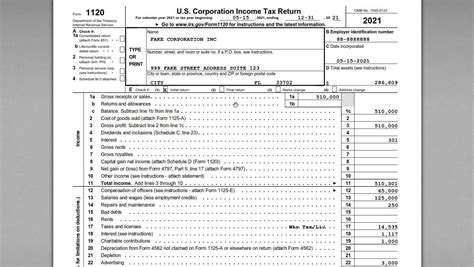

The IRS Form 1120 is a crucial document for corporations to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS). As a corporation, it is essential to understand the form and its instructions to ensure accurate and timely filing. In this comprehensive guide, we will walk you through the Form 1120 instructions, providing a step-by-step approach to help you navigate the process.

Why is Form 1120 Important?

Form 1120 is a vital document for corporations, as it serves as the primary means of reporting corporate income tax to the IRS. The form requires corporations to report their financial activities, which helps the IRS to determine the correct tax liability. Failure to file or accurately complete the form can result in penalties, fines, and even audit.

Who Must File Form 1120?

Form 1120 must be filed by corporations, including:

- C-corporations (also known as regular corporations)

- S-corporations (although they file Form 1120S instead)

- Personal service corporations (PSCs)

- Certain foreign corporations with U.S. income

Additional Filing Requirements

In addition to Form 1120, corporations may need to file other forms, such as:

- Form W-2: Wage and Tax Statement

- Form 1099: Miscellaneous Income

- Form 940: Employer's Annual Federal Unemployment Tax Return

- Form 941: Employer's Quarterly Federal Tax Return

Step-by-Step Guide to Form 1120 Instructions

To accurately complete Form 1120, follow these steps:

- Gather Required Information: Collect financial records, including income statements, balance sheets, and depreciation schedules.

- Determine Your Accounting Method: Choose between the cash or accrual method of accounting.

- Complete Form 1120: Fill out the form, starting with the corporation's name, address, and employer identification number (EIN).

- Report Income: Enter gross income, including sales, services, and other revenue streams.

- Claim Deductions: List business expenses, such as salaries, rent, and utilities.

- Calculate Tax Liability: Use the tax rate schedule to determine the corporation's tax liability.

- Claim Credits: Apply for any applicable tax credits, such as the research and development credit.

- Sign and Date the Form: The corporation's authorized representative must sign and date the form.

Form 1120 Schedules and Attachments

Form 1120 requires several schedules and attachments, including:

- Schedule C: Capital Gains and Losses

- Schedule D: Depreciation and Amortization

- Schedule E: Income and Expenses

- Schedule K-1: Shareholder's Share of Income, Deductions, and Credits

Tips for Accurate and Timely Filing

To ensure accurate and timely filing:

- Seek Professional Help: Consult with a tax professional or accountant.

- Use IRS Resources: Utilize IRS publications and online tools.

- Keep Accurate Records: Maintain detailed financial records throughout the year.

- File Electronically: Submit the form electronically to reduce errors and speed up processing.

Penalties and Consequences of Late or Inaccurate Filing

Failure to file or accurately complete Form 1120 can result in:

- Penalties: Up to $100 per day or $10,000 per year

- Fines: Up to $100,000 or more

- Audit: Increased risk of audit and potential loss of tax benefits

Conclusion and Next Steps

Form 1120 is a critical document for corporations, requiring careful attention to detail and accurate completion. By following this step-by-step guide, you can ensure timely and accurate filing. Remember to seek professional help, utilize IRS resources, and maintain accurate records throughout the year.

Share your thoughts: Have you encountered any challenges while filing Form 1120? Share your experiences and tips in the comments below.

Stay informed: Subscribe to our blog for more tax-related articles and guides.

What is the deadline for filing Form 1120?

+The deadline for filing Form 1120 is typically March 15th or April 15th, depending on the corporation's tax year-end.

Can I file Form 1120 electronically?

+Yes, you can file Form 1120 electronically through the IRS's e-file system.

What is the penalty for late filing of Form 1120?

+The penalty for late filing of Form 1120 can be up to $100 per day or $10,000 per year.