As a Grubhub driver, you're considered an independent contractor, not an employee. This classification affects how you report your income and expenses on your taxes. One essential document you'll receive from Grubhub is the 1099 form, which outlines your earnings from the platform. In this article, we'll delve into the world of Grubhub 1099 forms, exploring what they are, how to read them, and what you need to know when filing your taxes.

Understanding the Grubhub 1099 Form

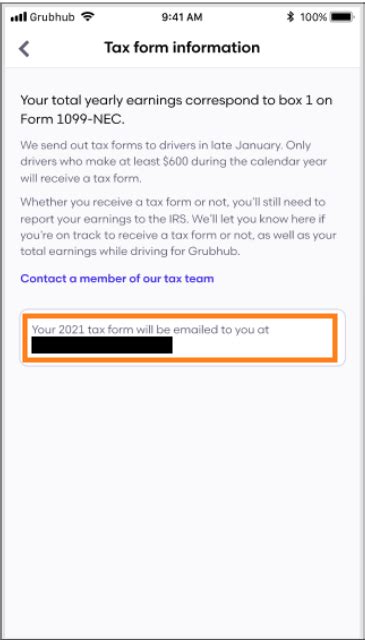

The Grubhub 1099 form, also known as the 1099-MISC (Miscellaneous Income), is a tax document that reports the payments you've received from Grubhub throughout the year. As an independent contractor, you're required to report this income on your tax return. The 1099 form will show the total amount of money you've earned from Grubhub, excluding any fees or expenses.

What to Expect on Your Grubhub 1099 Form

When you receive your Grubhub 1099 form, you'll notice the following information:

- Your name and address

- Grubhub's name and address

- The total amount of money you've earned from Grubhub (Box 7: Nonemployee Compensation)

- Any state or local taxes withheld (Box 17: State or local income tax withheld)

- A verification code (if you're filing electronically)

How to Read Your Grubhub 1099 Form

Reading your Grubhub 1099 form is relatively straightforward. Here's a breakdown of what you need to know:

- Box 1: Payer's Federal Identification Number: This is Grubhub's federal tax ID number.

- Box 7: Nonemployee Compensation: This is the total amount of money you've earned from Grubhub.

- Box 17: State or local income tax withheld: If you've had state or local taxes withheld, this box will show the amount.

Tax Obligations as a Grubhub Driver

As a Grubhub driver, you're responsible for reporting your income and expenses on your tax return. Here are some key tax obligations to keep in mind:

- Self-Employment Tax: As an independent contractor, you're responsible for paying self-employment tax on your net earnings from Grubhub. This tax is used to fund Social Security and Medicare.

- Business Expenses: You can deduct business expenses related to your Grubhub work, such as gas, maintenance, and phone expenses.

- Quarterly Estimated Tax Payments: As a self-employed individual, you're required to make quarterly estimated tax payments to the IRS.

Deducting Business Expenses on Your Tax Return

As a Grubhub driver, you can deduct business expenses on your tax return to reduce your taxable income. Here are some common expenses you may be able to deduct:

- Gas and Fuel: You can deduct the cost of gas and fuel used for Grubhub deliveries.

- Vehicle Maintenance: You can deduct expenses related to maintaining your vehicle, such as oil changes and tire rotations.

- Phone and Internet Expenses: You can deduct expenses related to your phone and internet usage for Grubhub work.

- Insurance: You can deduct the cost of insurance premiums related to your Grubhub work.

Steps to Take When Receiving Your Grubhub 1099 Form

When you receive your Grubhub 1099 form, follow these steps:

- Review the form for accuracy: Make sure the information on the form is correct, including your name, address, and earnings.

- Gather receipts and records: Collect receipts and records for your business expenses, as you'll need these to deduct expenses on your tax return.

- Consult a tax professional: If you're unsure about how to report your income and expenses, consider consulting a tax professional.

- File your tax return: Report your Grubhub income and expenses on your tax return, and make sure to pay any taxes owed by the deadline.

Common Mistakes to Avoid When Filing Your Tax Return

As a Grubhub driver, it's essential to avoid common mistakes when filing your tax return. Here are some mistakes to watch out for:

- Failing to report income: Make sure to report all income earned from Grubhub, including tips and bonuses.

- Not deducting business expenses: Don't forget to deduct business expenses related to your Grubhub work.

- Missing deadlines: Make sure to file your tax return and pay any taxes owed by the deadline.

Conclusion and Next Steps

As a Grubhub driver, understanding your 1099 form and tax obligations is crucial for filing an accurate tax return. By following the steps outlined in this article, you'll be well on your way to navigating the world of taxes as a Grubhub driver. Remember to review your 1099 form carefully, gather receipts and records, and consult a tax professional if needed. Don't hesitate to reach out to us in the comments below if you have any questions or concerns.

FAQ Section

What is the deadline for filing my tax return?

+The deadline for filing your tax return is typically April 15th of each year.

Can I deduct expenses related to my vehicle on my tax return?

+Yes, you can deduct expenses related to your vehicle, such as gas, maintenance, and insurance premiums.

What happens if I don't report my Grubhub income on my tax return?

+If you don't report your Grubhub income on your tax return, you may be subject to penalties and fines from the IRS.