Hawaii is a state known for its stunning natural beauty, rich culture, and unique laws governing property ownership. For those looking to transfer property in the Aloha State, understanding the nuances of the Hawaii quit claim deed form is essential. In this article, we will delve into the world of quit claim deeds, exploring their purpose, benefits, and requirements specific to Hawaii.

What is a Quit Claim Deed?

A quit claim deed, also known as a quitclaim deed, is a type of deed that transfers the interest of the grantor (the person giving up the property) to the grantee (the person receiving the property). Unlike other types of deeds, a quit claim deed does not guarantee that the grantor has clear title to the property. Instead, it simply conveys whatever interest the grantor has in the property to the grantee.

How Does a Quit Claim Deed Work in Hawaii?

In Hawaii, a quit claim deed is often used in situations where the grantor wants to quickly transfer property without making any promises about the property's title. This can be useful in a variety of scenarios, such as:

- Transferring property to a family member or spouse

- Correcting errors in a previous deed

- Adding or removing a co-owner

- Transferring property to a trust

However, it's essential to note that a quit claim deed does not provide the same level of protection as other types of deeds, such as a warranty deed. With a quit claim deed, the grantee assumes the risk of any title defects or encumbrances.

Benefits of Using a Quit Claim Deed in Hawaii

Despite the lack of title guarantees, quit claim deeds offer several benefits in Hawaii, including:

- Speed: Quit claim deeds can be executed quickly, often in a matter of days.

- Simplicity: The process of creating and recording a quit claim deed is relatively straightforward.

- Flexibility: Quit claim deeds can be used in a variety of situations, from family transfers to trust administration.

- Cost-effectiveness: Quit claim deeds often involve lower costs compared to other types of deeds.

Requirements for a Valid Quit Claim Deed in Hawaii

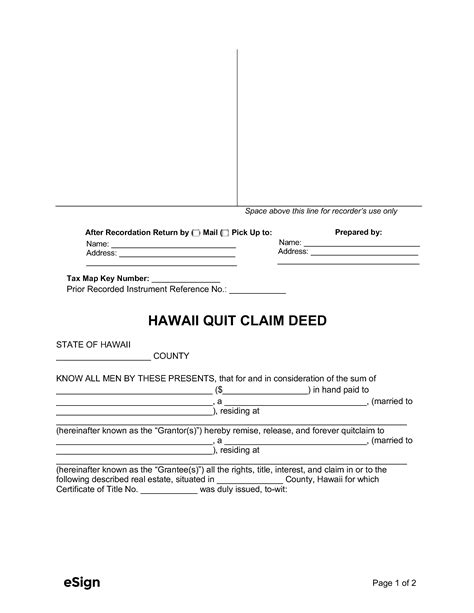

To create a valid quit claim deed in Hawaii, the following requirements must be met:

- The deed must be in writing and signed by the grantor.

- The deed must include the names and addresses of the grantor and grantee.

- The deed must provide a sufficient description of the property being transferred.

- The deed must be notarized.

- The deed must be recorded with the Hawaii Bureau of Conveyances.

How to Fill Out a Quit Claim Deed Form in Hawaii

Filling out a quit claim deed form in Hawaii requires careful attention to detail. Here's a step-by-step guide to help you get started:

- Download a quit claim deed form from a reputable source or create your own using a template.

- Fill in the grantor's name and address.

- Fill in the grantee's name and address.

- Provide a sufficient description of the property being transferred, including the street address, tax map key, and any other relevant details.

- Sign the deed as the grantor.

- Notarize the deed.

- Record the deed with the Hawaii Bureau of Conveyances.

Common Mistakes to Avoid When Using a Quit Claim Deed in Hawaii

While quit claim deeds can be a useful tool for transferring property in Hawaii, there are several common mistakes to avoid:

- Failing to provide a sufficient description of the property.

- Not signing the deed as the grantor.

- Not notarizing the deed.

- Not recording the deed with the Hawaii Bureau of Conveyances.

- Using a quit claim deed when a warranty deed is required.

Conclusion: Navigating the World of Quit Claim Deeds in Hawaii

Quit claim deeds can be a valuable tool for transferring property in Hawaii, but it's essential to understand the benefits and drawbacks of using this type of deed. By following the requirements and guidelines outlined in this article, you can ensure a smooth and successful transfer of property. Remember to always consult with an attorney or other qualified professional if you're unsure about any aspect of the process.

We encourage you to share your experiences and ask questions in the comments below. Have you used a quit claim deed in Hawaii before? What were some of the challenges you faced? Let's start a conversation!

What is the main difference between a quit claim deed and a warranty deed in Hawaii?

+The main difference between a quit claim deed and a warranty deed in Hawaii is the level of title guarantee provided. A quit claim deed does not guarantee that the grantor has clear title to the property, while a warranty deed provides a guarantee that the grantor has clear title and will defend against any title defects or encumbrances.

Can I use a quit claim deed to transfer property to a minor in Hawaii?

+Yes, you can use a quit claim deed to transfer property to a minor in Hawaii, but you will need to comply with the state's laws regarding minors and property ownership. It's recommended that you consult with an attorney to ensure that the transfer is done correctly and in the best interests of the minor.

How long does it take to record a quit claim deed in Hawaii?

+The time it takes to record a quit claim deed in Hawaii can vary depending on the county and the complexity of the transaction. Generally, it can take anywhere from a few days to several weeks to record a quit claim deed. It's recommended that you check with the Hawaii Bureau of Conveyances for the most up-to-date information on recording times.