Fannie Mae Form 236 is a crucial document in the multifamily lending process. For investors and property owners looking to secure financing for their apartment buildings or other multifamily properties, understanding this form is essential. In this article, we will delve into the details of Fannie Mae Form 236, its importance, and its role in the multifamily loan process.

What is Fannie Mae Form 236?

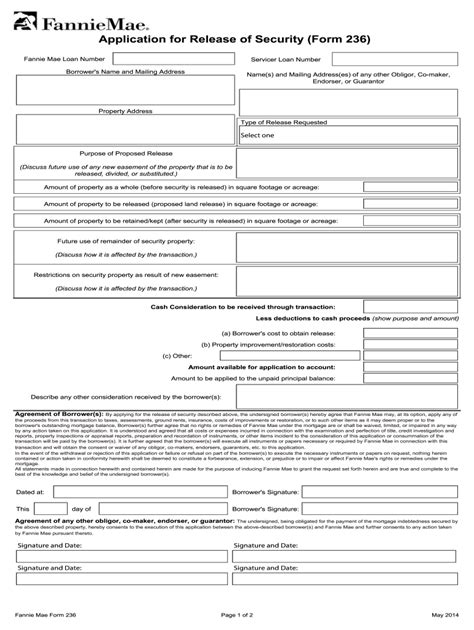

Fannie Mae Form 236 is a standardized loan application used by Fannie Mae, a government-sponsored enterprise (GSE), to evaluate multifamily loan requests. The form requires borrowers to provide detailed information about the property, including its financial performance, physical condition, and market data. This information helps Fannie Mae assess the loan's creditworthiness and determine the appropriate loan terms.

Importance of Fannie Mae Form 236

Fannie Mae Form 236 is a critical component of the multifamily loan process. By providing a standardized framework for loan applications, the form helps ensure that all borrowers provide the necessary information for Fannie Mae to make informed lending decisions. This, in turn, helps to reduce the risk of default and ensures that borrowers receive the best possible loan terms.

Benefits of Using Fannie Mae Form 236

Using Fannie Mae Form 236 offers several benefits to borrowers, including:

- Streamlined loan process: By providing all necessary information upfront, borrowers can expedite the loan process and reduce the time it takes to close the loan.

- Competitive loan terms: Fannie Mae's standardized loan application process helps ensure that borrowers receive the best possible loan terms, including competitive interest rates and flexible repayment terms.

- Increased transparency: The form provides a clear and transparent framework for loan applications, helping borrowers understand the loan terms and conditions.

How to Complete Fannie Mae Form 236

Completing Fannie Mae Form 236 requires careful attention to detail and a thorough understanding of the loan application process. Here are some tips to help borrowers complete the form successfully:

- Review the form carefully: Before starting the application process, borrowers should review the form carefully to ensure they understand what information is required.

- Gather all necessary documentation: Borrowers should gather all necessary documentation, including financial statements, property appraisals, and market data, before starting the application process.

- Seek professional help: Borrowers may want to consider seeking professional help from a multifamily loan expert or attorney to ensure the form is completed accurately and thoroughly.

Fannie Mae Form 236 Requirements

Fannie Mae Form 236 requires borrowers to provide detailed information about the property, including:

- Property description: Borrowers must provide a detailed description of the property, including its location, size, and age.

- Financial performance: Borrowers must provide financial statements, including income statements and balance sheets, to demonstrate the property's financial performance.

- Physical condition: Borrowers must provide information about the property's physical condition, including any needed repairs or renovations.

- Market data: Borrowers must provide market data, including information about the local rental market and competing properties.

Fannie Mae Form 236 Tips and Best Practices

Here are some tips and best practices to help borrowers complete Fannie Mae Form 236 successfully:

- Provide accurate and complete information: Borrowers should ensure that all information provided is accurate and complete to avoid delays or loan rejection.

- Use clear and concise language: Borrowers should use clear and concise language when completing the form to avoid confusion or misinterpretation.

- Seek professional help: Borrowers may want to consider seeking professional help from a multifamily loan expert or attorney to ensure the form is completed accurately and thoroughly.

Common Mistakes to Avoid When Completing Fannie Mae Form 236

Here are some common mistakes to avoid when completing Fannie Mae Form 236:

- Incomplete or inaccurate information: Borrowers should ensure that all information provided is accurate and complete to avoid delays or loan rejection.

- Failure to provide required documentation: Borrowers should ensure that all required documentation, including financial statements and property appraisals, is provided to support the loan application.

- Failure to seek professional help: Borrowers may want to consider seeking professional help from a multifamily loan expert or attorney to ensure the form is completed accurately and thoroughly.

Fannie Mae Form 236 Frequently Asked Questions

Here are some frequently asked questions about Fannie Mae Form 236:

- What is Fannie Mae Form 236? Fannie Mae Form 236 is a standardized loan application used by Fannie Mae to evaluate multifamily loan requests.

- What information is required on Fannie Mae Form 236? Borrowers must provide detailed information about the property, including its financial performance, physical condition, and market data.

- How long does it take to complete Fannie Mae Form 236? The time it takes to complete Fannie Mae Form 236 varies depending on the complexity of the loan application and the borrower's level of preparation.

Conclusion

Fannie Mae Form 236 is a critical component of the multifamily loan process. By providing a standardized framework for loan applications, the form helps ensure that all borrowers provide the necessary information for Fannie Mae to make informed lending decisions. By understanding the form's requirements and following the tips and best practices outlined in this article, borrowers can increase their chances of securing a multifamily loan and achieving their investment goals.

Now that you've read this article, we encourage you to share your thoughts and experiences with Fannie Mae Form 236 in the comments section below. Have you completed the form before? What challenges did you face, and how did you overcome them? Share your insights to help others navigate the multifamily loan process.

What is the purpose of Fannie Mae Form 236?

+Fannie Mae Form 236 is a standardized loan application used by Fannie Mae to evaluate multifamily loan requests.

What information is required on Fannie Mae Form 236?

+Borrowers must provide detailed information about the property, including its financial performance, physical condition, and market data.

How long does it take to complete Fannie Mae Form 236?

+The time it takes to complete Fannie Mae Form 236 varies depending on the complexity of the loan application and the borrower's level of preparation.