Tax season can be a daunting time for many individuals, especially when it comes to navigating the complexities of tax forms. One form that can be particularly challenging is the 4972 tax form, which is used to report tax on certain employee benefits. In this article, we will provide an in-depth guide on how to master the 4972 tax form, including five essential tips to help you navigate this process with ease.

As a taxpayer, it's essential to understand the importance of accurately completing the 4972 tax form. This form is used to report tax on certain employee benefits, such as life insurance coverage, and failure to accurately complete it can result in penalties and fines. By mastering the 4972 tax form, you can ensure that you are in compliance with tax laws and avoid any potential issues.

The 4972 tax form is a critical component of the tax filing process, and it's essential to understand its purpose and how it works. The form is used to calculate the tax on certain employee benefits, including life insurance coverage, and it must be filed annually. By understanding how the form works, you can ensure that you are accurately reporting your employee benefits and avoiding any potential tax liabilities.

Understanding the 4972 Tax Form

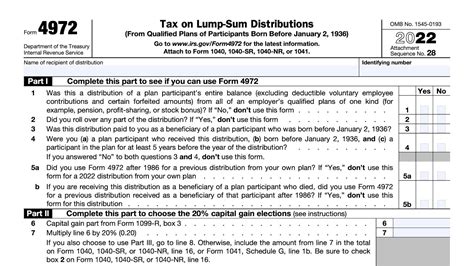

The 4972 tax form is a complex document that requires careful attention to detail. To accurately complete the form, you'll need to understand the different sections and how they relate to your employee benefits. Here are the main sections of the 4972 tax form:

- Section 1: Employee Information: This section requires you to provide basic information about the employee, including their name, social security number, and date of birth.

- Section 2: Life Insurance Coverage: This section requires you to report the life insurance coverage provided to the employee, including the face amount of the policy and the annual premiums paid.

- Section 3: Tax Calculation: This section requires you to calculate the tax on the life insurance coverage, using the IRS-provided tables and rates.

Tip 1: Understand the IRS Tables and Rates

The IRS provides tables and rates to help you calculate the tax on life insurance coverage. To accurately complete the 4972 tax form, you'll need to understand how to use these tables and rates. Here's a step-by-step guide on how to use the IRS tables and rates:

- Determine the face amount of the life insurance policy.

- Determine the annual premiums paid on the policy.

- Use the IRS tables to determine the taxable amount of the life insurance coverage.

- Use the IRS rates to calculate the tax on the taxable amount.

Common Mistakes to Avoid

When completing the 4972 tax form, there are several common mistakes to avoid. Here are some of the most common mistakes:

- Incorrect Employee Information: Make sure to accurately provide the employee's name, social security number, and date of birth.

- Incorrect Life Insurance Coverage: Make sure to accurately report the life insurance coverage provided to the employee, including the face amount of the policy and the annual premiums paid.

- Incorrect Tax Calculation: Make sure to accurately calculate the tax on the life insurance coverage, using the IRS-provided tables and rates.

Tip 2: Keep Accurate Records

Keeping accurate records is essential when completing the 4972 tax form. Here are some tips on how to keep accurate records:

- Keep Employee Records: Keep accurate records of employee information, including their name, social security number, and date of birth.

- Keep Life Insurance Records: Keep accurate records of life insurance coverage, including the face amount of the policy and the annual premiums paid.

- Keep Tax Records: Keep accurate records of tax calculations, including the IRS tables and rates used.

Additional Tips and Strategies

In addition to the tips and strategies outlined above, here are some additional tips and strategies to help you master the 4972 tax form:

- Seek Professional Help: If you're unsure about how to complete the 4972 tax form, consider seeking professional help from a tax professional or accountant.

- Use Tax Software: Consider using tax software to help you complete the 4972 tax form. Tax software can help you accurately calculate the tax on life insurance coverage and avoid common mistakes.

- Stay Up-to-Date with Tax Laws: Stay up-to-date with tax laws and regulations to ensure that you're in compliance with the latest requirements.

Tip 3: Use Tax Software

Tax software can be a valuable tool when completing the 4972 tax form. Here are some benefits of using tax software:

- Accuracy: Tax software can help you accurately calculate the tax on life insurance coverage and avoid common mistakes.

- Convenience: Tax software can help you quickly and easily complete the 4972 tax form, saving you time and effort.

- Compliance: Tax software can help you stay up-to-date with tax laws and regulations, ensuring that you're in compliance with the latest requirements.

Tip 4: Seek Professional Help

If you're unsure about how to complete the 4972 tax form, consider seeking professional help from a tax professional or accountant. Here are some benefits of seeking professional help:

- Expertise: Tax professionals and accountants have the expertise and knowledge to accurately complete the 4972 tax form.

- Accuracy: Tax professionals and accountants can help you accurately calculate the tax on life insurance coverage and avoid common mistakes.

- Compliance: Tax professionals and accountants can help you stay up-to-date with tax laws and regulations, ensuring that you're in compliance with the latest requirements.

Tip 5: Stay Up-to-Date with Tax Laws

Staying up-to-date with tax laws and regulations is essential when completing the 4972 tax form. Here are some tips on how to stay up-to-date with tax laws:

- Check the IRS Website: Check the IRS website for the latest tax laws and regulations.

- Subscribe to Tax Publications: Subscribe to tax publications to stay up-to-date with the latest tax laws and regulations.

- Attend Tax Seminars: Attend tax seminars to learn about the latest tax laws and regulations.

What is the purpose of the 4972 tax form?

+The 4972 tax form is used to report tax on certain employee benefits, including life insurance coverage.

How do I calculate the tax on life insurance coverage?

+Use the IRS tables and rates to calculate the tax on life insurance coverage.

What are some common mistakes to avoid when completing the 4972 tax form?

+Some common mistakes to avoid include incorrect employee information, incorrect life insurance coverage, and incorrect tax calculation.

We hope this article has provided you with a comprehensive guide on how to master the 4972 tax form. By following these tips and strategies, you can ensure that you accurately complete the form and avoid any potential tax liabilities. Remember to stay up-to-date with tax laws and regulations, and seek professional help if you're unsure about how to complete the form. Share your thoughts and questions in the comments section below, and don't forget to share this article with your friends and colleagues.