The world of corporate taxation can be complex and overwhelming, especially for businesses navigating the intricacies of tax deductions. One crucial aspect of corporate tax compliance is Form 1120 Schedule M-3, which provides the Internal Revenue Service (IRS) with detailed information about a corporation's financial transactions and tax-related activities. In this article, we will delve into the world of Form 1120 Schedule M-3, exploring its purpose, benefits, and key components, as well as providing practical examples and expert insights to help corporate taxpayers navigate this complex landscape.

Understanding Form 1120 Schedule M-3

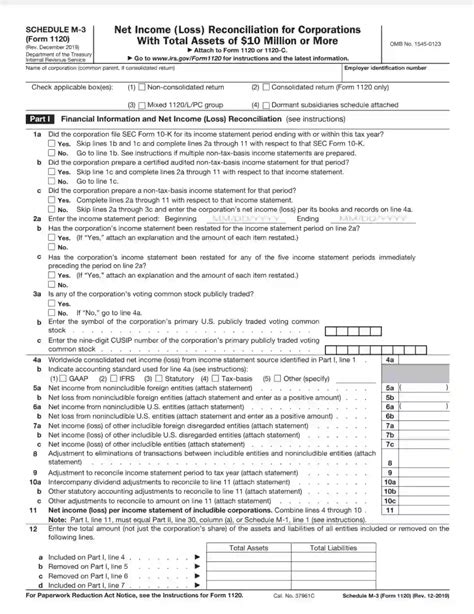

Form 1120 Schedule M-3 is a supplemental schedule that must be filed with Form 1120, the U.S. Corporation Income Tax Return. The purpose of Schedule M-3 is to provide a detailed reconciliation of a corporation's financial statements with its tax return, enabling the IRS to better understand a company's financial activities and identify potential discrepancies.

Why is Form 1120 Schedule M-3 important?

The importance of Form 1120 Schedule M-3 cannot be overstated. By providing a comprehensive overview of a corporation's financial transactions, Schedule M-3 helps the IRS to:

- Identify potential tax discrepancies and inconsistencies

- Verify the accuracy of a corporation's tax return

- Determine the correct tax liability

- Assess the risk of potential tax audits

In addition, Schedule M-3 helps corporations to:

- Ensure compliance with tax laws and regulations

- Identify areas for tax optimization and planning

- Enhance financial transparency and accountability

Components of Form 1120 Schedule M-3

Form 1120 Schedule M-3 consists of several sections, each providing specific information about a corporation's financial transactions and tax-related activities. The key components of Schedule M-3 include:

- Section 1: Income (Loss) reconciliation: This section requires corporations to reconcile their financial statement income with their tax return income.

- Section 2: Reconciliation of net income (loss) per books with taxable income: This section requires corporations to reconcile their net income or loss per books with their taxable income.

- Section 3: Reconciliation of current year net income (loss) with taxable income: This section requires corporations to reconcile their current year net income or loss with their taxable income.

How to complete Form 1120 Schedule M-3

Completing Form 1120 Schedule M-3 requires careful attention to detail and a thorough understanding of a corporation's financial transactions and tax-related activities. Here are some tips to help you complete Schedule M-3 accurately and efficiently:

- Review your financial statements: Ensure that your financial statements are accurate and up-to-date.

- Gather supporting documentation: Collect all supporting documentation, including invoices, receipts, and contracts.

- Reconcile income and expenses: Reconcile your financial statement income and expenses with your tax return income and expenses.

- Use Schedule M-3 instructions: Follow the instructions provided with Schedule M-3 to ensure accuracy and completeness.

Benefits of Accurate Form 1120 Schedule M-3 Filings

Accurate and complete Form 1120 Schedule M-3 filings offer numerous benefits for corporations, including:

- Reduced risk of tax audits: By providing a detailed and accurate reconciliation of financial transactions, corporations can reduce the risk of tax audits.

- Improved financial transparency: Schedule M-3 helps corporations to enhance financial transparency and accountability.

- Increased tax savings: By identifying areas for tax optimization and planning, corporations can increase tax savings.

Common Challenges and Solutions

Completing Form 1120 Schedule M-3 can be challenging, especially for corporations with complex financial transactions. Here are some common challenges and solutions:

- Challenge: Inaccurate financial statements: Solution: Review and update financial statements regularly to ensure accuracy.

- Challenge: Insufficient supporting documentation: Solution: Collect and maintain all supporting documentation, including invoices, receipts, and contracts.

- Challenge: Complex tax laws and regulations: Solution: Consult with tax professionals or experts to ensure compliance with tax laws and regulations.

Best Practices for Form 1120 Schedule M-3 Filings

To ensure accurate and complete Form 1120 Schedule M-3 filings, follow these best practices:

- Use tax preparation software: Utilize tax preparation software to streamline the filing process and reduce errors.

- Consult with tax professionals: Consult with tax professionals or experts to ensure compliance with tax laws and regulations.

- Maintain accurate financial records: Maintain accurate and up-to-date financial records to support Schedule M-3 filings.

Conclusion

Form 1120 Schedule M-3 is a critical component of corporate tax compliance, providing the IRS with detailed information about a corporation's financial transactions and tax-related activities. By understanding the purpose, benefits, and key components of Schedule M-3, corporations can ensure accurate and complete filings, reduce the risk of tax audits, and identify areas for tax optimization and planning. Remember to follow best practices, consult with tax professionals, and maintain accurate financial records to ensure compliance with tax laws and regulations.

Take Action

We encourage you to share your experiences and insights about Form 1120 Schedule M-3 filings in the comments section below. If you have any questions or concerns, please don't hesitate to ask. Share this article with your colleagues and friends to help spread awareness about the importance of accurate Form 1120 Schedule M-3 filings.

What is Form 1120 Schedule M-3?

+Form 1120 Schedule M-3 is a supplemental schedule that must be filed with Form 1120, the U.S. Corporation Income Tax Return. It provides a detailed reconciliation of a corporation's financial statements with its tax return.

Why is Form 1120 Schedule M-3 important?

+Form 1120 Schedule M-3 is important because it helps the IRS to identify potential tax discrepancies and inconsistencies, verify the accuracy of a corporation's tax return, and determine the correct tax liability.

How do I complete Form 1120 Schedule M-3?

+To complete Form 1120 Schedule M-3, review your financial statements, gather supporting documentation, reconcile income and expenses, and use Schedule M-3 instructions.