Business taxes can be a daunting task, especially for small businesses and startups. In Georgia, the 500EZ form is a crucial document for businesses to file their taxes accurately. In this article, we will delve into the world of Georgia's 500EZ form, explaining its importance, benefits, and providing a step-by-step guide on how to fill it out.

What is the 500EZ Form?

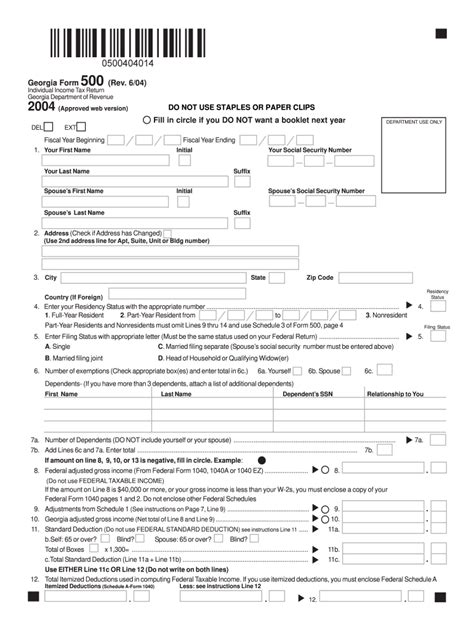

The 500EZ form is a simplified tax return form designed for small businesses and startups in Georgia. It is a condensed version of the standard 500 form, making it easier for businesses to file their taxes. The 500EZ form is used to report business income, deductions, and credits, and it is typically filed annually.

Benefits of Filing the 500EZ Form

Filing the 500EZ form has several benefits for businesses in Georgia. Some of the advantages include:

- Simplified tax filing process: The 500EZ form is designed to be easier to fill out, reducing the time and effort required to file business taxes.

- Reduced paperwork: The 500EZ form requires less documentation and paperwork compared to the standard 500 form.

- Faster processing: The Georgia Department of Revenue processes 500EZ forms faster, allowing businesses to receive their refunds quicker.

- Eligibility for tax credits: Businesses that file the 500EZ form may be eligible for certain tax credits, such as the Georgia Film Tax Credit.

Who is Eligible to File the 500EZ Form?

To be eligible to file the 500EZ form, businesses must meet certain criteria. Some of the requirements include:

- The business must be a sole proprietorship, partnership, or S corporation.

- The business must have gross receipts of $100,000 or less.

- The business must have total assets of $100,000 or less.

- The business must not have any income from sources outside of Georgia.

Step-by-Step Guide to Filing the 500EZ Form

Filing the 500EZ form can seem daunting, but it's a straightforward process. Here's a step-by-step guide to help you get started:

- Gather necessary documents: Collect all necessary documents, including your business's financial statements, receipts, and tax-related documents.

- Download the 500EZ form: Download the 500EZ form from the Georgia Department of Revenue's website or pick one up from a local office.

- Fill out the form: Fill out the form carefully, making sure to include all required information. You can use a tax preparation software or consult with a tax professional if needed.

- Calculate your tax liability: Calculate your tax liability using the form's instructions and your business's financial statements.

- Pay any tax due: If you owe taxes, pay the amount due by the filing deadline to avoid penalties and interest.

- File the form: File the completed form with the Georgia Department of Revenue by the filing deadline.

Tips and Reminders

- File on time: File the 500EZ form by the deadline to avoid penalties and interest.

- Keep accurate records: Keep accurate records of your business's financial statements and tax-related documents.

- Consult a tax professional: If you're unsure about any part of the process, consult with a tax professional or the Georgia Department of Revenue.

- Take advantage of tax credits: Take advantage of tax credits and deductions available to your business.

Common Mistakes to Avoid

When filing the 500EZ form, there are several common mistakes to avoid. Some of the most common mistakes include:

- Incorrect or incomplete information: Make sure to include all required information and double-check for accuracy.

- Failure to report income: Report all business income, including income from sources outside of Georgia.

- Incorrect tax calculation: Calculate your tax liability carefully, using the form's instructions and your business's financial statements.

- Missing deadlines: File the 500EZ form by the deadline to avoid penalties and interest.

Conclusion

Filing the 500EZ form is an essential part of doing business in Georgia. By understanding the form's requirements and following the step-by-step guide, businesses can ensure accurate and timely filing. Remember to take advantage of tax credits and deductions, and consult with a tax professional if needed. Don't hesitate to reach out to the Georgia Department of Revenue if you have any questions or concerns.

Take Action

- Download the 500EZ form from the Georgia Department of Revenue's website.

- Consult with a tax professional or the Georgia Department of Revenue if you have any questions or concerns.

- Take advantage of tax credits and deductions available to your business.

What is the deadline for filing the 500EZ form?

+The deadline for filing the 500EZ form is typically April 15th of each year.

Can I file the 500EZ form electronically?

+Yes, you can file the 500EZ form electronically through the Georgia Department of Revenue's website.

What are the penalties for late filing or payment?

+The penalties for late filing or payment vary, but can include interest, penalties, and fines. Consult with a tax professional or the Georgia Department of Revenue for more information.