays in processing your return.

Tip 3: Report All Income

Reporting all income is essential to ensure accuracy and avoid any penalties. Make sure to include all income from:

- W-2 forms

- 1099 forms

- Freelance or contract work

- Investments

- Any other sources of income

Failure to report all income can result in penalties and interest on the unpaid tax amount.

Tip 4: Claim All Eligible Deductions

Deductions can help reduce your tax liability, so make sure to claim all eligible deductions. Some common deductions include:

- Charitable donations

- Medical expenses

- Mortgage interest

- Property taxes

Keep receipts and records of all deductions to support your claims in case of an audit.

Tip 5: File Electronically

Filing electronically is the fastest and most convenient way to submit your NH Form DP-10. It reduces the risk of errors and ensures that your return is processed quickly. You can file electronically through the New Hampshire Department of Revenue Administration's website or through a tax preparation software.

By following these tips, you can ensure that your NH Form DP-10 filing is a success. Remember to stay organized, report all income, and claim all eligible deductions. Filing electronically can also help reduce errors and speed up the processing of your return.

By taking the time to understand the NH Form DP-10 and following these tips, you can avoid any penalties or delays and ensure a smooth filing experience.

Take Action Now

Don't wait until the last minute to file your NH Form DP-10. Start gathering your documents, understanding your filing status, reporting all income, claiming all eligible deductions, and filing electronically. By taking action now, you can ensure a stress-free filing experience and avoid any potential penalties or delays.

Share Your Experience

Have you filed your NH Form DP-10 successfully? Share your experience and tips with others in the comments below. Your insights can help others navigate the filing process with ease.

What is the NH Form DP-10?

+The NH Form DP-10 is a tax form used to report income tax liability to the state of New Hampshire.

What is the deadline for filing the NH Form DP-10?

+The deadline for filing the NH Form DP-10 is typically April 15th of each year.