As a business owner in New York City, it's essential to understand the tax requirements that apply to your business. One of the key tax forms you'll need to file is the IT-370-PF, also known as the Unincorporated Business Tax Return. In this article, we'll take a closer look at what the IT-370-PF is, who needs to file it, and how to complete the form.

What is the IT-370-PF?

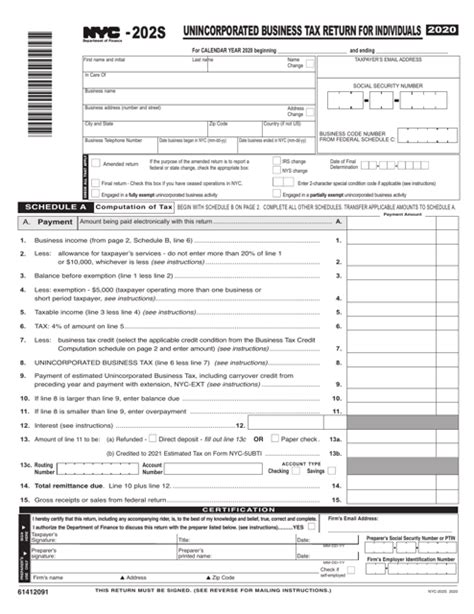

The IT-370-PF is a tax form used by the New York City Department of Finance to collect taxes from unincorporated businesses operating within the city. Unincorporated businesses include sole proprietorships, partnerships, and limited liability companies (LLCs) that are not treated as corporations for tax purposes. The form is used to report the business's income, deductions, and tax liability.

Who Needs to File the IT-370-PF?

You'll need to file the IT-370-PF if your business meets the following criteria:

- Your business is an unincorporated business, such as a sole proprietorship, partnership, or LLC that is not treated as a corporation for tax purposes.

- Your business has a physical presence in New York City, such as an office, store, or warehouse.

- Your business has income or losses that are subject to New York City taxation.

How to Complete the IT-370-PF

Completing the IT-370-PF requires careful attention to detail and a thorough understanding of the tax laws and regulations that apply to your business. Here's a step-by-step guide to help you get started:

- Gather necessary documents: Before you start filling out the form, gather all the necessary documents, including your business's financial statements, tax returns, and any other relevant documentation.

- Complete the business information section: Provide your business's name, address, and tax identification number.

- Report business income: Report your business's income from all sources, including sales, services, and investments.

- Claim deductions: Claim any deductions that are allowed under New York City tax law, such as business expenses, depreciation, and amortization.

- Calculate tax liability: Calculate your business's tax liability based on the income and deductions reported.

- Pay any tax due: If you owe taxes, make a payment by the due date to avoid penalties and interest.

Deadlines and Penalties

The IT-370-PF is due on the same date as your federal tax return, which is typically April 15th for calendar-year businesses. If you need more time to file, you can request an extension by filing Form IT-370-EXT. However, keep in mind that an extension of time to file does not extend the time to pay any tax due.

Failure to file the IT-370-PF or pay any tax due by the deadline can result in penalties and interest. The penalty for late filing is 5% of the tax due for each month or part of a month, up to a maximum of 25%. The interest rate is currently 8% per year, compounded daily.

Additional Requirements

In addition to filing the IT-370-PF, you may also need to file other tax forms and schedules, such as:

- Schedule C: If you have a sole proprietorship, you'll need to file Schedule C to report your business income and expenses.

- Schedule K-1: If you have a partnership or LLC, you'll need to file Schedule K-1 to report each partner's or member's share of income and expenses.

- Form 2555: If you have foreign-sourced income, you may need to file Form 2555 to report that income.

Amended Returns

If you need to make changes to your original return, you can file an amended return using Form IT-370-X. You'll need to complete the form in its entirety, including any changes you're making, and attach a copy of your original return.

Conclusion

Filing the IT-370-PF is a critical part of meeting your tax obligations as a business owner in New York City. By following the steps outlined in this guide, you can ensure that you're completing the form accurately and on time. Remember to also file any additional forms and schedules that are required for your business, and don't hesitate to seek professional help if you need it.

What's Next?

We hope this guide has been helpful in understanding the IT-370-PF and how to complete it. If you have any questions or need further guidance, please don't hesitate to reach out to a tax professional or the New York City Department of Finance.

Share Your Thoughts!

Have you filed the IT-370-PF before? What challenges did you face, and how did you overcome them? Share your experiences and tips in the comments below!

FAQs

Who is required to file the IT-370-PF?

+Unincorporated businesses, such as sole proprietorships, partnerships, and LLCs that are not treated as corporations for tax purposes, are required to file the IT-370-PF.

What is the deadline for filing the IT-370-PF?

+The IT-370-PF is due on the same date as your federal tax return, which is typically April 15th for calendar-year businesses.

Can I file an amended return if I made a mistake on my original return?

+Yes, you can file an amended return using Form IT-370-X. You'll need to complete the form in its entirety, including any changes you're making, and attach a copy of your original return.