Introduction to Form IT-201

Filing taxes can be a daunting task, especially for those who are new to the process. One of the most important forms for New York State residents is Form IT-201, also known as the Resident Income Tax Return. This form is used to report an individual's income and claim any applicable credits or deductions. In this article, we will provide a comprehensive guide to understanding Form IT-201, including its purpose, who needs to file, and how to complete it.

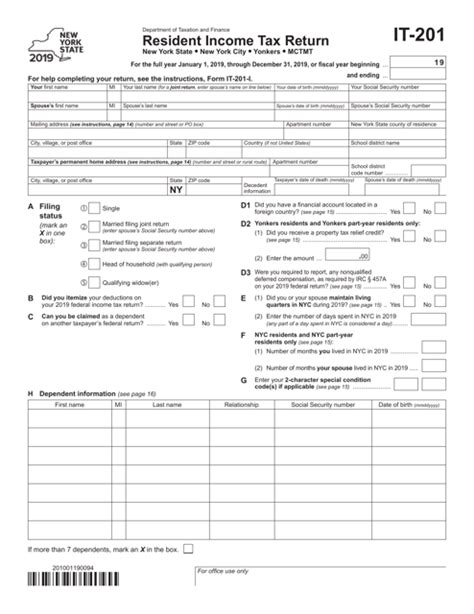

Purpose of Form IT-201

Form IT-201 is used by the New York State Department of Taxation and Finance to collect income tax from residents. The form is used to report an individual's income from various sources, including employment, self-employment, investments, and retirement accounts. The form also allows taxpayers to claim credits and deductions, such as the earned income tax credit (EITC), child tax credit, and mortgage interest deduction.

Who Needs to File Form IT-201?

Not everyone needs to file Form IT-201. To determine if you need to file, you should check the following criteria:

- You are a resident of New York State

- You have income from a job, self-employment, investments, or retirement accounts

- You have withholding from a pension or retirement account

- You have received a distribution from a qualified plan or IRA

- You have income from a trust or estate

If you meet any of these criteria, you will need to file Form IT-201.

How to Complete Form IT-201

Completing Form IT-201 can be a complex process, but it can be broken down into several steps:

- Gather necessary documents: You will need to gather all necessary documents, including your W-2 forms, 1099 forms, and any other relevant tax documents.

- Choose a filing status: You will need to choose a filing status, such as single, married filing jointly, or head of household.

- Report income: You will need to report all income from various sources, including employment, self-employment, investments, and retirement accounts.

- Claim credits and deductions: You will need to claim any applicable credits and deductions, such as the EITC, child tax credit, and mortgage interest deduction.

- Calculate tax liability: You will need to calculate your tax liability based on your income and credits and deductions.

- Sign and date the form: Once you have completed the form, you will need to sign and date it.

Tips for Completing Form IT-201

Here are some tips to keep in mind when completing Form IT-201:

- Use tax software: Consider using tax software, such as TurboTax or H&R Block, to help guide you through the process.

- Seek professional help: If you are unsure about how to complete the form, consider seeking help from a tax professional.

- Double-check calculations: Make sure to double-check your calculations to avoid errors.

- File on time: Make sure to file your tax return on time to avoid penalties and interest.

Common Errors to Avoid

Here are some common errors to avoid when completing Form IT-201:

- Incorrect filing status: Make sure to choose the correct filing status, as this can affect your tax liability.

- Incorrect income reporting: Make sure to report all income from various sources, as this can affect your tax liability.

- Incorrect credits and deductions: Make sure to claim all applicable credits and deductions, as this can reduce your tax liability.

- Math errors: Make sure to double-check your calculations to avoid errors.

Conclusion

Completing Form IT-201 can be a complex process, but by following these steps and tips, you can ensure that you file your tax return accurately and on time. Remember to seek professional help if you are unsure about how to complete the form, and to double-check your calculations to avoid errors. By understanding Form IT-201, you can take control of your tax obligations and avoid any potential penalties and interest.

What is the deadline for filing Form IT-201?

+The deadline for filing Form IT-201 is typically April 15th of each year.

Do I need to file Form IT-201 if I don't have any income?

+No, you do not need to file Form IT-201 if you do not have any income.

Can I file Form IT-201 electronically?

+Yes, you can file Form IT-201 electronically through the New York State Department of Taxation and Finance website.