Mastering Form 8911 on TurboTax is an essential skill for individuals and businesses looking to claim the Alternative Fuel Mixture Credit. This credit is designed to incentivize the use of alternative fuels, such as biodiesel and renewable diesel, which can help reduce greenhouse gas emissions and dependence on fossil fuels. In this article, we will explore five ways to master Form 8911 on TurboTax, including understanding the eligibility criteria, gathering required documents, calculating the credit, reporting the credit on Form 8911, and avoiding common errors.

Understanding Eligibility Criteria

To claim the Alternative Fuel Mixture Credit, you must meet specific eligibility criteria. The credit is available to taxpayers who produce or sell alternative fuel mixtures, such as biodiesel and renewable diesel. The mixture must be produced from biomass, such as plants, algae, or agricultural waste, and must meet certain standards for energy content and greenhouse gas emissions.

To determine if you are eligible for the credit, you will need to review the IRS guidelines and ensure that your alternative fuel mixture meets the necessary standards. You can also consult with a tax professional or industry expert to ensure that you meet the eligibility criteria.

**Gathering Required Documents**

To claim the Alternative Fuel Mixture Credit on Form 8911, you will need to gather certain documents, including:

- Records of alternative fuel mixture production or sales

- Certificates of compliance from the IRS or a designated testing laboratory

- Records of energy content and greenhouse gas emissions testing

- Documentation of biomass sources and production processes

It is essential to keep accurate and detailed records to support your credit claim. You should also ensure that your records are organized and easily accessible in case of an audit.

**Types of Documents Required**

- Production records: These should include details of the alternative fuel mixture produced, including the type and quantity of biomass used.

- Sales records: These should include details of the alternative fuel mixture sold, including the date, quantity, and price.

- Certificates of compliance: These should be obtained from the IRS or a designated testing laboratory and should verify that the alternative fuel mixture meets the necessary standards.

Calculating the Credit

The Alternative Fuel Mixture Credit is calculated based on the number of gallons of alternative fuel mixture produced or sold. The credit is $0.50 per gallon for biodiesel and renewable diesel, and $0.25 per gallon for other alternative fuels.

To calculate the credit, you will need to multiply the number of gallons produced or sold by the applicable credit rate. You can use the following formula:

Credit = (Number of gallons x Credit rate)

For example, if you produced 10,000 gallons of biodiesel, the credit would be:

Credit = (10,000 x $0.50) = $5,000

**Reporting the Credit on Form 8911**

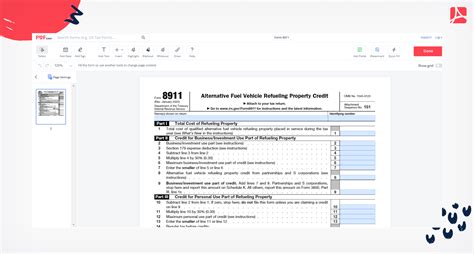

Form 8911 is used to report the Alternative Fuel Mixture Credit. The form should be completed accurately and in its entirety to avoid delays or rejection.

To report the credit on Form 8911, you will need to:

- Complete Part I: Alternative Fuel Mixture Credit

- Enter the total credit claimed in Part II: Credit

- Attach supporting documentation, including production and sales records, certificates of compliance, and energy content and greenhouse gas emissions testing records

**Tips for Completing Form 8911**

- Ensure that all information is accurate and complete

- Use the correct credit rate for the type of alternative fuel mixture produced or sold

- Attach all required supporting documentation

- Keep a copy of the completed form and supporting documentation for your records

Avoiding Common Errors

Common errors to avoid when claiming the Alternative Fuel Mixture Credit on Form 8911 include:

- Inaccurate or incomplete information

- Failure to attach supporting documentation

- Incorrect credit rate or calculation

- Failure to meet eligibility criteria

To avoid these errors, it is essential to carefully review the IRS guidelines and ensure that you meet the eligibility criteria. You should also keep accurate and detailed records to support your credit claim.

**Conclusion: Mastering Form 8911 on TurboTax**

Mastering Form 8911 on TurboTax requires a thorough understanding of the eligibility criteria, required documents, credit calculation, and reporting requirements. By following the tips and best practices outlined in this article, you can ensure that you accurately and efficiently claim the Alternative Fuel Mixture Credit.

Remember to keep accurate and detailed records, use the correct credit rate, and attach all required supporting documentation. With practice and patience, you can master Form 8911 on TurboTax and claim the credit you deserve.

**Additional Resources**

For more information on the Alternative Fuel Mixture Credit and Form 8911, you can consult the following resources:

- IRS Form 8911 and Instructions

- IRS Publication 510: Excise Taxes

- TurboTax Support Center

**Get Started Today!**

Don't wait to claim the Alternative Fuel Mixture Credit. Get started today by gathering your documents, calculating your credit, and reporting it on Form 8911. With TurboTax, you can accurately and efficiently claim the credit you deserve.

What is the Alternative Fuel Mixture Credit?

+The Alternative Fuel Mixture Credit is a tax credit available to taxpayers who produce or sell alternative fuel mixtures, such as biodiesel and renewable diesel.

Who is eligible for the Alternative Fuel Mixture Credit?

+The credit is available to taxpayers who produce or sell alternative fuel mixtures that meet specific standards for energy content and greenhouse gas emissions.

How do I report the Alternative Fuel Mixture Credit on Form 8911?

+To report the credit on Form 8911, you will need to complete Part I: Alternative Fuel Mixture Credit, enter the total credit claimed in Part II: Credit, and attach supporting documentation.