Form 8822-B: Change Of Address For Businesses Explained

Keeping track of the various forms and paperwork required by the IRS can be a daunting task, especially for businesses. One crucial form that often gets overlooked is Form 8822-B, also known as the Change of Address for Businesses. In this article, we'll delve into the world of Form 8822-B, explaining its purpose, who needs to file it, and how to fill it out correctly.

What is Form 8822-B?

Form 8822-B is used by businesses to notify the IRS of a change in their business address. This form is a crucial document that ensures the IRS has the most up-to-date information about your business's location. By filing Form 8822-B, you can update your business's address with the IRS, which will help prevent delays or issues with your tax returns, refunds, or other correspondence.

Who Needs to File Form 8822-B?

Any business that has undergone a change of address must file Form 8822-B with the IRS. This includes:

- Sole proprietors

- Partnerships

- Corporations

- Limited Liability Companies (LLCs)

- Estates and trusts

Even if your business has only changed its mailing address, you still need to file Form 8822-B. Failure to notify the IRS of an address change can lead to delays or issues with your tax returns, refunds, or other correspondence.

When to File Form 8822-B

You should file Form 8822-B as soon as possible after changing your business's address. The IRS recommends filing the form within 30 days of the address change. However, if you're filing an annual tax return, you can report the address change on the return instead of filing a separate Form 8822-B.

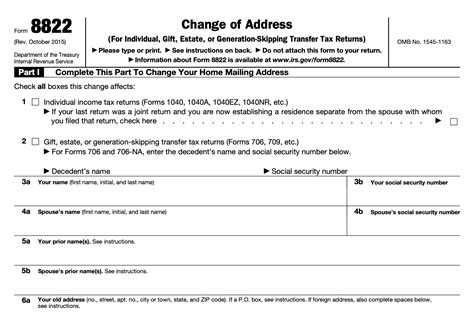

How to Fill Out Form 8822-B

Filling out Form 8822-B is a relatively straightforward process. Here's a step-by-step guide to help you get started:

- Download or obtain Form 8822-B: You can download the form from the IRS website or obtain it from your local IRS office.

- Enter your business information: Provide your business's name, address, and Employer Identification Number (EIN).

- Provide the new address: Enter your business's new address, including the street address, city, state, and ZIP code.

- Indicate the reason for the address change: Check the box that indicates the reason for the address change (e.g., moved to a new location, changed mailing address, etc.).

- Sign and date the form: Sign and date the form as the business owner or authorized representative.

- Mail or fax the form: Mail or fax the completed form to the IRS address or fax number listed on the form.

Common Mistakes to Avoid

When filling out Form 8822-B, it's essential to avoid common mistakes that can delay or reject your filing. Here are some mistakes to watch out for:

- Incorrect or incomplete business information: Make sure to provide accurate and complete business information, including your EIN.

- Incorrect or incomplete new address: Double-check that the new address is correct and complete.

- Failure to sign and date the form: Sign and date the form as the business owner or authorized representative.

- Failure to mail or fax the form correctly: Mail or fax the completed form to the correct IRS address or fax number.

Additional Tips and Resources

Here are some additional tips and resources to help you navigate the process:

- Use the IRS's Address Change webpage: The IRS provides an online resource to help businesses change their address. Visit the IRS website for more information.

- Consult with a tax professional: If you're unsure about the process or need help filling out the form, consider consulting with a tax professional.

- Keep a record of your filing: Keep a copy of your completed Form 8822-B and proof of mailing or faxing the form.

By following these tips and resources, you can ensure a smooth and successful filing process for your business's change of address.

Conclusion and Next Steps

Changing your business's address with the IRS is a crucial step to ensure you receive important tax documents and correspondence. By understanding the purpose and requirements of Form 8822-B, you can take the necessary steps to update your business's address with the IRS. Remember to file the form as soon as possible after changing your business's address, and don't hesitate to seek help if you need it.

What's next?

- Share your experience with changing your business's address with the IRS in the comments below.

- Download Form 8822-B and start the process of updating your business's address with the IRS.

- Consult with a tax professional for personalized advice and guidance.

What is the purpose of Form 8822-B?

+Form 8822-B is used by businesses to notify the IRS of a change in their business address.

Who needs to file Form 8822-B?

+Any business that has undergone a change of address must file Form 8822-B with the IRS.

How do I fill out Form 8822-B?

+Fill out Form 8822-B by providing your business information, new address, and signing and dating the form.