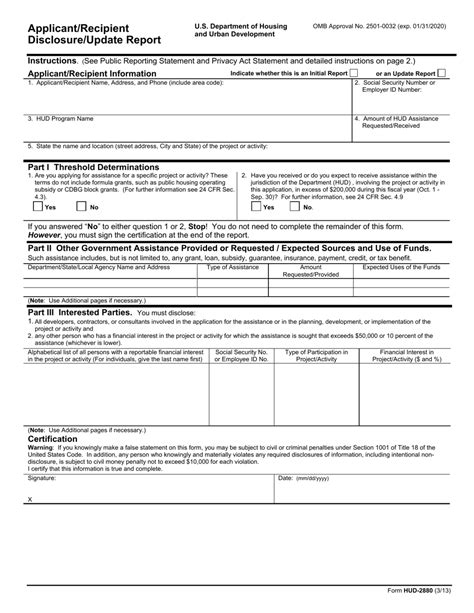

The HUD Form 2880 is a crucial document in the mortgage industry, particularly for lenders and borrowers. It's a pre-endorsement review of the creditworthiness of the borrower, and it plays a significant role in the mortgage approval process. However, the complexity of the form and its requirements can be overwhelming for many individuals. In this article, we will delve into the details of the HUD Form 2880, its importance, and the requirements that borrowers and lenders need to fulfill.

What is HUD Form 2880?

The HUD Form 2880 is a pre-endorsement review form used by lenders to evaluate the creditworthiness of borrowers. The form is a requirement for mortgage insurance applications, and it helps lenders determine whether a borrower is eligible for a mortgage loan. The form is used to review the borrower's credit history, income, and other financial information to assess their creditworthiness.

Why is HUD Form 2880 important?

The HUD Form 2880 is essential in the mortgage approval process because it helps lenders evaluate the risk of lending to a borrower. By reviewing the borrower's credit history and financial information, lenders can determine whether the borrower is capable of repaying the loan. The form also helps lenders identify potential issues that may affect the borrower's ability to repay the loan.

HUD Form 2880 Requirements

To complete the HUD Form 2880, borrowers and lenders must provide specific information and documentation. The following are some of the requirements:

- Borrower's personal and financial information, including name, address, income, and employment history

- Credit history, including credit scores and any past credit issues

- Debt-to-income ratio, which is the percentage of the borrower's monthly gross income that goes towards paying debts

- Asset information, including bank accounts, investments, and other assets

- Employment verification, including proof of income and employment history

- Identification documents, such as a driver's license or passport

How to Fill Out HUD Form 2880

Filling out the HUD Form 2880 requires careful attention to detail and accuracy. Borrowers and lenders must ensure that all information is accurate and complete. The following are some steps to follow when filling out the form:

- Review the form carefully and read the instructions before starting to fill it out.

- Provide all required information and documentation, including personal and financial information.

- Ensure that all information is accurate and complete.

- Review the form for errors or omissions before submitting it.

HUD Form 2880 Benefits

The HUD Form 2880 provides several benefits to borrowers and lenders, including:

- Helps lenders evaluate the creditworthiness of borrowers

- Helps borrowers understand their creditworthiness and identify areas for improvement

- Provides a standardized process for evaluating creditworthiness

- Helps reduce the risk of default by identifying potential issues

HUD Form 2880 vs. Other Forms

The HUD Form 2880 is one of several forms used in the mortgage industry to evaluate creditworthiness. Other forms, such as the Uniform Residential Loan Application (URLA) and the Loan Estimate (LE), also provide similar information. However, the HUD Form 2880 is unique in that it provides a comprehensive review of the borrower's credit history and financial information.

HUD Form 2880 FAQs

What is the purpose of the HUD Form 2880?

+The HUD Form 2880 is used to evaluate the creditworthiness of borrowers and determine their eligibility for a mortgage loan.

What information is required on the HUD Form 2880?

+The HUD Form 2880 requires borrowers to provide personal and financial information, including credit history, income, employment history, and asset information.

How long does it take to complete the HUD Form 2880?

+The time it takes to complete the HUD Form 2880 varies depending on the complexity of the borrower's financial situation and the lender's requirements.

Conclusion

In conclusion, the HUD Form 2880 is a critical document in the mortgage industry that helps lenders evaluate the creditworthiness of borrowers. By understanding the requirements and benefits of the form, borrowers and lenders can navigate the mortgage approval process with confidence. Remember to fill out the form accurately and completely, and don't hesitate to seek guidance if needed.

We hope this article has provided valuable insights into the HUD Form 2880. If you have any questions or comments, please feel free to share them below.