As the world becomes increasingly digital, the way we do business is also undergoing a significant transformation. One area that has seen significant advancements in recent years is tax filing. Gone are the days of manual paperwork and long queues at the IRS office. Today, businesses can e-file their tax returns with ease and convenience. For corporations, Form 8453 Corp is an essential document that enables them to take advantage of electronic filing. In this article, we will delve into the world of corporate e-filing and provide a comprehensive guide to Form 8453 Corp.

The Benefits of Corporate E-Filing

E-filing has revolutionized the way businesses file their tax returns. It's faster, more efficient, and reduces the risk of errors. For corporations, e-filing offers several benefits, including:

- Convenience: E-filing allows corporations to file their tax returns from the comfort of their own offices. No more waiting in line or worrying about paperwork getting lost in the mail.

- Speed: E-filing is significantly faster than traditional paper filing. Returns are processed quickly, and refunds are issued faster.

- Accuracy: E-filing reduces the risk of errors, as the software used for filing automatically checks for mistakes and alerts the user.

What is Form 8453 Corp?

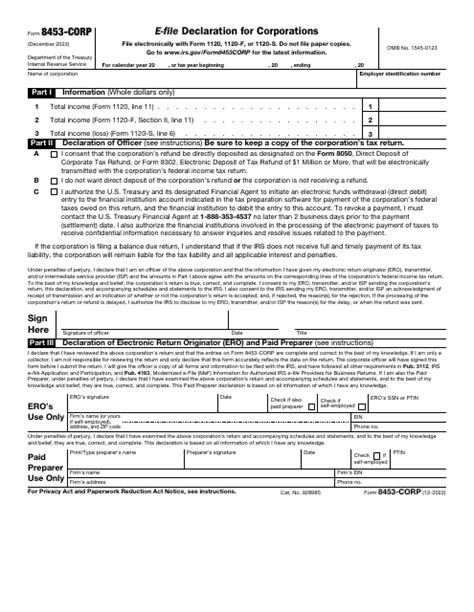

Form 8453 Corp is a document that corporations use to authorize the electronic filing of their tax returns. It's a critical component of the e-filing process, as it allows the IRS to verify the identity of the corporation and ensure that the return is filed accurately.

The Form 8453 Corp is typically prepared by the corporation's tax preparer or accountant. It requires the following information:

- Corporation's name and address

- Employer Identification Number (EIN)

- Tax year

- Name and title of the person signing the form

How to Complete Form 8453 Corp

Completing Form 8453 Corp is a straightforward process. Here's a step-by-step guide:

- Download the form: The Form 8453 Corp can be downloaded from the IRS website or obtained from a tax professional.

- Fill in the required information: The form requires the corporation's name and address, EIN, tax year, and the name and title of the person signing the form.

- Sign the form: The form must be signed by an authorized representative of the corporation.

- Attach the form to the tax return: The completed Form 8453 Corp must be attached to the corporation's tax return (Form 1120).

Common Mistakes to Avoid

When completing Form 8453 Corp, there are several common mistakes to avoid:

- Inaccurate information: Ensure that the information provided on the form is accurate and up-to-date.

- Missing signatures: The form must be signed by an authorized representative of the corporation.

- Incomplete forms: Ensure that all required fields are completed.

E-Filing Requirements for Corporations

To e-file their tax returns, corporations must meet certain requirements, including:

- Obtaining an EIN: Corporations must obtain an EIN from the IRS.

- Using approved software: Corporations must use approved software to prepare and file their tax returns.

- Having a secure internet connection: Corporations must have a secure internet connection to transmit their tax returns.

Penalties for Late Filing

Corporations that fail to file their tax returns on time may be subject to penalties and interest. The IRS imposes a penalty of 5% of the unpaid taxes for each month or part of a month that the return is late, up to a maximum of 25%.

Conclusion

E-filing is a convenient and efficient way for corporations to file their tax returns. Form 8453 Corp is an essential document that authorizes the electronic filing of corporate tax returns. By following the steps outlined in this guide, corporations can ensure that their tax returns are filed accurately and on time.

We hope this guide has been informative and helpful. If you have any questions or need further assistance, please don't hesitate to ask. Share your thoughts and experiences with e-filing in the comments section below.

What is Form 8453 Corp used for?

+Form 8453 Corp is used to authorize the electronic filing of corporate tax returns.

Who must sign Form 8453 Corp?

+The form must be signed by an authorized representative of the corporation.

What is the penalty for late filing of corporate tax returns?

+The IRS imposes a penalty of 5% of the unpaid taxes for each month or part of a month that the return is late, up to a maximum of 25%.