Understanding the NC E-595E form is crucial for businesses in North Carolina, as it relates to the sales and use tax exemption for qualifying purchases. Filling out the form correctly is essential to avoid any potential issues or delays. In this article, we will explore five ways to fill out the NC E-595E form correctly, ensuring a seamless and compliant process.

What is the NC E-595E Form?

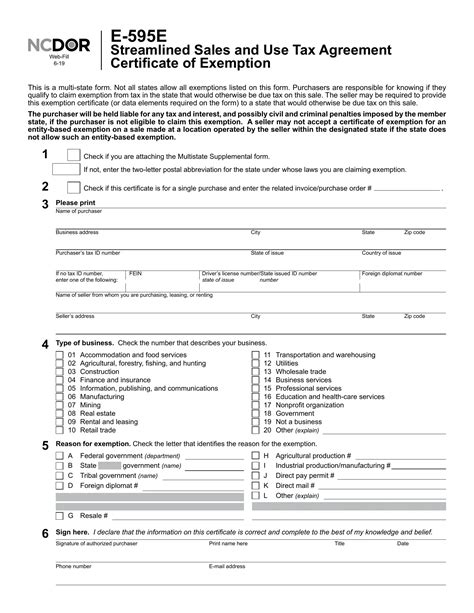

The NC E-595E form is a document used by businesses in North Carolina to claim an exemption from sales and use tax on qualifying purchases. This form is typically used for purchases of tangible personal property, such as equipment, machinery, and supplies, that are exempt from sales and use tax.

1. Gather Required Information

Before filling out the NC E-595E form, it's essential to gather all the required information. This includes:

- Business name and address

- Taxpayer identification number (FEIN or SSN)

- Type of exemption being claimed

- Description of the property being purchased

- Cost of the property

- Date of purchase

Having all the necessary information readily available will help ensure that the form is completed accurately and efficiently.

Understanding the Exemption Types

The NC E-595E form requires the claimant to specify the type of exemption being claimed. There are several exemption types, including:

- Exemption for Manufacturers: This exemption applies to manufacturers who purchase tangible personal property for use in their manufacturing processes.

- Exemption for Farmers: This exemption applies to farmers who purchase tangible personal property for use in their farming operations.

- Exemption for Non-Profit Organizations: This exemption applies to non-profit organizations that purchase tangible personal property for use in their exempt activities.

It's essential to understand the different exemption types and choose the correct one to avoid any potential issues.

2. Complete the Form Accurately

Once you have gathered all the required information and understand the exemption types, it's time to complete the form. Make sure to:

- Use black ink and print clearly

- Fill out all required fields

- Use the correct exemption type

- Provide a detailed description of the property being purchased

- Include the cost of the property and date of purchase

Accuracy is crucial when completing the NC E-595E form. Any errors or omissions may result in delays or even the rejection of the exemption claim.

Additional Tips for Completing the Form

- Use a separate form for each exemption claim

- Keep a copy of the completed form for your records

- Submit the form to the seller or vendor at the time of purchase

- Ensure the seller or vendor signs and dates the form

3. Attach Supporting Documentation

In some cases, you may need to attach supporting documentation to the NC E-595E form. This can include:

- Manufacturer's Certificate: A certificate issued by the manufacturer that certifies the property being purchased is exempt from sales and use tax.

- Farmer's Certificate: A certificate issued by the farmer that certifies the property being purchased is exempt from sales and use tax.

- Non-Profit Certificate: A certificate issued by the non-profit organization that certifies the property being purchased is exempt from sales and use tax.

Make sure to attach all required supporting documentation to the form to ensure a smooth and compliant process.

4. Retain Records

It's essential to retain records of the NC E-595E form and supporting documentation for at least three years. This includes:

- A copy of the completed form

- Supporting documentation

- Records of the exemption claim

Retaining records will help ensure compliance with North Carolina sales and use tax laws and regulations.

Record Retention Tips

- Keep records in a secure and accessible location

- Use a record retention policy to ensure compliance

- Consider using a digital record-keeping system

5. Consult with a Tax Professional

Filling out the NC E-595E form correctly can be complex, especially for businesses that are new to North Carolina sales and use tax laws and regulations. Consider consulting with a tax professional to ensure:

- Accuracy and compliance with North Carolina sales and use tax laws and regulations

- Correct completion of the form and supporting documentation

- Timely submission of the form and supporting documentation

A tax professional can provide valuable guidance and support to ensure a seamless and compliant process.

By following these five ways to fill out the NC E-595E form correctly, businesses in North Carolina can ensure a seamless and compliant process. Remember to gather required information, understand exemption types, complete the form accurately, attach supporting documentation, retain records, and consult with a tax professional.

We hope this article has provided valuable insights and guidance on filling out the NC E-595E form correctly. If you have any questions or comments, please feel free to share them below.

FAQ Section:

What is the NC E-595E form used for?

+The NC E-595E form is used by businesses in North Carolina to claim an exemption from sales and use tax on qualifying purchases.

What types of exemptions are available?

+There are several exemption types, including exemptions for manufacturers, farmers, and non-profit organizations.

What documentation is required to support the exemption claim?

+Supporting documentation may include a manufacturer's certificate, farmer's certificate, or non-profit certificate.